What is a Credit Limit?

Contents

A credit limit is the maximum amount of credit that a financial institution will extend to a borrower. It’s important to know your credit limit so you can avoid going over it and incurring fees.

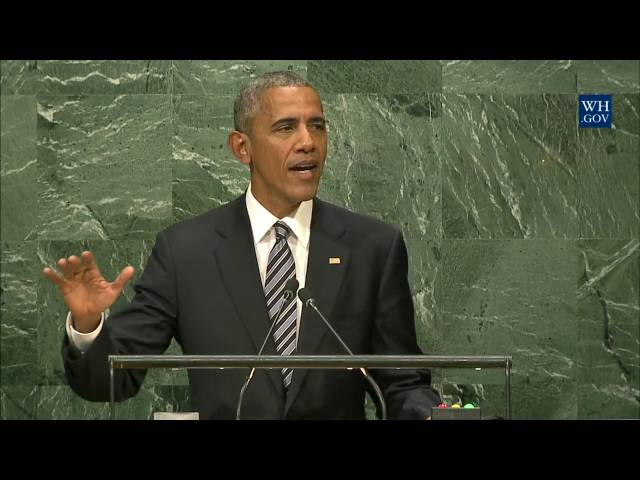

Checkout this video:

What is a credit limit?

A credit limit is the maximum amount of money that a financial institution will lend to a customer. Credit limits are set by taking into account factors such as the customer’s income, credit score, and outstanding debt. Customers with higher incomes and credit scores are typically given higher credit limits.

How is a credit limit determined?

Credit limits are determined by credit bureaus and creditors based on credit scores and creditworthiness. A higher credit score means you’re seen as a lower-risk borrower, so you may be approved for a higher limit.

Creditors also look at your income, employment history, and other factors to decide how much of a credit limit to extend. If you have a good history with the creditor, you’re more likely to be approved for a higher limit.

Some cards, like secured cards, have lower limits because they require a security deposit. Other cards may have initial limits that are low but can be increased over time if you make all your payments on time and keep your balance low.

What are the benefits of having a credit limit?

There are a number of benefits to having a credit limit, including:

-You can use your credit limit to help you stay within your budget.

-A credit limit can help you avoid overspending.

-A credit limit can help you build a good credit history.

-A credit limit can help you improve your credit score.

What are the drawbacks of having a credit limit?

While a credit limit can give you a sense of financial security, it can also have some drawbacks. If you charge up to your credit limit, you may be paying more interest on your debt than you would with a lower limit. Also, a high credit limit may tempt you to spend more money than you can afford to pay back. If you’re not careful, this can lead to debt problems down the road.

How can I increase my credit limit?

There are a few ways you can try to increase your credit limit. You can start by requesting a credit limit increase from your credit card issuer. This is usually as simple as calling customer service and asking for a higher limit. If you have a good history with the company, they may be willing to give you a higher credit limit.

Another way to increase your credit limit is to apply for a new credit card. When you are approved for a new credit card, you will be given a new credit limit. You can also try transferring some of the balance from another credit card onto your new credit card. This will usually give you an instant boost in your available credit.

Lastly, you can try paying down your balances on other credit cards. This will improve your overall credit utilization ratio and may lead to an increase in your credit limits.