How to Pay Off Student Loan Debt

If you’re struggling to pay off your student loan debt, you’re not alone. In fact, you’re part of a growing trend. According to the latest statistics, the average graduate leaves school with over $37,000 in student loan debt.

That’s a huge amount of debt to tackle, but don’t despair. There are a number of things you can do to get your student loan debt under control. In this blog post, we’ll explore some of the best strategies

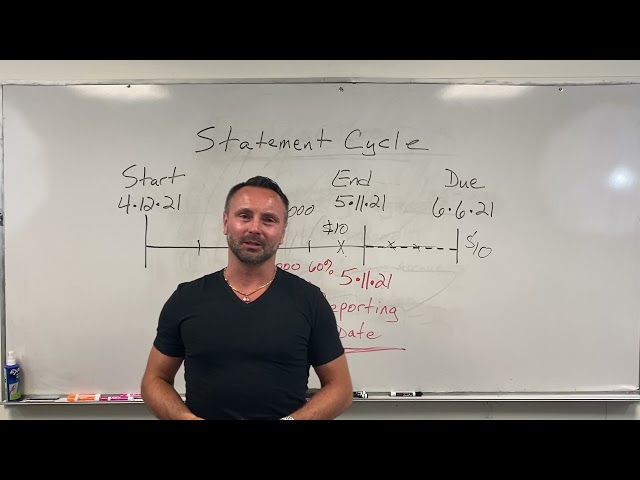

Checkout this video:

Assess your debt

Before you can come up with a plan to pay off your student loan debt, you need to know exactly how much debt you have. This involves looking at all of your loans and finding the total amount that you owe. You should also take into account the interest rate of each loan so that you can prioritize certain loans over others. Once you have a solid understanding of your debt, you can start to develop a plan to pay it off.

Determine the total amount of your debt

Before you can begin to pay off your debt, you need to know exactly how much money you owe. Make a list of all of your outstanding loans, including the lender, balance, interest rate, and minimum payment for each.

If you have both federal and private loans, make sure to keep them separate. You’ll want to focus on paying off your private loans first because they typically have higher interest rates than federal loans.

Determine your interest rate

The first step in paying off your student loan debt is to understand what you’re. signed up for. Check your student loan statements or login to your account on your lender’s website to find out the interest rate on each of your loans. If you have multiple loans with different interest rates, you may want to consider consolidation or refinancing to get a lower interest rate.

Determine your monthly payment

To begin, you’ll need to sign in to your account on the student loan servicing website. Once you’re logged in, find the section labeled ” repayment & consolidation.” In this section, you should see a link that says ” repayment estimator.” Click on this link and enter in the requested information about your loans.

The repayment estimator will provide you with an estimate of your monthly payment under different repayment plans, as well as how long it will take to repay your loans in full under each plan. It’s important to remember that these estimates are just that – estimates. Your actual monthly payment may be higher or lower than the estimate, depending on factors like changes to your income or family size.

Once you’ve reviewed the different repayment options, you can decide which plan is best for you. If you have multiple loans, you may be able to consolidate them into a single loan with a single monthly payment. You can learn more about consolidation by visiting the Department of Education’s website or by contacting your loan servicer.

Create a budget

The first step to paying off your student loan debt is to create a budget. You need to know how much money you have coming in and going out each month. Start by adding up your monthly income from all sources, including your job, any side hustles, and any financial aid or scholarships you receive. Next, list out all of your fixed expenses, such as your rent, car payment, and student loan payments. Then, list out your variable expenses, such as your food, transportation, and entertainment costs. Finally, calculate your monthly surplus or deficit. If you have a surplus, you can use that extra money to make extra student loan payments. If you have a deficit, you’ll need to find ways to cut back on your spending or increase your income.

Determine your monthly income

The first step to creating a budget is understanding your monthly income. This includes all sources of money coming in, such as your paycheck, financial aid, and side hustles.

To get an accurate picture of your monthly income, take a look at your bank statements from the past few months. If your income varies month-to-month, take an average of what you’ve earned.

Once you have your number, write it down or add it to a budgeting app. This will be your starting point as you create your budget.

Determine your monthly expenses

Before you can create a budget, you need to know where your money is going. Track your spending for one month to get a sense of your regular expenses. Include everything from rent and groceries to coffee and entertainment.

You can use a simple Excel spreadsheet or one of the many budgeting apps out there, like Mint or You Need a Budget (YNAB). Once you have a good understanding of your monthly expenses, you can start creating your budget.

If you find that your spending is consistently higher than your income, you’ll need to make some changes. Look for ways to reduce your expenses or increase your income. You may need to get a second job or make some other sacrifices in order to get your finances under control.

Determine your monthly debt payments

One way to figure out how much you need to pay each month is by using the Debt Snowball method. This involves listing all of your debts from smallest to largest, regardless of interest rate. Then, you make the minimum payment on all debts except the smallest one. Attack that debt with as much extra money as you can afford until it’s paid off, and then move on to the next debt on your list. As you knock out each debt, your confidence will grow, and you’ll have more money available to put toward the remaining debts.

Develop a plan

If you’re one of the 45 million Americans with student loan debt, you’re not alone. In fact, you’re in good company. The average graduate leaves college with $28,400 in student loan debt, according to Edvisors. But don’t despair. You can do something about it.

Determine how much extra you can pay each month

To develop a plan to pay off your student loan debt, you’ll need to determine how much extra you can pay each month. To do this, consider your budget and other financial obligations. If you have room in your budget, you can make larger monthly payments or make additional payments throughout the year.

If you’re struggling to make your monthly payments, there are options available to help you. You can extend your repayment term, which will lower your monthly payment but increase the total amount you’ll pay over the life of the loan. You can also enroll in an income-driven repayment plan, which will base your monthly payment on a percentage of your income.

Once you’ve determined how much extra you can pay each month, you’ll need to select a repayment plan. There are various repayment plans available, so be sure to select one that meets your needs. For example, if you’re looking for a plan with lower monthly payments, an extended repayment plan may be right for you. If you’re looking for a plan that willPay off debt quicker,you might want to consider making additional payments each year or making larger monthly payments.

Making extra payments on your student loans can be a great way to reduce the amount of interest you’ll pay over the life of the loan and save money in the long run. Be sure to develop a plan that meets your needs and budget so that you can successfully pay off your student loan debt!

Determine the order in which you will pay off your loans

Once you know how much money you need to pay off your loans, you can develop a plan to pay them off. You might want to start by paying off the loan with the highest interest rate first. This will save you money in the long run because you will accrue less interest on that loan over time. You can also choose to pay off the loan with the lowest balance first. This can give you a psychological boost as you see your debt balance decrease quickly. Alternatively, you can choose to pay off multiple loans at once if you want to save on overall interest payments or if your lenders offer benefits for making multiple payments.

Determine how long it will take you to pay off your loans

Now that you know how much you owe and what your interest rate is, you can begin to develop a plan to pay off your student loan debt. The first step is to determine how long it will take you to pay off your loans. To do this, you need to calculate your monthly student loan payment.

Your monthly student loan payment is the amount you will need to pay each month to repay your loans within a certain number of years. To calculate your monthly payment, you will need to know your loan amount, interest rate, and repayment term.

Loan amount: This is the total amount of money you borrowed from the lender.

Interest rate: This is the percentage of interest that accrues on your loan each year.

Repayment term: This is the length of time that you have to repay your loan.

Once you have this information, you can use a student loan payment calculator to determine your monthly payment. Once you know your monthly payment, you can start to develop a plan to pay off your loans.

Stay on track

If you’re like most college graduates, you’re probably looking at a hefty student loan debt. You’re not alone – two-thirds of Americans who attend college leave with student loan debt. The average graduate has about $28,400 in student loan debt, but some students owe much more than that. If you’re struggling to make your payments, you’re not alone. Every year, millions of Americans default on their student loans. But there are some things you can do to make sure you’re able to pay off your debt.

Make your monthly payments on time

Your credit report will show late or missed payments, which can hurt your credit score and make it harder to get approved for loans in the future. Even if you can’t make your full payment, try to pay something so you don’t fall behind. You might also want to set up automatic payments from your bank account so you don’t have to think about it each month.

Stay within your budget

It’s important to stay within your budget when you’re trying to pay off your student loan debt. You may have to make some sacrifices, but it will be worth it in the end. Here are a few tips to help you stay on track:

– Make a budget and stick to it. Track your income and expenses so you know where your money is going.

– Cut back on non-essential expenses. This may include eating out, entertainment, and luxury items.

– Use any extra money you have to make extra payments on your loans.

– Consider consolidating or refinancing your loans to get a lower interest rate.

– Stay motivated by reminding yourself why you’re doing this. Remember that each payment brings you one step closer to being debt-free!

Monitor your progress

As you work toward paying off your student loans, it’s important to monitor your progress. This will help you stay on track and motivated.

There are a few key things to look at when evaluating your progress:

-Your loan balance: This is the amount of money you still owe on your loan.

-Your monthly payment amount: This is the amount you are required to pay each month.

-Your payment history: This is a record of whether you have made your payments on time.

To get an overview of your loans, visit the National Student Loan Data System (NSLDS). This website provides information on all federal student loans you have received. You will need to provide your Social Security number, date of birth, and federal PIN to log in.