How Often Does Your Credit Score Update?

Contents

Wondering how often your credit score is updated? We have the answer, along with some tips on how you can improve your credit score.

Checkout this video:

How credit scores are calculated

There are many factors that go into your credit score, including payment history, credit utilization, credit age, and more. Your credit score can also be affected by things like hard inquiries and late payments. So how often does your credit score update?

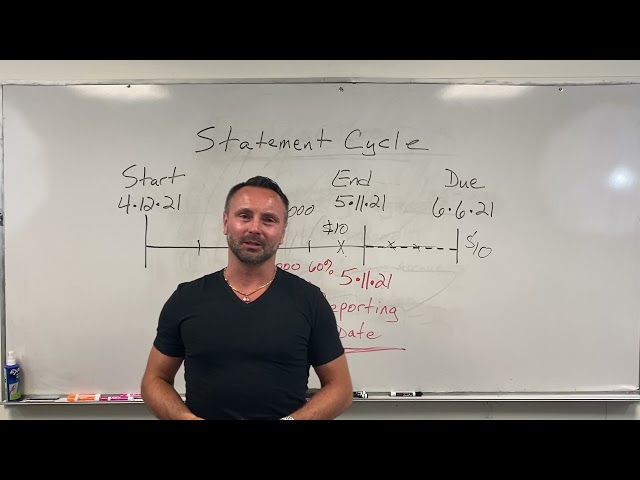

The importance of credit utilization

Credit utilization is one of the most important factors in your credit score. It’s a measure of how much debt you have compared to your credit limit. A high credit utilization ratio can hurt your score, because it shows companies you’re more likely to max out your cards.

Here’s an example: Let’s say you have two credit cards with limits of $1,000 each. One has a balance of $500, and the other has a balance of $50. Your credit utilization ratio would be 50%, because the total of your balances is $550 and your total credit limit is $2,000.

Ideally, you want to keep your credit utilization ratio below 30%. That shows lenders you’re using a small portion of your available credit and that you’re able to manage your debt responsibly. If your ratio is higher than that, you may want to consider paying down some of your debt or increasing your credit limit so that your ratio improves.

The impact of late payments

Late payments have a major negative impact on your credit score. The scoring system used to calculate your credit score is designed to take into account how you’ve managed your accounts in the past, and late payments are a major red flag.

If you have a history of late payments, it’s important to make a concerted effort to pay all of your bills on time going forward. You may also want to consider signing up for automatic bill pay, which can help you avoid missing payments in the future.

The role of credit mix

Credit mix is the types of debt you have. A good credit mix shows lenders that you can responsibly handle different types of loans. For example, having both revolving debt (like credit cards) and installment debt (like a mortgage or auto loan) is generally better for your credit score than just having one or the other.

How often credit scores are updated

Your credit score is constantly changing, even when you don’t realize it. The scoring models are always being updated with new information, which means that your score could be going up or down without you even knowing it. So, how often does your credit score actually update?

The frequency of credit score updates

Your credit score is updated regularly, typically every month. However, the frequency with which it’s updated can vary depending on the credit reporting agency and the type of credit score.

For example, FICO® Scores are updated every 30 days, whereas VantageScore® 3.0 Scores are updated every 14 days. So if you’re looking at your score and see that it hasn’t changed in awhile, don’t panic! It may just be that the scoring model hasn’t been updated recently.

Of course, even if your score isn’t updated very often, it’s still important to keep an eye on your credit report so you can catch any potential red flags early on. You can get your free annual credit report from each of the major credit reporting agencies at AnnualCreditReport.com.

The impact of credit inquiries

Your credit score is designed to give lenders an idea of how likely you are to repay a loan on time. A higher score means you’re more likely to repay a loan, while a lower score means you’re more likely to default on a loan.

One factor that can impact your credit score is credit inquiries. These are requests for your credit report made by lenders, businesses, or companies that are considering lending you money or extending you credit.

Credit inquiries can be divided into two categories: hard inquiries and soft inquiries. Hard inquiries happen when you’ve applied for new credit, such as a credit card or loan. Soft inquiries occur when businesses check your credit report for purposes other than lending, such as when you check your own credit report or when a business checks your report for marketing purposes.

Hard inquiries can impact your credit score because they indicate that you’re looking for new credit. This can be viewed as a higher risk by lenders, and it can cause your score to drop slightly. Depending on the scoring model being used, hard inquiries can stay on your report for up to two years and can have a bigger impact on your score if they occur in a short period of time.

Soft inquiries have no effect on your credit score because they don’t indicate that you’re looking for new credit. However, they may still show up on your report so that businesses can see your entire borrowing history.

If you’re concerned about the impact of hard inquiries on your credit score, there are a few things you can do to minimize the damage:

– Limit the number of applications you make for newcredit products. Multiple applications in a short period of time can signals financial distress to lenders and result in more hard inquiries onyour report.

– Shop around for rates before applyingfor newcredit products. Many lenders use pre-qualification tools that allowyou to compare rates without triggering a hard inquiry onyour report.

– Consider alternatives to traditional forms ofcredit, such as personal loans from family or friends. These types of loans don’t require a formal application process and won’t result ina hard inquiry onyour report

The role of credit monitoring

While some people think of credit monitoring as a way to track their score and make sure it stays high, credit monitoring is really about much more than that. It’s also about detecting and preventing fraud, protecting your identity, and monitoring your credit report for errors.

Your credit score is important, but it’s not the only factor that lenders look at when considering a loan or other type of credit. Your credit history, which includes information about your previous loans and payments, is also taken into account. And while your credit score can change over time, your credit history usually stays the same.

That’s why it’s important to monitor both your credit score and your credit report. By keeping an eye on both, you can catch errors and spot potential identity theft early. You can also see how your score changes over time, which can help you understand what factors are affecting your credit.

How to improve your credit score

If you’re looking to improve your credit score, there are a few things you can do. You can start by making sure you make all of your payments on time. You can also try to pay down your balances, and if you have any derogatory items on your report, you can work on repairing your credit.

The importance of paying your bills on time

One of the biggest determinants of your credit score is your payment history. Whenever you make a late payment, it is reported to the credit bureaus and will show up on your credit report. If you have a history of making late payments, this will negatively impact your credit score. On the other hand, if you have a history of making payments on time, this will be reflected in a positive way on your credit score.

Additionally, the more recent late payments you have made, the more they will impact your credit score. So, if you have recently made a late payment, it is important to make any future payments on time to help offset the negative impact on your credit score.

In addition to paying your bills on time, another way to improve your credit score is by paying down your debts. The amount of debt you owe makes up 30% of your credit score. So, if you have high levels of debt, this will drag down your credit score. On the other hand, if you have been working diligently to pay down your debts, this will be reflected in a higher credit score.

Lastly, another factor that impacts your credit score is the length of your credit history. The longer you have been using credit, the better it reflects on your credit score. So, if you are just starting to usecredit, it may take some time for yourcredit score to improve. However, by making all of your payments on time and keepingyour debt levels low

The impact of maintaining a good credit history

A good credit history is important because it shows creditors that you’re a responsible borrower. This is especially important if you’re trying to get a mortgage or another loan with a competitive interest rate.

When you have a good credit history, it’s easier to get approved for loans and lines of credit, and you’ll usually be able to get better terms and interest rates. This can save you thousands of dollars over the life of a loan.

Your credit score is a snapshot of your credit history at a given point in time. It’s based on information in your credit report, which is a record of your borrowing and repayment activity.

There are many different factors that can impact your credit score, but one of the most important is your payment history. This includes whether you’ve made your payments on time and in full.

If you have a history of late or missed payments, it will have a negative impact on your score. On the other hand, consistently making on-time payments will have a positive impact. Your payment history makes up 35% of your FICO® Score☉ , so it’s an important factor to keep in mind if you’re trying to improve your score.

Another factor that impacts your score is the amount of debt you owe relative to the amount of credit available to you, also known as your “credit utilization ratio.” If you’re using a lot of your available credit, it can be seen as a sign that you’re overextended and may have trouble making your payments in full and on time. Your credit utilization ratio makes up 30% of your FICO® Score☉ , so it’s also something to keep an eye on if you want to improve your score over time.

Keeping tabs on these two factors—your payment history and credit utilization—is a good place to start if you’re looking to improve your credit score. You can also check out our free Credit History 101 course for more tips on how to build and maintain good credit over time.

The role of credit counseling

Credit counseling can help you work out a debt repayment plan with your creditors. Often, the creditors will agree to lower interest rates or drop certain fees if you agree to make regular, on-time payments. Credit counseling can also teach you how to better manage your money and improve your spending habits.

If you decide to use credit counseling, make sure to choose a reputable organization that has experience working with your type of financial situation. Be sure to get everything in writing before you begin working with a credit counselor.