What is a Leveraged Loan?

Contents

A Leveraged Loan is a type of loan that is extended to a company or individual with the use of collateral. The collateral for a Leveraged Loan is typically the borrower’s assets, which may include real estate, equipment, or inventory.

Checkout this video:

Introduction

A leveraged loan is a commercial loan provided by a group of lenders. It is first structured, arranged, and administered by one or several commercial or investment banks in the role of arranger. A syndicate of banks then provides the funding for the loan. Leveraged loans are also known as senior secured leverage loans or simply leverage loans.

Leveraged loans are generally made to companies that havesignificant debt or that are highly leveraged (have a high debt-to-equity ratio). The loans are considered higher risk than other types of corporate debt and thus typically offer higher interest rates to offset the increased risk. Leveraged loans are typically made in syndicated form, with a group of lenders pooling their resources to provide the necessary funds.

The primary advantage of a leveraged loan for borrowers is that it allows them to obtain financing on more favorable terms than would be available if they were borrowing from traditional sources such as banks or insurance companies. The increased competition among lenders for these loans also tends to result in lower interest rates. In addition, leveraged loans often include “covenants” that protect borrowers by restricting certain actions that could increase the risks associated with the loan (such as increasing leverage beyond certain levels).

The primary disadvantage of leveraged loans is that they are more expensive than other types of financing, such as bonds. In addition, the covenants included in these loans can restrict the actions of borrowers in ways that may limit their flexibility.

What is a Leveraged Loan?

A leveraged loan is a type of loan in which the borrower is able to obtain a larger loan than they would be able to without the use of leverage. The loan is secured by collateral, which can be used to reduce the risk of default. Leveraged loans can be used for a variety of purposes, including consolidating debt, financing a large purchase, or investing in a new business.

What is Leverage?

Leverage is the use of debt to buy assets. When you leverage something, you’re using borrowed money to increase your potential return on investment. The more debt you take on, the higher your potential return—but also the greater the risk.

In investing, leverage can be created by using margin, options, or derivatives. Margin is borrowing money from your broker to purchase an asset. Options and derivatives are financial contracts that give you the right to buy or sell an asset at a later date. These instruments can be used to generate leveraged returns without taking on additional debt.

Leveraged loans are a type of debt that is often used by companies to finance their operations or expand their businesses. These loans are typically made by banks or other financial institutions and are secured by the assets of the borrowing company. Leveraged loans can be an important source of funding for companies, but they also come with a higher degree of risk than other types of debt.

What are the Benefits of a Leveraged Loan?

A leveraged loan is a type of debt financing that allows a borrower to use leverage, or borrowed funds, to finance the purchase of an asset. In most cases, leveraged loans are used to finance the purchase of large assets such as businesses, real estate, or investment properties.

Leveraged loans can be an attractive option for borrowers because they typically have lower interest rates than other types of debt financing, such as credit cards or unsecured loans. Additionally, the borrower only pays interest on the portion of the loan that is used to finance the asset purchase.

There are some risks associated with leveraged loans, including the possibility of default if the borrower is unable to make payments. However, these risks can be mitigated by working with a reputable lender and carefully evaluating one’s ability to repay the loan before entering into a contract.

What are the Risks of a Leveraged Loan?

Leveraged loans are becoming an increasingly popular way for companies to finance their operations, but there are some risks associated with this type of lending. Here are a few things to consider before taking out a leveraged loan:

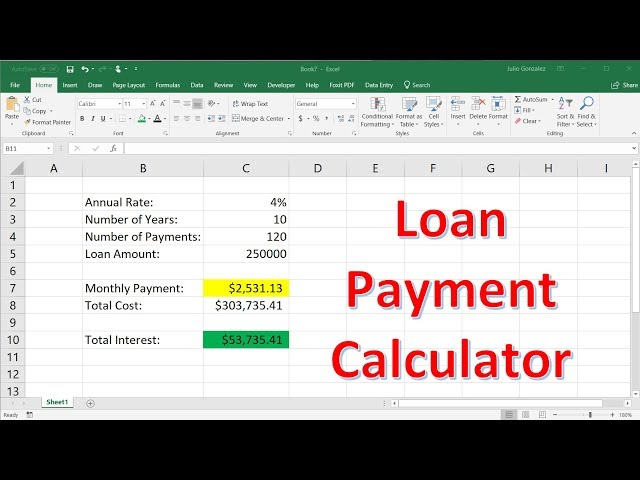

1. Higher Interest Rates: Leveraged loans typically have higher interest rates than non-leveraged loans, so you’ll need to be prepared to pay more in interest over the life of the loan.

2. Risk of Default: Leveraged loans also carry a higher risk of default, which means that you could end up owing more money than you originally borrowed if your company is unable to make the loan payments.

3. Collateral: Leveraged loans often require collateral, which means that you could lose your personal assets if you are unable to repay the loan.

4. Personal Guarantee: Most leveraged loans also require a personal guarantee from the borrower, which means that you could be held personally liable for the debt if your company is unable to repay it.

How Does a Leveraged Loan Work?

A leveraged loan is a loan that is extended to a borrower that already has a significant amount of debt. In other words, the borrower is “leveraging” their debt to secure the loan. This type of loan is often used by companies that are struggling to make ends meet and need extra cash. The downside of a leveraged loan is that if the borrower is unable to make the payments, the lender can foreclose on the collateral, which is usually the company’s assets.

The Process of Applying for a Leveraged Loan

Leveraged loans are a type of financing that is provided by lenders to borrowers who already have a significant amount of debt. In other words, leveraged loans are used by borrowers to consolidate and pay off their existing debts.

There are two types of leveraged loans: secured and unsecured. Secured leveraged loans are backed by collateral, such as real estate or other assets. Unsecured leveraged loans are not backed by collateral and are therefore more risky for lenders.

The process of applying for a leveraged loan begins with the borrower contacting a lender and requesting a loan application. The borrower will then need to provide the lender with information about their current financial situation, including their income, debts, and assets.

After the lender has reviewed the borrower’s financial information, they will make a decision about whether or not to approve the loan. If the loan is approved, the borrower will then be required to sign a loan agreement that outlines the terms of the loan, such as the interest rate, repayment schedule, and any fees or penalties associated with late or missed payments.

The Terms of a Leveraged Loan

Leveraged loans are typically made to companies with a lot of debt. The loans are often used to finance leveraged buyouts or to help a company avoid bankruptcy.

The terms of a leveraged loan are usually more favorable to the borrower than a typical loan. For example, the interest rate on a leveraged loan is often lower than the rate on a standard loan. Additionally, the borrower may only have to pay interest on the loan for a certain period of time, after which they can begin paying down the principal.

Leveraged loans are typically made by banks or other financial institutions. However, because of the higher risk involved, they are often sold to hedge funds or other investors.

Conclusion

Leveraged loans are a type of business loan in which the lender—usually a bank, finance company, or venture capitalists—offers the borrower a larger amount of money than they would ordinarily be able to obtain, in exchange for an agreed-upon interest rate and repayment schedule. The borrower usually uses the loan to finance the purchase of equipment or property, or to expand their business.

Leveraged loans can be an attractive option for borrowers who are unable to obtain traditional financing, but they come with certain risks. Specifically, if the borrower is unable to make their payments, the lender may take possession of the collateral used to secure the loan—which could include the business itself. For this reason, it’s important that borrowers understand the terms of their loan agreement and are confident in their ability to repay the loan before signing on the dotted line.