How Do I Repay My PPP Loan?

Contents

If you’re one of the many small business owners who received a Paycheck Protection Program (PPP) loan, you may be wondering how you can repay it. Here are a few things to keep in mind.

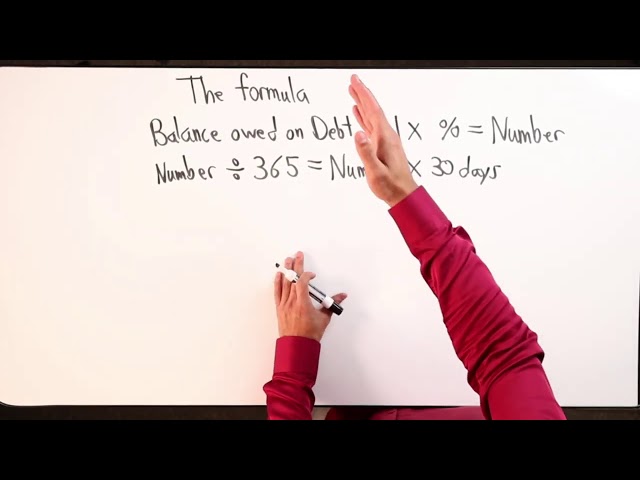

Checkout this video:

Introduction

The forgivable Paycheck Protection Program (PPP) loan is part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The PPP loan was designed to provide relief to small businesses that have been struggling during the COVID-19 pandemic.

If you have received a PPP loan, you may be wondering how you will be expected to repay the loan. In this article, we will provide an overview of the repayment process for PPP loans.

As outlined in the CARES Act, PPP loans have a maturity of two years and an interest rate of 1%. Loan payments are deferred for six months, meaning that you will not have to make any payments on your loan for the first six months after you receive the loan.

After the six-month payment deferral period ends, you will begin making payments on your loan. You will be required to make monthly payments on your loan for the remainder of the two-year term.

At the end of the two-year term, if you have used at least 60% of your loan for payroll expenses, then your loan will be forgiven and you will not be required to repay any outstanding balance on your loan.

If you have not used at least 60% of your loan for payroll expenses, then you will be required to repay any outstanding balance on your loan. However, you may still be eligible for partial forgiveness if you can demonstrate that you were unable to return to pre-pandemic levels of business activity due to COVID-related circumstances beyond your control.

It is important to note that even if your PPP loan is forgiven, you may still be responsible for paying taxes on the forgiven amount. For more information about tax implications associated with PPP loans, please consult with a tax advisor or accountant.

If you have questions about how to repay your PPP loan or whether or not your PPP loan qualifies for forgiveness, we encourage you to speak with your lender or a qualified financial advisor.

What is a PPP loan?

A PPP loan is a loan that is meant to help small businesses keep their workers employed during the COVID-19 pandemic. The loans are 100% federally guaranteed and will be forgiven if the borrower uses the loan proceeds for payroll costs, interest on mortgage obligations, rent, and utility payments.

The Paycheck Protection Program (PPP) loans are part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which was signed into law on March 27, 2020.

How do I repay my PPP loan?

If you received a Paycheck Protection Program (PPP) loan from a participating lender, you may be eligible for loan forgiveness. Loan forgiveness is based on the use of loan proceeds for eligible payroll costs, interest on an eligible mortgage, rent, and utility payments over the covered period. You must apply for loan forgiveness with your lender.

If you are not eligible for full loan forgiveness, any remaining balance on your PPP loan must be repaid to the lender with interest but not earlier than 10 months after the last day of the covered period or maturity date of 18 months from the date when you received your first disbursement of the PPP loan, whichever is later. Your lender will contact you to discuss repayment options prior to the end of the covered period or maturity date.

You will not be personally liable for any remaining balance on your PPP loan if SBA is unable to collect from your business.

What are the consequences of not repaying my PPP loan?

Not repaying your PPP loan has serious consequences. If you don’t repay your loan, you will:

-damage your credit score

-be liable for the full amount of the loan, plus interest and fees

-be subject to civil and criminal penalties, including possible imprisonment

Conclusion

We hope this guide has helped you understand some of the key details around repaying your PPP loan. Remember, you will need to work with your lender to ensure you are following all the necessary steps and requirements.

If you have any further questions, please don’t hesitate to reach out to our team of experts at Business Finance Depot. We’re here to help you every step of the way!