How to Get a Farm Loan

Contents

Applying for a farm loan may seem like a daunting task, but we’re here to help. Follow our step-by-step guide on how to get a farm loan and you’ll be on your way to owning your very own farm in no time.

Checkout this video:

Research the best type of farm loan for your needs

It’s important to research the best type of farm loan for your needs before applying. The U.S. Department of Agriculture (USDA) offers several types of farm loans that can be used for a variety of purposes, such as purchasing land, building barns or other structures, buying livestock and equipment, or making farm improvements. The most common type of loan is the direct operating loan, which can be used for operating expenses such as seed, fertilizer, and fuel. The USDA also offers direct and guaranteed ownership loans, which can be used to purchase land and buildings, and guaranteed loans, which can be used to buy larger pieces of equipment.

The interest rates for USDA farm loans are typically lower than those for traditional bank loans, and there are no down payment or minimum credit score requirements. To qualify for a USDA loan, you must be a farmer or rancher who intends to use the loan for agricultural purposes, and you must meet the eligibility requirements for the specific type of loan you are applying for. For example, to qualify for a direct ownership loan, you must have operated a farm for at least three years.

Research and contact different lenders

There are many different types of lenders that offer farm loans, so it’s important to do your research to find the one that best suits your needs. You’ll want to consider things like the size of the loan you need, the interest rate, and the repayment terms. Once you’ve narrowed down your options, you can then contact the different lenders to get more information and start the application process.

Gather the required documentation

To get a farm loan, you will need to provide the lender with a variety of documentation, including financial statements, tax returns, and a business plan. The amount of documentation you will need to provide will vary depending on the type of loan you are applying for and the lender’s requirements.

When you are gathering the required documentation, be sure to have everything in order and organized. This will make it easier for the lender to review your loan application and make a decision.

The following is a list of some of the common documents that you will need to provide when applying for a farm loan:

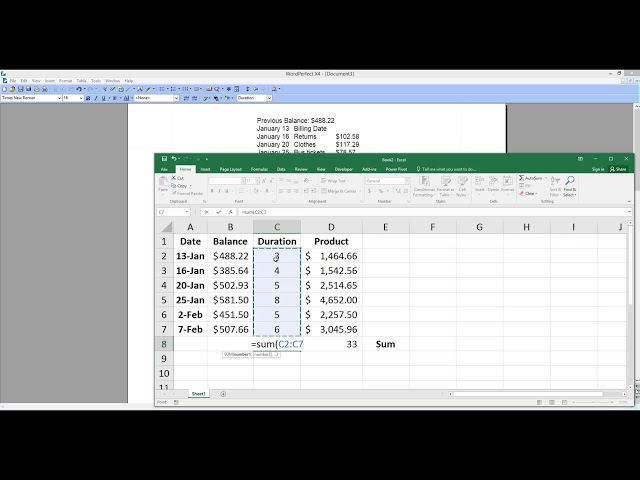

-Financial statements: This can include balance sheets, income statements, and cash flow statements. Lenders will use these documents to assess your financial health and determine whether or not you are a good candidate for a loan.

-Tax returns: Most lenders will require tax returns for the past three years. Be sure to have these documents ready when you apply for a loan.

-Business plan: A business plan is not always required, but it can be helpful in securing a loan. If you have one, be sure to include it with your other documentation.

Prepare your business plan

If you don’t have a business plan, now is the time to start working on one. A business plan will help you communicate your vision for the farm to potential lenders and clarify your goals. You can find templates and resources for developing a business plan on the U.S. Small Business Administration website.

Be sure to include:

-An executive summary

-Your farm’s history

-Your farm’s current status

-A description of your farming operation

-Your management team

-Your marketing strategy

-Your financial projections

Complete the loan application

You will need to fill out a loan application and provide the following documentation:

-Proof of citizenship or legal residency

-Proof of income

-Social Security number or Alien Registration number

-Bank statements for the past three months

-List of debts and creditors

-Collateral information (if any)

Negotiate the loan terms

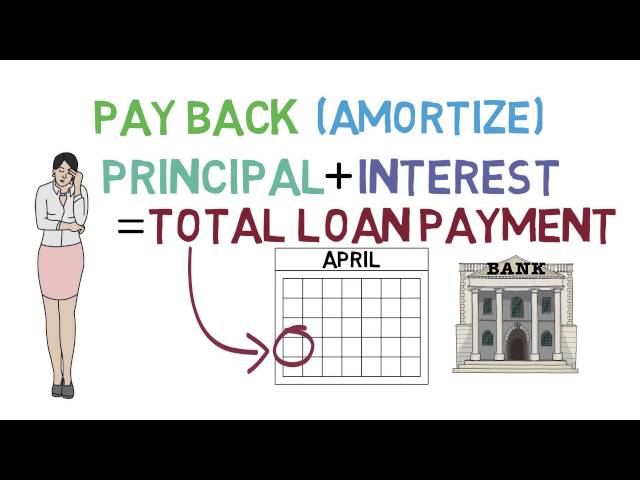

Before you sign on the dotted line, be sure to negotiate the loan terms that are most favorable to you and your farm. Some things you may want to consider include:

-The interest rate

-The loan repayment schedule

-Whether the loan is secured or unsecured

-The collateral required

Close on the loan

The process of getting a farm loan is a lengthy one, but once you have been approved for the loan, you will need to close on the loan. The process of closing on the loan can vary depending on the lender, but there are some general steps that you will need to follow.

1. Review the loan documents. Before you sign any paperwork, it is important that you take the time to review all of the loan documents. This includes the promissory note, mortgage documents, and any other paperwork associated with the loan. Make sure that you understand all of the terms and conditions of the loan before you sign anything.

2. Pay any fees associated with the loan. In most cases, there will be fees associated with getting a farm loan. These fees can include appraisal fees, origination fees, and closing costs. Be sure to ask your lender about all of the fees associated with the loan so that you can be prepared to pay them.

3. Close on the loan. Once all of the paperwork has been signed and all of the fees have been paid, you will need to close on the loan. This usually involves going to a title company or an attorney’s office to sign the final paperwork and pay any remaining closing costs. Once this is done, you will be officially approved for the farm loan!