How to Get the Lowest Interest Rate on a Car Loan

Contents

It’s no secret that interest rates on car loans are at an all-time high. Here’s how to get the lowest interest rate on a car loan.

Checkout this video:

Introduction

Historically, the average interest rate on a car loan has been around six percent. However, in recent years rates have been on the rise and are now closer to eight or nine percent. If you’re in the market for a new vehicle, you may be wondering how to get the lowest interest rate possible on your car loan. Here are a few tips to help you get started:

-Check your credit report and score: This is one of the most important things you can do when applying for any type of loan. Your credit score will determine what interest rate you qualify for. The higher your score, the lower your rate will be.

-Shop around: Don’t just accept the first offer you get. Talk to several different lenders and compare rates before making a decision.

-Get pre-approved: Many lenders will give you a better rate if you get pre-approved for a loan before shopping for a car. This means that you’ve already been through the process of applying and qualifying for a loan and they know exactly how much they’re willing to lend you.

-Negotiate: Once you’ve found the car you want, be sure to negotiate the price of the vehicle itself as well as the interest rate on the loan. You may be surprised at how much leeway there is on both of these things.

If you follow these tips, you should be able to get a good interest rate on your car loan. Just remember to shop around and don’t accept the first offer that comes your way.

How to Get the Lowest Interest Rate on a Car Loan

One of the most important factors in getting a car loan is the interest rate. The interest rate can make a big difference in the amount of money you end up paying for your car, so it’s important to get the lowest rate possible. There are a few things you can do to get the lowest interest rate on a car loan.

Know Your Credit Score

Your credit score is one of the biggest factors in getting a low interest rate on a car loan, and you should always know your score before shopping for a car.

If you don’t know your score, you can get it for free from a number of sources, including CreditKarma.com, Quizzle.com and CreditSesame.com. Once you know your score, you’ll have a better idea of the interest rates you’re likely to qualify for, and you can shop around for the best deal.

If your credit score is on the low end, don’t despair – there are still options available to you. subprime lenders specialize in loans for people with less-than-perfect credit, and they can often help you get financing at a reasonable rate. Just be aware that subprime loans typically come with higher interest rates and fees than prime loans, so it’s important to compare offers from multiple lenders before choosing one.

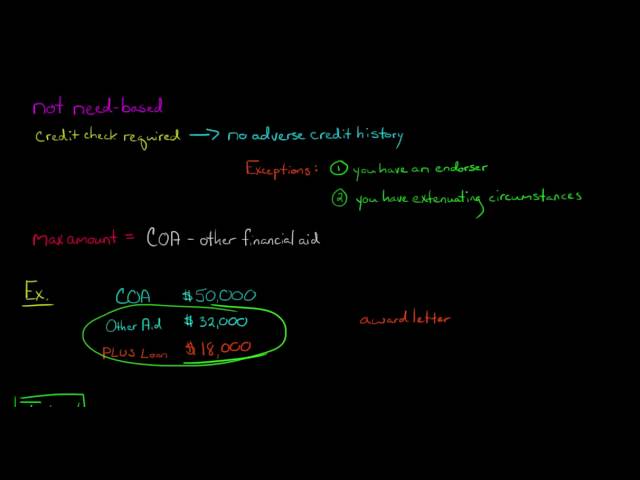

Get Pre-Approved for a Loan

One of the best ways to get the lowest interest rate on a car loan is to get pre-approved for a loan before you even start shopping for a car. This way, you know exactly how much you can afford to spend on a car and you can shop around for the best interest rate.

When you pre-apply for a loan, the lender will do a hard credit check, which will lower your credit score by a few points. But as long as you shop around for loans within a 30-day period, the impact on your credit score will be minimal. And the benefit of getting pre-approved for a loan is that you’ll know exactly how much money you have to spend on a car and what interest rate you’ll be getting.

Shop Around for the Best Rate

The best way to get the lowest interest rate on a car loan is to shop around for the best rate. Many banks and financial institutes offer auto loans, and each has their own interest rate.

In order to find the best interest rate possible, it is important to compare rates from multiple lenders. The best way to do this is to use an online loan calculator. With a loan calculator, you can input your desired loan amount, interest rate, and repayment period, and the calculator will give you an estimated monthly payment.

Once you have found a few different lenders that offer competitive rates, it is important to compare the terms of each loan. Some loans may have a lower interest rate but a shorter repayment period, while others may have a higher interest rate but a longer repayment period. It is important to choose the loan that is best for your individual situation.

If you have good credit, you may be able to negotiate with the lender for a lower interest rate. It is always important to remember that lenders are interested in making money, so if you can show them that you are a low-risk borrower, they may be willing to offer you a better deal.

Negotiate the Interest Rate with the Dealer

After you’ve selected the car you want to buy, it’s time to start thinking about the loan. You don’t have to finance your car through the dealership, but many people do because it’s convenient. The dealership will work with a lender to get you a loan, and then they’ll add the interest rate to the price of the car. This is called the “buy rate.”

You can negotiate the interest rate with the dealer, just like you would negotiate the price of the car. It’s important to remember that the dealer is working for their commission, so they may not be motivated to give you the best deal on financing. If you’re not comfortable negotiating with the dealer, you can get pre-approved for a loan through your bank or credit union. This will give you more bargaining power because you’ll know exactly how much money you have to work with.

If you do choose to finance through the dealership, make sure you understand all of the terms and conditions before you sign anything. Read over your contract carefully and ask questions if there’s anything you don’t understand. It’s also a good idea to get a copy of your credit report before you go so that you know what kind of interest rate you should be expecting.

The bottom line is that it’s possible to get a low interest rate on a car loan, but it takes some work on your part. By doing your research and being prepared to negotiate, you can get a great deal on financing for your new car.

Conclusion

Now that you know how to get the lowest interest rate on a car loan, put that knowledge to work when you’re ready to buy a car. Getting a low interest rate can save you hundreds, even thousands, of dollars over the life of your loan.