What Appears on a Loan Estimate?

Contents

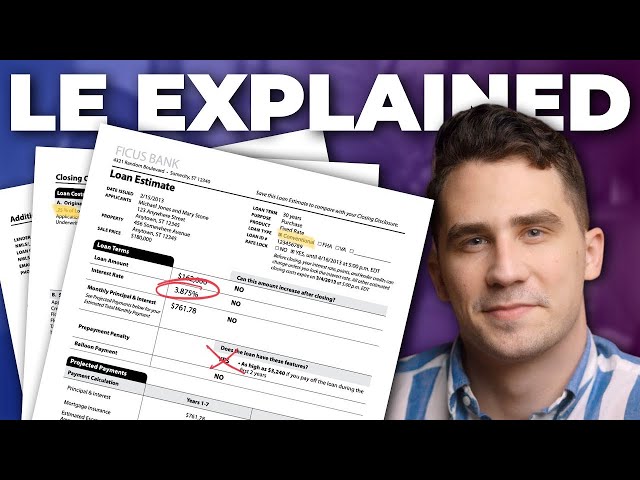

If you’re in the process of shopping for a mortgage, you’ve probably heard the term “Loan Estimate.”

A Loan Estimate is a three-page form that you receive from a lender after you submit a loan application.

Checkout this video:

Introduction

A Loan Estimate is a three-page form that you receive after applying for a mortgage. The Loan Estimate tells you important details about the loan you have requested.

You will receive a Loan Estimate within three business days of applying for a loan with a lender. The Loan Estimate includes information such as:

-an estimate of the monthly principal and interest payments for the loan

-the total estimated costs of obtaining the loan

-the estimated taxes, insurance, and assessments for the property

The Loan Estimate form is designed to help you compare different offers from different lenders. It is important to review the Loan Estimate carefully and ask questions about anything you do not understand.

What is a Loan Estimate?

A Loan Estimate is a three-page form that you receive after applying for a mortgage. It contains important information, such as the estimated interest rate, monthly payment, and closing costs. It will also list the type of loan you applied for, as well as the terms of the loan. This document is important because it will give you an idea of what you can expect when you close on your loan.

The Purpose of a Loan Estimate

A Loan Estimate is a three-page form that you receive after applying for a mortgage. The Loan Estimate tells you important details about the loan you have requested.

You will receive a Loan Estimate within three business days of applying for a loan with a lender. The Loan Estimate includes important details about the loan you have requested, such as:

-The estimated interest rate

-The monthly principal and interest payment

-The estimated amount of taxes and insurance that will be required each year

-The estimated total monthly payment

-The loan terms (the length of time you will have to repay the loan)

-The type of loan product

-The estimated costs of obtaining the loan, such as origination fees, appraisal fees, and title insurance premiums

It is important to review the Loan Estimate carefully so that you understand the terms of the loan and can compare offers from different lenders.

When to Expect a Loan Estimate

You should receive a Loan Estimate within 3 business days of applying for a mortgage. If you applied in person, you should receive it immediately.

If you have not received your Loan Estimate within 3 business days, contact your loan officer or the lender to inquire about the status of your application.

How to Use a Loan Estimate

A Loan Estimate is a three-page form that you receive after applying for a mortgage. The Loan Estimate tells you important details about the loan you have requested. Use this document to compare offers from different lenders.

The Loan Estimate will tell you:

-The interest rate and monthly payment amount

-The total cost of the loan

-How much money you will need to bring to closing

-Whether there are any prepayment penalties

The Contents of a Loan Estimate

A Loan Estimate is a three-page document that you receive from a lender after you submit a loan application. The Loan Estimate tells you about the estimated loan terms, monthly payments, and closing costs. It is important to review your Loan Estimate carefully so that you understand the terms of your loan and what you will be responsible for.

Personal Information

The first page of your Loan Estimate shows your loan terms, your estimated interest rate and monthly payment amounts. This page also includes your personal information (name, address, etc.) as well as the property information (address, type of home, value, etc.). The second page contains additional details about your loan terms and costs.

Loan Terms

The loan terms section is probably the most important part of the Loan Estimate. It tells you the key features of your loan, including how much you’ll pay each month, how much interest you’ll pay over the life of your loan, and when your payments are due.

Be sure to look at both the interest rate and the Annual Percentage Rate (APR). The interest rate is the cost of borrowing money, while the APR includes the interest rate plus other costs like certain fees and points. The APR can help you compare loans because it reflects the total cost of the loan.

Other important terms to look for include:

-The length or “term” of your loan (the number of years you have to repay it)

– whether your loan has a fixed or adjustable interest rate

– whether there are any prepayment penalties (fees charged if you pay off your loan early)

Estimated Costs

The first section of the Loan Estimate is Estimated Costs. This section provides an overview of the expected closing costs for the loan.

The Estimated Costs are grouped into three categories:

-Origination Charges: These are the charges for loan origination, application, and processing.

-Services You Cannot Shop For: These are charges for services that you cannot shop for, such as a credit report or appraisal. The creditor must give you these charges up front so that you can shop around for these services if you wish.

-Services You Can Shop For: These are charges for services that you can shop for, such as title insurance. The creditor does not have to give you these charges up front, but must provide you with a good faith estimate of these charges so that you can shop around for these services if you wish.

Summary of Estimated Costs

The Summary of Estimated Costs is a key section of the Loan Estimate because it helps you compare loan offers and understand what you’ll pay at closing.

This section includes four cost categories:

· Interest – This is the cost of borrowing the money and is expressed as a percentage of the loan amount. The higher the interest rate, the more you’ll pay over the life of the loan.

· Origination Charges – These are fees charged by the lender for processing your loan application and originating your loan. They can include fees for services like appraisal, credit report, tax service, document preparation and underwriting.

· Discount Points – Discount points are a form of prepaid interest that can help lower your interest rate and monthly payments. One point equals 1% of your loan amount.

· Third-Party Charges – These are fees charged by third parties for services related to your loan, like appraisal, title insurance and government recording charges.

Comparison of Loan Estimates

When you applied for your mortgage, you should have received a Loan Estimate form from each lender with your loan offer. Now that you have chosen a loan, you can compare the final Loan Estimates to be sure that the terms are the same as what you were expecting.

The comparison should include all of the following:

-Loan amount

-Interest rate

-Type of interest rate (fixed or adjustable)

– APR (annual percentage rate)

– Monthly payment amount

– Estimated closing costs

– Mortgage insurance (if required)

– Prepayment penalties (if any)

Conclusion

Now that you know what appears on a Loan Estimate, you can be sure to ask your lender for one whenever you’re considering a new loan. This document will help you compare offers from different lenders and make an informed decision about which loan is right for you.