How to Get a Loan for a House

Contents

Applying for a home loan can be a daunting task. There are many things to consider when applying for a loan , and it is important to be prepared. This blog post will provide you with some tips on how to get a loan for a house.

Loan for a House’ style=”display:none”>Checkout this video:

Introduction

If you’re in the market for a new home, you probably already know that you’ll need to get a loan in order to finance your purchase. But what you might not know is how to actually get a loan for a house.

The process of getting a loan for a house can be complicated, but it doesn’t have to be. In this guide, we’ll walk you through the steps you need to take in order to get a loan for your new home.

First, you’ll need to find a lender who is willing to give you a loan. This can be difficult if you have bad credit, but there are some lenders who specialize in loans for people with bad credit. Once you’ve found a lender, you’ll need to fill out an application and provide any documentation that the lender requires.

Once your application is approved, the lender will give you a loan estimate. This document will outline the terms of your loan, including the interest rate, monthly payments, and total amount that you will owe. Be sure to review this estimate carefully before deciding whether or not to accept the loan.

If you decide to accept the loan, the next step is to sign the mortgage documents. These documents will legally obligate you to make your monthly payments on time and keep up with all of the other terms of your loan agreement. Once these documents are signed, your loan will be funded and you’ll be on your way to owning your new home!

How to Get a Loan for a House

If you’re looking to get a loan for a house, there are a few things you’ll need to do. First, you’ll need to find a lender who is willing to work with you. Once you’ve found a lender, you’ll need to fill out a loan application and provide any supporting documentation. After your loan is approved, you’ll need to sign the loan agreement and make any necessary down payments.

How to Get a Loan for a House with Bad Credit

Bad credit can make it tough to qualify for a home loan, but there are options for homebuyers with less-than-perfect credit. The U.S. Department of Housing and Urban Development (HUD) offers a variety of federal programs that may help you, including the Federal Housing Administration’s (FHA) mortgage insurance program. FHA loans have more flexible lending requirements than most other loans, and your down payment could be as low as 3.5%.

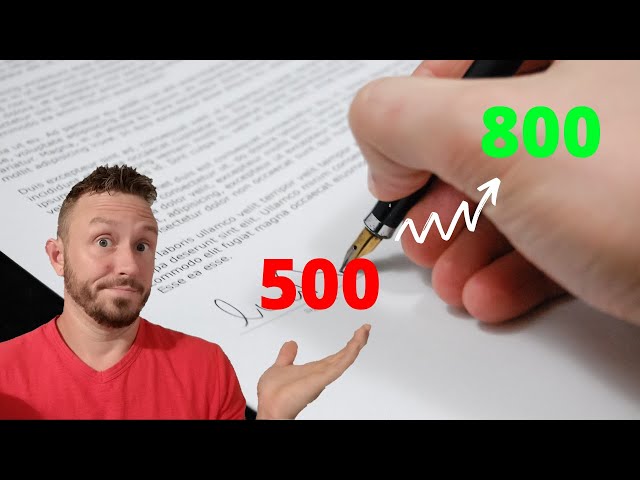

If you have a credit score of at least 580, you may be eligible for an FHA loan with a down payment of just 3.5%. If your credit score is between 500 and 579, you may be eligible for an FHA loan with a 10% down payment. However, FHA loans usually require mortgage insurance, which can add to your monthly payments.

The HUD has a list of approved lenders who participate in its programs, so you may want to start there when shopping for a loan. You can also check with your state housing finance agency about possible down payment assistance programs or other types of financing that may be available to first-time homebuyers in your area.

How to Get a Loan for a House with No Credit

No credit? Getting a loan for a house with no credit is possible. There are plenty of lenders who will work with you, even if you have no credit history.

A good place to start is by getting pre-approved for a mortgage. This will give you an idea of how much you can borrow and what interest rate you can expect to pay. You can get pre-approved from a bank or a credit union.

Once you have pre-approval, start shopping for a house. Once you find a house that you want to make an offer on, the next step is to get a loan.

The first thing you need to do is get in touch with a few different lenders and see what they’re willing to give you. Each lender has different standards, so it’s important to shop around. Be sure to compare interest rates and terms before making your decision.

If you have trouble qualifying for a traditional loan, there are other options available. You may be able to get a government-backed loan, such as an FHA loan or a VA loan. You may also be able to qualify for a “no doc” loan, which doesn’t require any documentation of income or assets. However, these loans often come with higher interest rates and may be more difficult to qualify for.

If you have any questions about how to get started, or if you need help finding a lender, contact a real estate agent today. They will be able to help you through the process and guide you to the best lenders in your area.

How to Get a Loan for a House with Good Credit

One of the best ways to get a loan for a house with good credit is to find a lender who specialize in bad credit home loans. There are many subprime lenders who offer loans to people with bad credit, and these lenders are often willing to work with you to get you the best possible terms on your loan.

Another option for getting a loan for a house with good credit is to work with a private lender. Private lenders are individuals or companies that lend money to people without going through a bank. Private lenders typically charge higher interest rates than banks, but they can be more flexible in their lending criteria. If you have good credit, you should be able to find a private lender who is willing to give you a loan for your home.

Conclusion

In order to get a loan for a house, you will need to meet with a loan officer and fill out a loan application. Be sure to have all of your financial information, such as your tax returns, W-2 forms, and pay stubs, ready to provide to the loan officer. You may also be asked for information about your employment history and your debt-to-income ratio. Once you have submitted your loan application, the loan officer will review it and make a decision on whether or not to approve your loan.