How to Calculate the Total Interest Paid on a Loan

Contents

How to Calculate the Total Interest Paid on a Loan. You can use this calculator to figure out the total interest paid on a loan.

Checkout this video:

Introduction

When you borrow money, whether it’s for a car, a house, or a credit card, you’ll have to pay back the principal of the loan plus interest. Interest is what lenders charge for the use of their money. The amount of interest you’ll have to pay depends on several factors: the principal (the amount you borrow), the interest rate, and the length of time you have to pay back the loan. In this article, we’ll show you how to calculate the total interest paid on a loan.

The Basics of Interest

Interest is the price you pay for the use of someone else’s money. When you take out a loan, you agree to pay back the principal — the amount you borrowed — plus interest. The total amount you pay back is the principal plus the total interest paid on the loan.

There are two types of interest: simple and compound. Simple interest is calculated as a percentage of the principal and is paid only on the principal. Compound interest is calculated on both the principal and any unpaid interest, and it is paid both on the principal and on previous interest that has not been paid.

To calculate the total interest paid on a loan, you need to know the following information:

– The loan amount (principal)

– Theinterest rate

– The number of years you will be paying off the loan

How to Calculate the Total Interest Paid on a Loan

You can use this calculator to figure out the total interest paid on a loan. You’ll need to know the loan amount, the interest rate, and the number of years you’ll be paying off the loan. Enter those values into the calculator and hit “calculate.”

The Formula

The easiest way to calculate the total interest paid on a loan is to use a loan calculator. However, if you want to do the math yourself, the formula is actually quite simple. Just follow these steps:

1. Determine the loan amount, the interest rate, and the length of the loan in months.

2. Convert the interest rate into a decimal by dividing it by 100. For example, if your interest rate is 7%, you would convert it to 0.07.

3. Raise the interest rate decimal to the number of months you’re loaning multiplied by -1. In our example, that would be 0.07 raised to -36, or 0.000000000378. This number is called the periodic rate because we’re calculating it for one period (month) of a larger loan (multiple periods).

4. Add 1 to this result and multiply it by -1 again (raise it to -1 again), and you have your interest factor, 1.000000000378 in our example above This step might seem redundant, but it’s not –- remember, we’re working with very small numbers here, so each step matters!

5 Multiply your original loan amount by your periodic rate and you’ll have your monthly interest payment: $500 x 0.000000000378 = $0.0189 in our example So on a $500 loan at 7% interest for 36 months, your monthly payment would be $0Listing 5 shows how this calculation might look for various loans with different terms and sizes

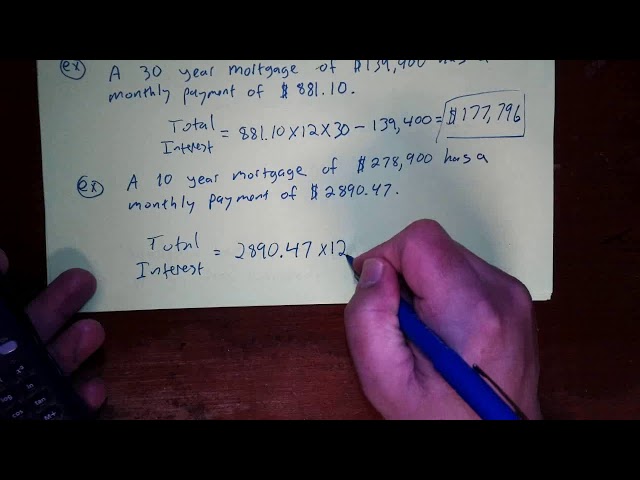

An Example

To calculate the total interest paid on a loan, simply multiply the total amount of the loan by the interest rate. For example, if you have a $100,000 loan with a 5% interest rate, your total interest paid would be $5,000.

Conclusion

To summarize, the total interest paid on a loan can be calculated by subtracting the original amount of the loan from the final amount of the loan, then multiplying that number by the interest rate and the length of time of the loan.