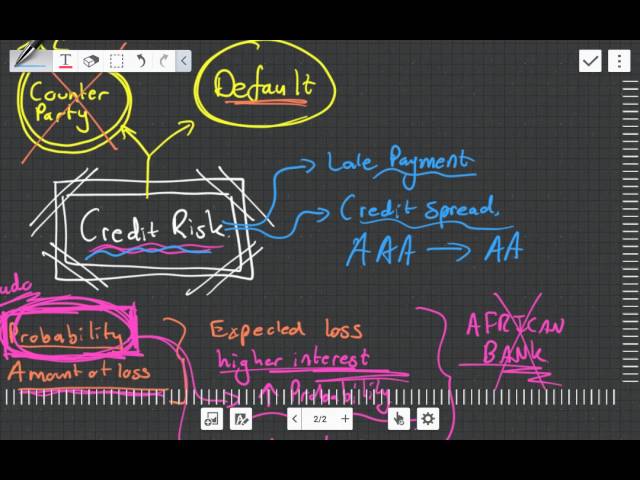

What is a Credit Risk?

Contents

Credit risk is the risk of loss that may occur from the failure of any party to perform on an agreement.

Credit Risk?’ style=”display:none”>Checkout this video:

Introduction

A credit risk is the risk of default on a debt that may arise from a borrower failing to make required payments. In the first resort, the risk is that of the lender and includes lost principal and interest, disruption to cash flows, and increased collection costs. The loss may be partial or complete. In an efficient market, lenders attempt to price loans with a consideration for both the level of risk and potential return that they are willing to accept. Borrowers are typically assessed by credit-rating agencies which publish information on their creditworthiness.

Banks are particularly exposed to credit risk and set aside capital against potential losses. Here, we provide an overview of credit risk, how it is measured, what it looks like in practice, and some of the key ways that banks manage their exposure to it.

What is a Credit Risk?

Credit risk is the risk of loss that may occur from the failure of any party to meet its contractual obligations under a financial contract. The risk is usually associated with debt instruments, but it can also be attached to other financial instruments such as derivatives.

Types of Credit Risk

Credit risk is the risk of financial loss to a lender or creditor if a borrower or debtor fails to make payments as promised. In general, the higher the risk of default, the higher the interest rate that will be charged to compensate for that risk.

There are four main types of credit risk:

-Default Risk: This is the most common type of credit risk and refers to the possibility that a borrower will default on their debt obligations. Default risks can be further divided into two subcategories: strategic and inadvertent defaults. Strategic defaults occur when borrowers deliberately choose to not repay their debts, while inadvertent defaults happen when borrowers are unable to make repayments due to financial difficulties.

-Prepayment Risk: This type of credit risk arises when borrowers repay their debt obligations ahead of schedule. This can be detrimental to lenders because it means they will not receive all of the interest payments they were expecting.

-Extension Risk: Extension risk occurs when borrowers extend the terms of their loan, resulting in a longer repayment period. This can be costly for lenders because it means they will need to tie up their capital for a longer period of time.

-Reinvestment Risk: This type of credit risk occurs when lenders are unable to reinvest lent funds at the same interest rate when they become due for repayment. This can eating into profits, as well as increasing funding costs.

.1 Macroeconomic or Systematic Credit Risk

This is the possibility that an event or trend in the overall economy will have a negative impact on the value of your investment. For example, if you own stock in a single company and that company goes bankrupt, you will lose money. But if you own a diversified portfolio of stocks and one company goes bankrupt, the impact on your overall portfolio will be much less.

Systematic risk can’t be diversified away, so it’s important to consider when making investment decisions. Some examples of systematic risks include:

-Recession

-Inflation

-Political upheaval

-Natural disasters

.2 Firm-Specific or Idiosyncratic Credit Risk

Firm-specific or idiosyncratic credit risk is the possibility that a company will experience financial distress or default on its debt obligations due to poor management, an unsuccessful business strategy, or other factors specific to that company. This type of risk is also sometimes called unsystematic risk.

Investors who are concerned about firm-specific credit risk can diversify their portfolios by investing in a variety of companies and industries, which will lessen the impact of any one company’s financial problems on the overall portfolio. For example, an investor who owns stock in only one company is more exposed to that company’s credit risks than an investor who owns stocks in several companies.

Sources of Credit Risk

Credit risk is the possibility that a borrower will default on a loan or other financial obligation. This can happen when a borrower is unable to make required payments, or when a borrower fails to repay a debt entirely. Credit risk can also arise when a borrower takes on too much debt, which can lead to financial difficulties.

There are many sources of credit risk, including:

-Borrowers with poor credit histories

-Borrowers who take on too much debt

-Borrowers who fail to make required payments

-Borrowers who default on their debts entirely

.1 External Sources of Credit Risk

There are many sources of risk that can affect the solvency or creditworthiness of a counterparty. Some risks are specific to certain counterparties or industries, while others are more general. The most common external sources of credit risk are described below.

-Economic conditions: The financial health of a counterparty is closely linked to general economic conditions, such as interest rates, inflation, and employment levels. For example, a company that relies heavily on consumer spending is likely to suffer during an economic downturn.

-Industry-specific factors: Certain industries are more prone to credit risk than others. For example, the airline industry is particularly vulnerable to economic shocks, as evidenced by the sharp decline in air travel following the 9/11 terrorist attacks.

-Political instability: Governmental policies and regulations can have a significant impact on the financial stability of a counterparty. For example, the nationalization of banks in Argentina and Venezuela has led to widespread defaults on loan obligations.

-Exchange rate risk: This type of risk arises when a counterparty has debt obligations denominated in a foreign currency. For example, a Canadian company that has borrowed US dollars will face higher borrowing costs if the Canadian dollar strengthens against the US dollar (i.e., if the exchange rate goes from 1 USD = 1 CAD to 1 USD = 0.75 CAD).

.2 Internal Sources of Credit Risk

There are two main types of credit risk: internal and external. Internal credit risk is any risk that comes from within your organization, while external credit risk is any risk that comes from outside your organization.

Internal Sources of Credit Risk

The most common internal source of credit risk is poor financial management. This can include things like mismanaging cash flow, taking on too much debt, or making bad investment decisions. Other internal sources of credit risk include fraud and embezzlement.

External Sources of Credit Risk

The most common external source of credit risk is the failure of another company that you do business with. This can happen if they can’t pay their debts, go bankrupt, or simply stop doing business. Other external sources of credit risk include natural disasters and political instability.

How to Manage Credit Risk?

Credit risk is the risk of financial loss that may arise from a borrower failing to make required payments on a credit obligation. In other words, it is the risk that a lender will not receive the full amount of principal and interest when due. There are a number of ways to manage credit risk.

Identifying Credit Risk

There are a number of methods used to identify credit risk. Financial institutions commonly use credit scores, which are calculated using a number of factors including payment history, outstanding debt, and length of credit history. Other methods may include reviewing a borrower’s employment history or checking for derogatory items on their credit report.

Once a potential credit risk has been identified, lenders will typically take steps to mitigate the risk. This may include requiring a higher down payment, charging a higher interest rate, or extending the term of the loan. In some cases, lenders may require collateral before extending a loan.

Measuring Credit Risk

When lenders make credit decisions, they consider many factors including an applicant’s income, employment stability, and credit history. But one important factor that is often overlooked is the applicant’s ability to manage credit risk.

Credit risk is the probability that a borrower will default on a loan. Lenders use a variety of methods to measure credit risk, including credit scores, debt-to-income ratios, and payment history.

Credit scores are the most commonly used method of measuring credit risk. The three major credit bureaus (Equifax, Experian, and TransUnion) all use different scoring models, but the most common is the FICO score. FICO scores range from 300 to 850, and the higher the score, the lower the risk of default.

Debt-to-income ratio (DTI) is another common method of measuring credit risk. DTI is calculated by dividing an applicant’s monthly debts by their monthly income. The higher the DTI, the greater the risk of default. Lenders typically prefer a DTI of 36% or less.

Payment history is also a important factor in measuring credit risk. Applicants with a history of late or missed payments are considered to be higher risk than those with a history of on-time payments.

Monitoring Credit Risk

Credit risk is the risk of loss that may arise from the failure of any party to perform on its obligations under a contract. The risk can be categorized as follows:

– counterparty risk

– settlement risk

– Herstatt risk

– sovereign risk

– commercial risk

– reputational risk.

Mitigating Credit Risk

Credit risk is the probability of losses arising from a debtor’s inability to meet their contractual obligations in full. In the banking sector, managing credit risk is vital to the health and stability of the institution. There are a number of ways to mitigate credit risk, including:

-Diversification: This involves spreading your risk across a number of different investments. For example, rather than lend all your money to one borrower, you could lend to 10 borrowers each with a lower loan amount. This way, if one borrower defaults on their loan, you will only lose a small portion of your overall investment.

-Collateral: This is an asset that can be used to secure a loan. If the borrower defaults on the loan, the lender can seize the collateral and sell it to recoup their losses. For example, if you are lending money to a small business owner to purchase inventory, you may ask for collateral in the form of the inventory itself. That way, if the business owner defaults on the loan, you can still sell the inventory to recoup your losses.

-Credit insurance: This is insurance that protects lenders from losses arising from a borrower’s inability to repay their debt. Credit insurance can help mitigate loss if a borrower defaults on their loan.

-Provisioning: This is an accounting technique that banks use to recognizing expected losses on loans as they occur. By setting aside money early on in the life of a loan for expected losses (known as provisioning), banks can minimize the impact of those losses when they do occur.

Conclusion

A credit risk is simply the risk of a borrower not being able to repay a loan. This can happen for a number of reasons, such as job loss, unexpected medical bills, or other financial emergencies. If the borrower is unable to repay the loan, the lender may be forced to write off the debt, which can lead to financial losses.

There are a few ways to mitigate credit risk, such as diversifying one’s loan portfolio or requiring collateral from the borrower. But ultimately, all lenders face some degree of credit risk when they extend loans.