Why Did My Credit Score Drop 40 Points?

Contents

If you’re wondering why your credit score dropped 40 points, there could be a few different reasons. In this blog post, we’ll explore some of the most common causes for a sudden credit score decrease.

Checkout this video:

Reasons for a Sudden Score Drop

A sudden drop in your credit score can be a cause for concern. It can be difficult to determine why your score dropped, but there are a few likely reasons. Maybe you missed a payment, or youopened a new line of credit. Maybe you applied for a new credit card. Whatever the reason, a drop in your credit score can be worrying. But don’t panic! In this article, we’ll cover some of the reasons your credit score could have dropped suddenly.

You Missed a Payment

One of the most common reasons for a sudden drop in credit score is missing a payment. Payment history is the most important factor in credit scoring, so even one late payment can have a significant negative impact. If you usually pay your bills on time but you missed a payment recently, that could be the reason for your score drop.

If you think you might have missed a payment, check your credit report to see if there is any information about late payments. If you see a late payment listed, it’s important to take action immediately. The sooner you can bring your account current, the better chances you have of improving your credit score.

There are other potential causes for a sudden score drop, but missing a payment is one of the most common reasons. If you’re not sure why your score dropped, checking your credit report is a good place to start.

You Opened a New Credit Card

Your credit score may have dropped suddenly because you opened a new credit card. While it’s true that adding a new credit card could potentially increase your credit score in the long run by adding to your overall credit limit and thus lowering your credit utilization rate, in the short term, your score could drop for a couple reasons.

First, opening a new credit card generally causes a small “hard pull” on your credit report, which can cause your score to drop a few points. Additionally, when you open a new credit card, your average age of accounts decreases (since it’s now a newer account), which can also cause your score to drop slightly.

If you’re trying to improve or maintain a good or excellent credit score, it’s generally best to avoid opening any new lines of credit unless absolutely necessary.

You Closed an Old Credit Card

One common reason for a sudden drop in credit score is closing an old credit card. When you close a credit card, you lose the history associated with that account, which can be detrimental to your score. If you have a good history with the card (i.e., you’ve never missed a payment and always paid your balance in full), then closing it could cause your score to drop.

Another reason your score may have dropped suddenly is if you’ve applied for a new credit card or loan. When you apply for any type of credit, the lender will do a hard inquiry on your credit report. This type of inquiry can stay on your report for up to two years and can ding your score by a few points.

You Have a Lot of Debt

If you have a lot of debt, your credit score is likely to suffer. This is because lenders see you as a high-risk borrower, and they’re not willing to lend to you unless you’re willing to pay a higher interest rate. If you’re carrying a lot of debt, it’s important to try to pay it down as quickly as possible. Otherwise, you’ll keep paying high interest rates, and your credit score will continue to suffer.

How to Recover From a Sudden Score Drop

A small drop in your credit score probably won’t affect your creditworthiness, but a sudden score drop of 40 points or more can be a cause for concern. There are a few things that could cause your score to drop suddenly, and we’ll go over some of those reasons now. If you see a sudden score drop, don’t panic. There are things you can do to recover.

Check for Errors

If you see a sudden, significant drop in your credit score, the first thing you should do is check for errors. Sometimes, a single mistake can cause your score to tank. Luckily, you can get these errors fixed relatively easily.

The first step is to get a copy of your credit report from the major credit bureaus (Experian, Equifax, and TransUnion). You’re entitled to one free report from each bureau every year. Look over your report carefully and look for any mistakes.

Common mistakes include:

-Incorrect personal information (e.g., wrong birthdate or Social Security number)

-Incorrect account information (e.g., wrong balance or payment history)

-Incorrect public record information (e.g., bankruptcies that have been discharged or foreclosures that have been paid off)

-Incorrect inquiries (e.g., hard inquiries that you didn’t authorize or soft inquiries that are listed as hard inquiries)

If you find any errors on your report, you should file a dispute with the credit bureau. The bureau will then investigate the error and, if they find that it is indeed an error, they will remove it from your report. This can often cause your score to rebound fairly quickly.

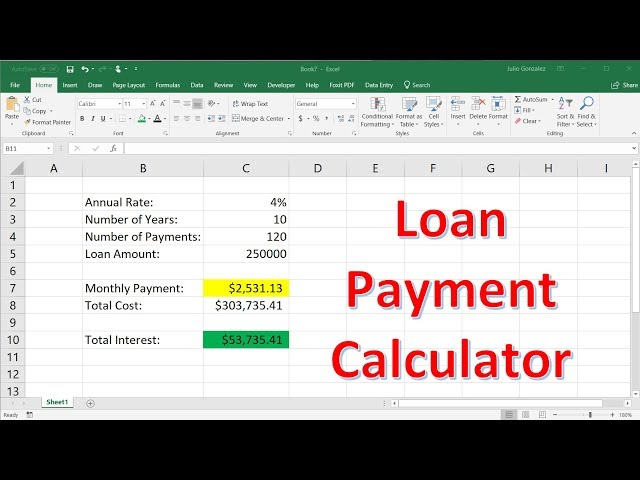

Create a Plan to Pay Down Debt

If you’re trying to improve your credit score, one of the first things you need to do is take a close look at your debt. Do you have any high-balance debt that you’re struggling to pay off? Are you only making the minimum payments on your credit cards?

If so, then you need to create a plan to pay down your debt. One of the best ways to do this is to focus on paying off your high-balance debt first. This will help you get rid of your debt more quickly, and it will also help you improve your credit score.

There are a few other things you can do to improve your credit score, but paying down your debt is one of the most important things you can do. If you’re not sure how to create a plan to pay down your debt, there are plenty of resources available online. You can also talk to a financial advisor or credit counselor who can help you create a plan that’s right for you.

Wait it Out

If you’ve recently experienced a score drop, the first thing you should do is wait it out. A single late payment can cause your score to drop anywhere from 60 to 110 points. However, the good news is that the effect of a late payment starts to lessen after about six months. So, if you’re able to make all your payments on time for the next six months, your score should start to rebound naturally.

In the meantime, there are a few other things you can do to try and mitigate the damage:

-Check your credit report for errors and dispute any that you find.

-Make sure you’re using no more than 30% of your credit limit on each of your credit cards.

-Consider opening a new credit card to help improve your credit utilization ratio.

-If you have any other loans or debts, make sure you’re making all your payments on time and in full.

-Pay down any high balances you have as much as possible.

What to Do if You Can’t Recover

A drop of 40 points in your credit score can be a significant blow to your ability to borrow money or get approved for new lines of credit. If you’re trying to figure out why your score dropped and how to recover, here are a few things to keep in mind.

Improve Your Credit utilization

Credit utilization, which is the percentage of your credit limit that you’re using, is one factor that makes up your credit score. So, if you’re maxing out your credit cards, you’re doing damage to your credit score.

There are a few things you can do to improve your credit utilization:

1) Pay down your balances. This will immediately reduce your credit utilization and help improve your credit score.

2) Request a credit limit increase from your issuer. If you have a good history with your issuer, they may be willing to increase your credit limit, which will lower your credit utilization ratio.

3) Use a balance transfer card to pay down debt. If you have good credit, you may be able to qualify for a balance transfer card with 0% APR for 12 months or more. This can help you pay down debt without accruing any additional interest charges.

Get a Secured Credit Card

If you have bad credit, you might be tempted to get a secured credit card to help improve your credit score. A secured credit card works like a regular credit card, but you have to put down a deposit—usually equal to your credit limit—when you open the account. Then, as you use the card and make timely payments, the issuer reports your activity to the credit bureaus, which can help boost your score.

However, before you sign up for a secured credit card, make sure you understand how they work and what their risks and limitations are. For example, some issuers charge high fees or require a minimum deposit that’s higher than what you’re likely to get approved for. Others might offer lower interest rates or perks like rewards points. And remember, even if you use a secured card responsibly, it will take time for your score to improve.

Become an Authorized User

One way to quickly improve your credit score is to become an authorized user on someone else’s credit card account. When you become an authorized user, the account holder’s positive payment history will be added to your credit report. This can help you improve your credit score in a matter of months.

To become an authorized user, the account holder must contact their credit card issuer and add you to the account. Once you’re added, the account will appear on your credit report and you’ll start building a positive payment history.

While becoming an authorized user is one of the fastest ways to improve your credit score, it’s important to make sure you understand the risks before moving forward. For example, if the account holder misses a payment or racks up a large balance, it could negatively impact your credit score. Therefore, it’s important to only become an authorized user on an account that’s in good standing.