Which Set of Items Appears on a Loan Estimate?

Find out which set of items appears on a Loan Estimate form and how to fill it out correctly.

Checkout this video:

Understanding the Loan Estimate

The lender must give you a Loan Estimate within three business days of receiving your loan application. The Loan Estimate tells you important information about the loan you have requested. This three-page form is designed to help you understand what the loan will cost. It will also help you compare different types of loans from different lenders.

What is a Loan Estimate?

A Loan Estimate is a three-page form that you receive after applying for a mortgage. The Loan Estimate tells you important details about the loan you have requested.

You will receive a Loan Estimate within three business days of the lender receiving your application. If you applied online, in person, or by phone, the Loan Estimate will be emailed or mailed to you. If you applied by mail, the Loan Estimate will be mailed to you.

The purpose of the Loan Estimate is to give you some key information about the loan so that you can compare loans from different lenders. The form gives only an estimate — actual terms may change once the loan is finalized.

A Loan Estimate must include:

-The interest rate and monthly payment amount

-Origination charges

-Services that cannot be refused

-Services for which the consumer may shop

-Prepaid items

**The following items may also appear on a Loan Estimate:**

-Discount points

-Mortgage insurance premium

-Other fees

When do I get a Loan Estimate?

You should get a Loan Estimate within 3 business days of applying for a mortgage. This applies whether you apply in person, over the phone, or online. That way, you’ll have time to compare your Loan Estimate with other offers to find the right loan for you.

If it will take longer than 3 business days to get your Loan Estimate, your lender must give you a written explanation of why it couldn’t meet the 3-day deadline. The written explanation is called a “notice.”

If you’re shopping for a loan with different lenders, make sure each one gives you a Loan Estimate within the same 3-day window so that you can compare them side by side.

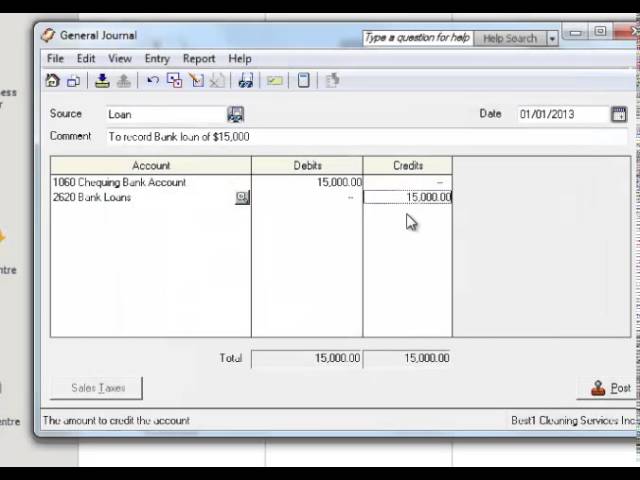

The Loan Estimate Form

The Loan Estimate is a three-page form that you receive after applying for a mortgage. The form provides you with important information, such as the estimated interest rate, monthly payment, and closing costs for the loan. It’s important to understand all the information on the form so that you can make an informed decision about your mortgage.

Itemizing the Costs

The charges listed on a Loan Estimate form are organized into five categories:

-Loan related charges: This is where you’ll find the fees charged by the lender and any third parties for services they provide, such as appraisals and title insurance.

-Discount points: You may choose to buy discount points to “buy down” the interest rate on your mortgage. One point equals 1 percent of the loan amount.

-Origination charges: These are fees charged by the lender for processing your loan application and creating the loan documents.

-Prepaid items: These are items that must be paid in advance, such as homeowners insurance, private mortgage insurance (PMI) and property taxes.

-Services you cannot shop for: These are services that the lender selects on your behalf, such as flood certification or tax service fees.

Loan Terms

The loan terms section items provide information about the key features of your loan, including the interest rate and monthly payments. You’ll also find information about the type of loan, the loan amount, the down payment (if any), and whether the interest rate is fixed or adjustable.

Prepayment

You may be able to pay off all or part of your loan early (prepay) without penalty. If you think you might do this, ask about it when you shop for a loan.

The amount you would need to prepay on your loan and avoid a penalty generally would be stated in this section. If no prepayment penalty applies, “No prepayment penalty” will be stated here.

Interest Rate

The Interest Rate is the rate at which interest accrues on the loan. The Annual Percentage Rate (APR) is a measure of the cost of credit, expressed as a yearly rate, that includes fees and other charges paid by the borrower to get the loan.

Discount Points

Discount points are a type of prepaid interest that you may be able to pay to get a lower interest rate on your loan. One point is equal to 1% of the loan amount. So, if you’re taking out a $250,000 mortgage, one point would cost $2,500.

While you’re not required to pay discount points in order to get a mortgage, it may be beneficial to do so if you plan on staying in your home for a long time. That’s because the interest savings from paying points upfront can add up over time and offset the upfront cost of paying points.

Keep in mind that not all lenders offer discount points and that the amount of points required to get a lower interest rate can vary from lender to lender. So, be sure to compare Loan Estimates from several lenders before deciding whether or not paying points makes sense for you.

Loan Origination Charges

Loan origination charges are any fees that are paid to the lender or broker for originating the loan. These fees can be charged by the lender, broker, or both, and can vary greatly from one lender to another. The origination charge must be included in the APR calculation. The following are some common origination charges:

– Points: A point is equal to 1 percent of the loan amount. For example, if you’re taking out a $200,000 loan and you’re charged two points, that would be an origination charge of $4,000.

– Application Fee: This is a fee charged by the lender to cover the cost of processing your loan application. It is generally a flat fee, but it can also be a percentage of the loan amount (usually no more than 1 percent).

– Commitment Fee: This is a fee charged by the lender to confirm that they will make the loan to you. It is generally a flat fee but can also be a percentage of the loan amount (usually no more than 1 percent).

– Underwriting Fee: This fee covers the cost of having your loan application reviewed by an underwriter. It is generally a flat fee but can also be a percentage of the loan amount (usually no more than 1 percent).

– broker Fees: These are fees charged by mortgage brokers for their services in originating your loan. They may be charged as a percentage of the loan amount (usually no more than 2 percent), or they may be charging as a flat fee.

Underwriting Fees

The underwriting fee covers the lender’s cost of verifying and approving the loan.

Third-Party Services

You may choose to shop for some of the services below on your own or use the services of providers identified by your creditor or broker. If you choose your own provider, you are not required to use a provider identified by your creditor or broker. If you use a provider identified by them, you may still be able to shop for a provider of that service on your own.

-Appraisal

-Homeowners insurance

-Survey

-Title insurance and related fees

-The following services must be provided by someone chosen by you, even if your creditor suggests someone:

--Attorney fees (if allowed by law) for closings in Iowa, Louisiana, Mississippi, and Tennessee

--Document preparation (except in Alaska, Arkansas, District of Columbia, Louisiana, Maryland, Mississippi, Oklahoma, Pennsylvania, Texas and Vermont)

--Mortgage broker’s fee (if any)

--Notary fees

--Property taxes

Taxes and Government Fees

On the left side of page 2, under the section titled “Other Costs,” there is a line for “Taxes and Government Fees.” Page 2 will also list other potential expenses like Homeowner’s insurance, flood insurance (if required), and private mortgage insurance (PMI).

The Loan Estimate form itemizes how much you can expect to pay in taxes and government fees at closing. Some of these taxes may be paid in advance, and some may be escrowed (held) by your lender to pay on your behalf when they come due. The amount disclosed for taxes and government fees should match the Good Faith Estimate that you received from your loan officer when you applied for the loan.

Prepaid Expenses

The following items may appear in Section J as prepaid expenses:

-Prepaid interest

-Prepaid taxes

-Homeowners insurance premiums

-Mortgage insurance premiums (MIP)

-Property taxes not escrowed by the servicer

-Homeowners dues, if applicable

Other prepaid expenses that are not included in Section J may include: loan origination fees, appraisal fee, flood certification fee, credit report fee, and tax service fee.

.10 Estimated Escrow Account Deposits

The estimated figure for any deposits you will make each year into your escrow account. This money is used to pay your property taxes and hazard insurance when they come due. If you have a loan with monthly mortgage insurance, the deposit also may be used to pay the mortgage insurance premium when it comes due.

.11 Mortgage Insurance

On lines 1101-1103, we’ll show you the monthly mortgage insurance premium (MIP) if you’re required to have it. Mortgage insurance is required for some loans used to purchase a home where the down payment is less than 20% of the price of the home. The MIP will continue until you reach 22% equity in your home based on the original value of your home. The MIP could also continue for the entire life of your loan if you’re unable to reach 22% equity and cancel your mortgage insurance, or if your loan has certain features such as an interest-only period or a balloon payment.

.12 Post-Closing Services

The following services must be listed in Post-Closing Services if applicable:

-Notary public fees

-Appraisal fees

-Homeowner’s insurance premiums

-Real estate taxes

-Mortgage insurance premiums

The Summary of Loan Terms

The Summary of Loan Terms is a good tool to use when you are shopping for a loan because it forces lenders to provide you with some basic information about the terms they are offering. The Summary of Loan Terms must include:

– The loan amount

– The interest rate

– The monthly payment

– The total amount of payments

– The periodic rate cap (if applicable)

– The lifetime interest rate cap (if applicable)

– The Balloon payment (if applicable)

– Prepayment penalties or fees (if any)

The Projected Payments Table

At the top of the Projected Payments table, you’ll find four labels:

1. “Payments Due When…”

2. “Initial Escrow Payment At Closing”

3. “Estimated Taxes, Insurance & Assessments”

4. “Estimated Homeowner’s Insurance Premium”

These correspond to the following two line items elsewhere on your Loan Estimate form:

1. “Total Estimated Closing Costs” (Line 10) and

2. “Total Estimated Monthly Payments” (Line 18).

The Comparison of Other Loans Table

The Comparison of Other Loans table appears near the top of the Loan Estimate form. The lender must provide you with two estimates of the loan terms you might qualify for – a “First Loan” estimate and an “Alternative Loan” estimate. If the lender is unable to provide an Alternative Loan, they must explain why in the space provided below the table.

The information in this table will help you compare different loan offers and choose the one that best meets your needs. The table includes:

-The name of each loan offer

-An estimate of the monthly principal and interest payment for each loan offer

-An estimate of the monthly payments for taxes, insurance, and assessments (TIA) for each loan offer

-The total monthly payment for each loan offer

-The amount of cash due from you at closing for each loan offer

-An estimate of the closing costs paid by the lender on your behalf for each loan offer (Lender Paid Closing Costs)

-An estimate of how much your monthly payments could increase if interest rates rise (APR for Adjustable Rate Mortgage) or if there are changes in your taxes or insurance (assumptions).