Which of the Following is Not True of Credit Cards?

Contents

Credit cards can be a great financial tool if used responsibly. However, there are some common misconceptions about credit cards that can lead to debt and financial problems. To help you avoid these pitfalls, we’ve compiled a list of five things that are not true about credit cards.

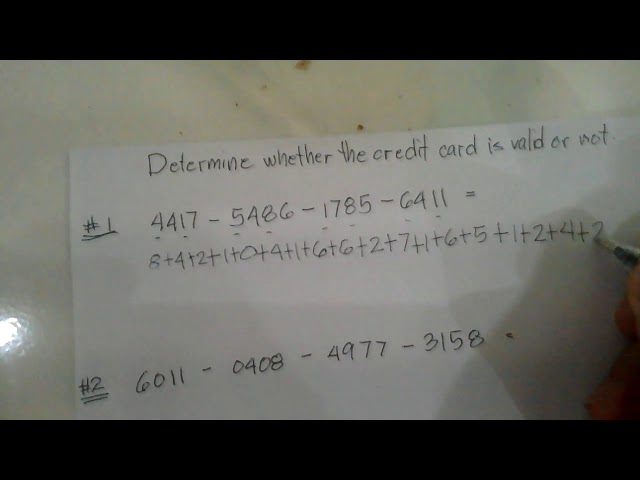

Checkout this video:

Credit cards are a type of unsecured loan.

One of the most important things to understand about credit cards is that they are a type of unsecured loan. This means that if you don’t make your payments on time, the credit card company can’t come and take your car or house away from you. However, they can take other legal action against you, including suing you or sending your account to a collection agency.

Credit cards are a type of revolving credit.

There are many different types of credit cards available on the market today, each with its own set of terms and conditions. However, not all credit cards are created equal. Some credit cards come with better interest rates, rewards programs, and perks than others.

One type of credit card that you may be considering is a revolving credit card. Revolving credit cards are a type of credit card that allows you to carry a balance from month to month, making them ideal for those who need a little extra time to pay off their purchases. However, there are some things you should know about revolving credit cards before you decide if they’re right for you.

Here are three things you should know about revolving credit cards:

1. Revolving credit cards have higher interest rates than other types of credit cards.

If you’re considering a revolving credit card, one thing you should know is that these cards typically have higher interest rates than other types of credit cards. This means that if you carry a balance on your revolvingcredit card from month to month, you’ll end up paying more in interest over time.

2. Revolving credit cards can be easier to qualify for than other types of credit cards.

Another thing to keep in mind about revolvingcredit cards is that they can be easier to qualify for than other types of credit cards. This is because revolvingcredit lines are based on your ability to make monthly payments, rather than your overall credit score. As long as you have a steady income and can show that you’re able to make your monthly payments on time, you should be able to qualify for a revolvingcredit card.

3. Revolving credits can help improve your overall Credit Score rating over time by reducing your Credit Utilization ratio

Credit utilization is one of the most important factors in your overall Credit Score rating—it accounts for 30% of your score—and it’s calculated by dividing your total outstanding debt by your total available credit limit

Credit cards are a type of installment loan.

While credit cards are a type of loan, they function differently than installment loans. With an installment loan, you borrow a set amount of money and then make fixed payments each month until the loan is paid off. With a credit card, you can borrow as much or as little as you need each month, up to your credit limit. You also have the option to carry a balance from month to month, if you choose.

Credit cards can help you build credit.

Credit cards can help you build credit.

When used wisely, credit cards can help you improve your credit score. But when used recklessly, credit cards can do the opposite.

Here are some things to keep in mind if you’re thinking of using a credit card to build credit:

1. Only use a small portion of your credit limit.

2. Make sure you make your payments on time, every time.

3. Keep your balances low.

4. Avoid closing unused credit cards.

5. Use a mix of different types of credit products.

Credit cards can help you save money on interest.

Credit cards can help you save money on interest. False! If you carry a balance on your credit card from month to month, you will be charged interest. The higher the interest rate, the more money you will pay in interest charges. You can avoid paying interest by paying your balance in full every month.