Which Loan Provides Interest Subsidy?

Contents

If you’re looking for a loan that provides interest subsidy, you may be wondering which one is right for you. Here’s a quick guide to help you choose the best option.

Checkout this video:

Loan Basics

Most loans come with some type of interest. This is the amount of money that you will have to pay on top of the original loan amount. The interest rate is the percentage of the loan that you will pay in interest.

What is an interest subsidy?

An interest subsidy is a benefit that lowers the interest rate on your loan. It can come from the federal government or from your state government. Interest subsidies can make your monthly payments more affordable, and can help you pay off your loan faster.

How do loans with interest subsidy work?

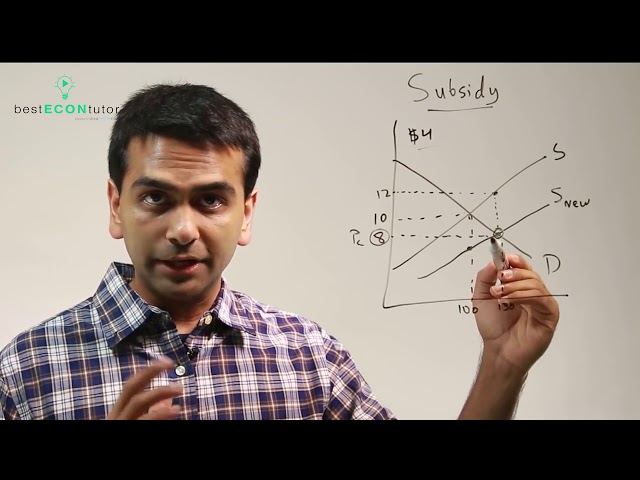

The payable interest on a loan with interest subsidy is calculated on the outstanding principal amount at the beginning of each month. The amount of interest subsidy that accrues during a month is determined by multiplying the subsidy rate with the outstanding principal loan amount at the beginning of that month. The subsidy is applied first towards payment of interest, and any balance is added to the outstanding principal. The effect is that your EMI each month will reduce, as the total loan tenure will not change.

Assuming that you have taken a home loan of Rs 30 lakh at an interest rate of 10% per annum for 20 years, with an annual interest subsidy of 4%, your monthly instalments would be as follows:

Year Loan amount Interest Subsidy Principal Total Subsidy Received

1 30,00,000 25,000 1,200 24,800 14,400

2 29,75,200 24,801 1,188 23,613 28,800

3 29,51,813 24,604 1,176 22,428 43200

4 29,28,241…

Types of Loans with Interest Subsidy

There are multiple types of loans which offer interest subsidy. The most common type of loan is the Federal Perkins Loan, which is a need-based loan offered to undergraduate and graduate students. Other types of loans which offer interest subsidy include the Direct Subsidized Loan and the Direct PLUS Loan.

Federal Direct Subsidized Stafford Loans

A subsidized Stafford Loan is a loan made to eligible undergraduate and undergraduate students by the U.S. Department of Education. The federal government pays the interest while the student is enrolled at least half-time, during grace periods, and during deferment periods.

Eligible students enrolled in an eligible program at a school that participates in the Direct Loan program can receive a Direct Subsidized Loan. The school will determine the loan amount you’re eligible to receive each academic year and whether you demonstrate financial need according to the information you provided on your Free Application for Federal Student Aid (FAFSA®) form.

Federal Direct Unsubsidized Stafford Loans

Federal Direct Unsubsidized Stafford Loans are not based on financial need. Interest is charged from the time the loan is disbursed until it is paid in full. You can pay the interest while you are in school or allow it to accumulate (capitalize) and be added to your principal balance. Your payments will be larger if you allow the interest to capitalize because you will pay interest on a larger principal balance.

Federal Perkins Loans

Federal Perkins Loans are low-interest federal student loans for undergraduate and graduate students with exceptional financial need. The interest rate on Federal Perkins Loans is 5%, and there is no fee to originate the loan. Federal Perkins Loans are made through a participating school’s financial aid office. The school is your lender, and the loan is made with government funds.

Federal Direct PLUS Loans

Federal Direct PLUS Loans are loans that parents and graduate or professional students can use to help pay for college or career school. PLUS loans can also be used to consolidate other educational debt. The maximum loan amount that can be borrowed is the cost of attendance (determined by the school) minus any other financial aid the student may receive.

To get a PLUS Loan, the borrower (and, in most cases, a co-signer) must pass a credit check. If approved, the borrower will receive the loan in two disbursements: one when classes begin and another when they are halfway finished.

The repayment period for PLUS Loans begins 60 days after the final loan disbursement. However, borrowers can choose to defer payments while the student is enrolled at least half-time and for an additional six months after graduation or after they drop below half-time enrollment. Interest accrues during deferment, so borrowers should consider making interest-only payments or having their payments automatically deducted from their paycheck to reduce their total loan cost.

How to Get a Loan with Interest Subsidy

If you are looking for a loan with interest subsidy, there are a few things you need to know. The first is that not all loans come with interest subsidy. You will need to look for a lender that offers this type of loan. The second thing you need to know is that you will need to meet certain criteria to qualify for an interest subsidy. In this article, we will talk about what you need to know in order to get a loan with interest subsidy.

Apply for federal student aid

The first step in getting federal student aid is to complete the Free Application for Federal Student Aid (FAFSA®) form. This form becomes available each year on October 1. The 2020–21 FAFSA form will be available on October 1, 2019. You should fill out and submit a FAFSA form as soon after October 1 as possible. Some states and schools have earlier deadlines than the federal government, so don’t wait to apply!

To complete the FAFSA form, you (and your parents, if you’re a dependent student) will need to gather some financial information, including your:

-Tax returns, W-2s, or other records of money earned

-Bank statements and records of investments such as stocks and bonds

-Records of untaxed income such as child support received or veterans’ non-education benefits

-A FSA ID to sign electronically

Fill out the Free Application for Federal Student Aid (FAFSA)

To be eligible to receive an interest subsidy, you must fill out the Free Application for Federal Student Aid (FAFSA) form. You can fill out the FAFSA form online at fafsa.ed.gov. The FAFSA form is used to determine your eligibility for federal student aid, which includes grants, loans, and work-study.

You will need to provide information about your family’s finances, including your parents’ income and assets. You will also need to provide information about your own finances, including your income and assets.

The sooner you fill out the FAFSA form, the better. Because the FAFSA form is used to determine your eligibility for federal student aid, you will want to make sure that you fill it out as soon as possible so that you don’t miss out on any aid that you may be eligible for.

Receive your financial aid award letter

The first step in getting a loan with interest subsidy is to receive your financial aid award letter from the college or university you will be attending. The award letter will list the types and amounts of aid you are eligible to receive.

Most schools participate in the William D. Ford Federal Direct Loan Program, which offers loans with interest subsidy. To participate, schools must enter into a agreement with the Department of Education.

If your school does not participate in the William D. Ford Federal Direct Loan Program, you may still be able to get a loan with interest subsidy from a private lender. Private lenders often offer loans with interest subsidy to students who attend schools that do not participate in the federal program.

Repaying Your Loan

Understand your repayment options

Before you decide which loan is right for you, it’s important that you understand all of your repayment options.

The first thing to consider is whether you want to repay your loans in full or make interest-only payments while you’re in school. If you choose to make interest-only payments, the interest will accrue (accumulate) on your loan while you’re in school and during your grace period. The amount of interest that accrues on your loan will depend on the type of loan you have and the current interest rate. You can check the current rates for Direct Subsidized Loans and Direct Unsubsidized Loans on the Interest Rates page.

Another repayment option that may be available to you is called an income-sensitive repayment plan. With this plan, your monthly payment will be based (in part) on your annual income. There are several different income-sensitive repayment plans, so it’s important to ask your loan servicer about which one is available for your loans.

If neither of these repayment options is right for you, don’t worry – there are other options available as well. You can read more about all of the repayment plans that are available to Direct Loan borrowers on the Repayment Plans page.

Make sure you know when your first payment is due

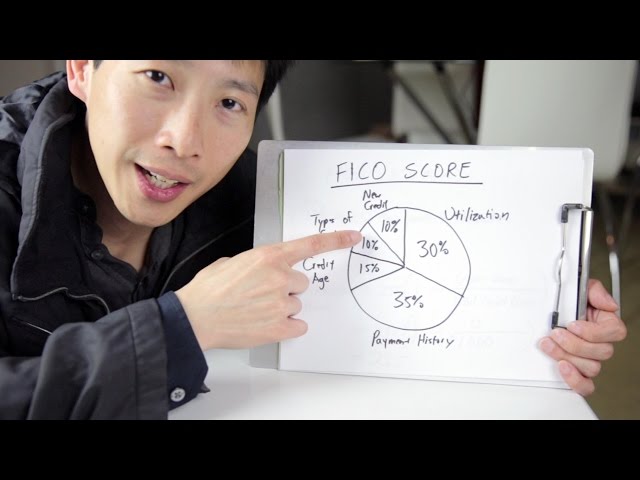

Many loans have a grace period, which is a set period of time after you graduate, leave school, or drop below half-time enrollment before you have to begin repaying your loan. The grace period gives you time to get financially settled and usually lasts 6 months. If you have a Direct Subsidized Loan or Subsidized Federal Stafford Loan, the government pays the interest on your loan during your grace period. If you have a Direct Unsubsidized Loan or Unsubsidized Federal Stafford Loan, you’re responsible for paying the interest on your loan during your grace period. It’s important to know when your first payment is due so that you don’t inadvertently damage your credit rating by missing a payment.

Consider consolidating your loans

Consolidating your loans can help you save money on interest and simplify your monthly payments, but it’s not the right choice for everyone. If you have multiple student loans, you might be considering consolidating them into a single loan. Loan consolidation can make sense if you want to:

-Lower your monthly payment by extending your repayment term

-Qualify for a lower interest rate

-Simplify your monthly payments by combining multiple loans into one

-Get out of default

Before you consolidate your loans, make sure you understand how consolidation works and what effect it will have on your overall financial picture.