What is a Balloon Loan?

Contents

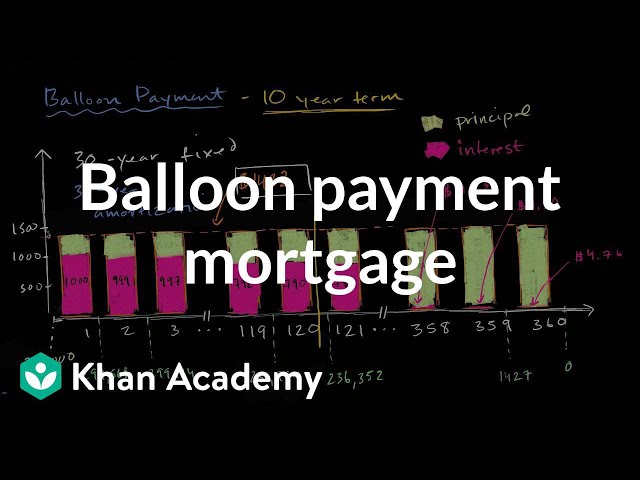

A balloon loan is a type of mortgage where the monthly payments are relatively small, but the full balance is due at the end of the loan’s term.

Checkout this video:

What is a Balloon Loan?

A balloon loan is a type of loan that is generally repaid in a lump sum at the end of its term. Unlike a traditional loan, which is repaid in periodic installments, a balloon loan is typically repaid all at once at the end of the term.

The most common type of balloon loan is the mortgage balloon loan. Mortgage balloon loans are popular among homebuyers because they offer lower monthly payments during the term of the loan. However, borrowers must be prepared to make a lump sum payment to repay the outstanding balance when the loan comes due.

Other types of balloon loans include auto loans and small business loans. Balloon loans are often used when borrowers need to access capital for a short period of time and they expect to have the ability to repay the loan in full when it comes due.

How Does a Balloon Loan Work?

A balloon loan is a type of loan that entails partial repayment of the loan amount at specific intervals, followed by a single final payment of the remaining balance. Because balloon loans involve partial repayment of the loan amount, they typically have lower monthly payments than loans that require full repayment of the loan amount upfront. However, because the borrower is required to repay the entire remaining balance of the loan in a single final payment, balloon loans typically have higher overall interest costs than loans that require full repayment of the loan amount upfront.

Pros and Cons of a Balloon Loan

A balloon loan is a type of loan that has a lower initial monthly payment but will require a large payment to be made at the end of the loan term. This large payment is known as the balloon payment and it usually occurs after five or seven years of making smaller monthly payments.

Balloon loans can be an attractive option for borrowers who are looking to minimize their monthly payments but still want the option to sell or refinance their property in the future. However, there are some risks associated with this type of loan that borrowers should be aware of before they commit to this type of financing.

One of the biggest risks associated with a balloon loan is the possibility that the value of your property could decrease over time. If this happens, you could end up owing more on your loan than your property is actually worth, which would make it difficult to sell or refinance. Another risk is that interest rates could rise over time, which would increase your monthly payments and make it even harder to sell or refinance your property.

Before you decide to take out a balloon loan, it’s important to speak with a qualified lender and make sure you understand all of the risks and potential pitfalls associated with this type of financing.

How to Get a Balloon Loan

A balloon loan is a type of loan that typically has a short term—usually five years or less—but comes with a large payment at the end of the loan. This final payment, called a balloon payment, is usually much higher than your regular monthly payments, often three times as much.

Alternatives to a Balloon Loan

A balloon loan is a type of loan that requires the borrower to make periodic, full payments of interest and principal for a certain period of time (usually five to seven years), followed by one large payment of the remaining principal balance. balloon loans are typically used to make large purchases, such as real estate or automobiles, and they usually carry lower interest rates than other types of loans.

There are several alternatives to a balloon loan, including:

1. A conventional loan with a higher interest rate

2. A conventional loan with a longer term

3. A cash-out refinance

4. A home equity line of credit (HELOC)

5. A home equity loan