Which Credit Scores Do Car Dealers Use?

Contents

If you’re in the market for a new car, you’re probably wondering which credit scores the dealers use. Here’s what you need to know.

Checkout this video:

Introduction

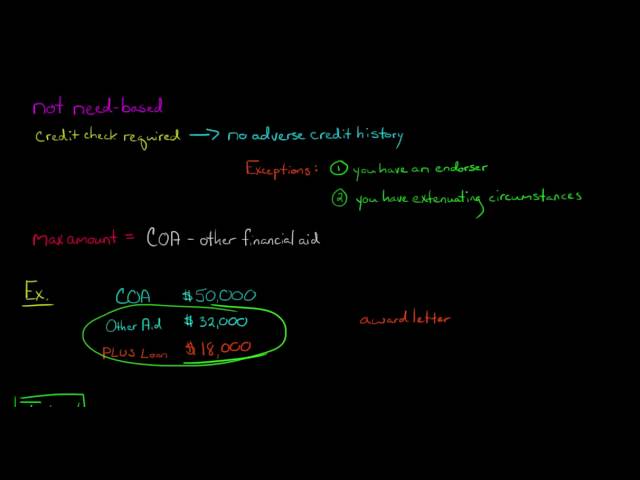

There are dozens of different credit scores available to lenders, and each one is calculated slightly differently. So, which credit score do car dealers use when you’re applying for an auto loan?

The answer is: it depends. Some car dealerships use your FICO® Score*, while others may use your VantageScore® 3.0 score. Some lenders will pull your credit report from all three major credit bureaus (TransUnion, Experian and Equifax) and look at all three of your Credit Scores.

And keep in mind, your Credit Score is just one factor that lenders will consider when you apply for an auto loan. Other factors include your income, employment history and the type of car you’re interested in purchasing.

If you’re not sure which credit score a particular lender is using, you can always ask. And if you’re concerned about your credit score, there are steps you can take to improve it.

The Three Major Credit Bureaus

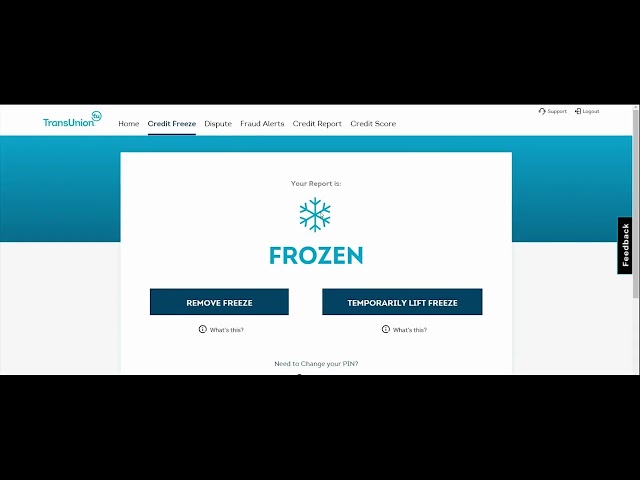

If you’re in the market for a new car, you might be wondering which credit scores the dealerships will use when considering your financing options. The answer is that there are three major credit bureaus in the United States – Experian, Equifax, and TransUnion – and most dealerships will use all three when considering your loan application.

Each credit bureau has its own method for calculating your score, so it’s possible that your score could be different depending on which one they pull. However, all three credit bureaus use similar information when calculating your score, so they should all be in the same general range.

If you have a good credit score, you should have no problem getting financing from a dealership. However, if your credit score is on the lower end, you may want to consider getting a pre-approved loan from a bank or credit union before going to the dealership. This can help you get better terms and avoid being taken advantage of by a dealer.

FICO Score

The FICO® Score is the most widely used credit score, and it’s the one that car dealers are most likely to check. FICO scores range from 300 (poor) to 850 (excellent). A “good” FICO score is generally considered to be anything above 660, while a “fair” score is between 620 and 659.

If your FICO® Score is below 660, you may still be able to get a car loan, but you may have to pay a higher interest rate. And if your score is below 620, you may have difficulty getting financing at all.

In addition to the FICO® Score, some lenders also consider other factors when making lending decisions, such as your income, employment history and debt-to-income ratio.

VantageScore

VantageScore is a credit scoring model created by the three major credit bureaus – Equifax, Experian and TransUnion. It’s used by some car dealerships as a way to gauge your creditworthiness.

The VantageScore model ranges from 300 to 850, with scores of 700 or above considered good. A high score means you’re likely to be approved for a loan with favorable terms, while a low score could make it harder to get approved or result in less favorable terms.

If you’re planning on buying a car, it’s a good idea to check your VantageScore ahead of time so you know where you stand. You can get your free credit scores from several personal finance websites, including Credit Karma, NerdWallet and Quizzle.

Other Considerations

In addition to your FICO® Score 8, car dealers may consider other factors when assessing your creditworthiness and determining the interest rate they’ll offer you.

For example, they may consider:

-Your employment history

-Your income

-Your debt-to-income ratio

-Your assets

-Your collateral (if you’re taking out a secured loan)

-Whether you’re a first-time buyer or an experienced borrower

-The type of vehicle you’re looking to finance

Conclusion

After reading this article, you should have a better understanding of which credit scores car dealerships use. Generally, they will use either your FICO score or your VantageScore. However, there are a few other factors that they may take into account, such as your income and credit history. So if you’re looking to buy a car, make sure you have a good understanding of your credit score and what the dealership is looking for.