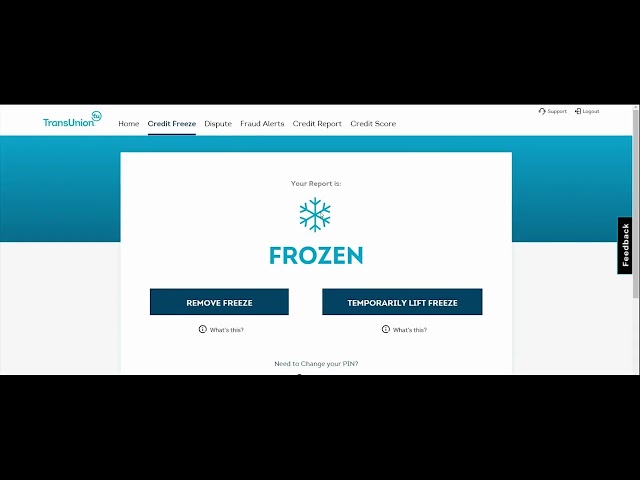

How to Unfreeze Your Credit with TransUnion

Contents

It’s important to know how to unfreeze your credit with TransUnion so you can stay on top of your financial health. Here’s a step-by-step guide on how to do it.

Checkout this video:

Introduction

If you’ve been the victim of identity theft, you may have taken the necessary steps to freeze your credit. This is an important step to prevent thieves from opening new lines of credit in your name. But what if you need to unfreeze your credit? Maybe you’re applying for a new car loan or a mortgage, and you need financial institutions to be able to access your credit report. Or maybe you just want to make sure your information is accurate and up-to-date. Whatever the reason, unfreezing your credit is a relatively simple process.

Here’s how to unfreeze your credit with TransUnion:

1. Log in to your TransUnion account. If you don’t have an account, you can create one for free.

2. Click on the “Freeze/Unfreeze” tab.

3. Enter the requested information, including your date of birth, Social Security number, and address.

4. Choose whether you want to unfreeze your credit temporarily or permanently. A temporary unfreeze will last for a specified period of time (usually 30 days), while a permanent unfreeze will remove the freeze indefinitely.

5. Click “Submit.”

Once you’ve submitted your request, TransUnion will process it and send you confirmation within a few days. After that, your credit will be unfrozen and financial institutions will again have access to your report.

What is TransUnion?

TransUnion is a consumer credit reporting agency that collects and maintains information on your personal credit history. This information is then used to generate your credit score, which is a number that lenders use to determine your creditworthiness.

If you have been the victim of identity theft or you are simply trying to protect your personal information, you may want to place a freeze on your TransUnion file. This will prevent anyone from accessing your file, which will in turn prevent them from opening new lines of credit in your name.

In order to unfreeze your TransUnion file, you will need to contact the company and provide them with certain identifying information. Once they have verified your identity, they will remove the freeze from your account and you will once again be able to access your file.

How to Unfreeze Your Credit with TransUnion

Step One: Request a Credit Freeze

TransUnion offers a credit freeze service that can help you protect your credit against fraud and identity theft. A credit freeze is a security measure that allows you to restrict access to your credit report, making it more difficult for identity thieves to open new accounts in your name.

If you suspect that you may be a victim of identity theft, or if you have been notified by a company that your personal information has been compromised, we recommend that you place a fraud alert on your credit file. A fraud alert is free and will notify creditors that they should take extra steps to verify your identity before granting credit.

To place a fraud alert, contact TransUnion at 1-800-680-7289.

You will need to provide TransUnion with the following information:

-Your name

-Address

-Date of birth

-Social security number

-A copy of a government-issued ID

Step Two: Request a Fraud Alert

If you think you may be a victim of identity theft, or if you know that your personal information has been compromised, you should place a fraud alert on your credit file. A fraud alert is free, and it will notify creditors that they should take extra steps to verify your identity before granting credit in your name.

You can place a fraud alert by calling any one of the three nationwide credit reporting agencies: TransUnion, Experian or Equifax. You only need to contact one of the agencies to place an alert; the others will be notified automatically. Once you call, the agency will ask for some basic information about yourself, including your name, Social Security number, date of birth and current address. You will also need to provide proof of your identity, such as a copy of your driver’s license or passport.

Once the agency has processed your request, they will send you written confirmation of your fraud alert, as well as instructions on how to order your free credit report.

Step Three: Place a Security Freeze on Your Credit Report

If you want to unfreeze your credit with TransUnion, you’ll need to follow these steps:

1. First, you’ll need to log into your TransUnion account.

2. Next, locate the “Security Freeze” section of your account.

3. finally, click on the “Place a Security Freeze on Your Credit Report” button.

4. You’ll be asked to provide some personal information, such as your Social Security number and date of birth.

5. Once you’ve submitted your information, TransUnion will place a security freeze on your credit report.

Conclusion

TransUnion is one of the major credit bureaus in the United States. If you have been a victim of identity theft, you may want to consider freezing your credit with TransUnion. This will prevent thieves from opening new lines of credit in your name.

It is important to note that freezing your credit will not impact your credit score. However, it may make it more difficult to apply for new lines of credit in the future. If you decide to freeze your credit, be sure to keep track of your PIN or password so that you can unfreeze it when you need to.