Which Credit Score Matters More: TransUnion or Equifax?

Contents

If you’re trying to improve your credit score, you might be wondering which credit score matters more: TransUnion or Equifax? While both are important, TransUnion is typically the more important score when it comes to credit approval.

Checkout this video:

What’s in a credit score?

Most people know that a credit score is important, but few understand what it actually is or how it’s calculated. A credit score is a three-digit number that lenders use to assess your creditworthiness. The higher your score, the more likely you are to be approved for a loan or credit card with favorable terms.

The difference between a FICO score and a VantageScore

There are two main credit scoring models in the U.S.: the FICO score and the VantageScore. Here’s a quick rundown of the key differences between them:

-The FICO score is the most widely used credit score in the U.S., and is broken down into five categories: excellent (750-850), very good (700-749), good (650-699), fair (600-649) and poor (300-599).

-The VantageScore was developed jointly by the three major credit bureaus (Equifax, Experian and TransUnion) and uses a different scoring range (350-850).

-Both scores take into account similar factors, such as payment history and credit utilization, but there are some key differences. For example, the VantageScore gives greater weight to recent activity, whereas the FICO score gives greater weight to older information.

So, which credit score should you focus on? The answer depends on your goals. If you’re trying to get a mortgage or other type of loan, your lender will likely use your FICO score to make their decision. On the other hand, if you’re simply trying to get an idea of where your credit stands, either score will do.

Which credit score should you focus on?

If you’re trying to improve your credit score, you might be wondering which credit score you should be focusing on. After all, there are three different credit scores out there: TransUnion, Equifax, and Experian. So which one is the most important?

The difference between TransUnion and Equifax

When trying to improve your credit score, it’s important to know which credit score matters more. TransUnion and Equifax are two of the most popular credit reporting agencies, so let’s take a look at the difference between the two.

TransUnion is a credit reporting agency that compiles information from creditors and uses it to create a credit report. This report is then used by lenders to determine your creditworthiness.

Equifax, on the other hand, is a credit scoring company. They develop their own credit scoring model, which is then used by lenders to determine your creditworthiness. So, while TransUnion provides the information that is used to calculate your score, Equifax actually calculates the score itself.

Generally speaking, most lenders will focus on your TransUnion score when making lending decisions. However, it’s important to keep in mind that each lender is different and some may focus on your Equifax score instead.

If you’re trying to improve your credit score, you should focus on both TransUnion and Equifax. You can get free copies of your credit report from both agencies once per year, so be sure to take advantage of this. By regularly checking your report and scoring, you can catch any errors or discrepancies early on and take steps to correct them.

The importance of credit utilization

Credit utilization is one of the most important factors in your credit score. It refers to the amount of credit you’re using in relation to the amount of credit you have available. For example, if you have a $5,000 credit limit and carry a balance of $2,500, your credit utilization would be 50%.

Ideally, you should keep your credit utilization below 30% to maintain a good credit score. However, if you’re trying to improve your credit score, it’s best to keep your credit utilization even lower — around 10% is ideal.

If your credit utilization is too high, it can hurt your credit score in two ways. First, it will lower your score because it’s an indicator that you’re using too much of your available credit. Second, it can signify that you’re in financial difficulty and are more likely to miss a payment or default on a loan.

There are a few different ways to lower your credit utilization:

-Pay down your balances: This will immediately lower your credit utilization and could help improve yourcredit score quickly.

-Request a higher credit limit: If you have a good payment history and low balances, you could contact your creditors and request a higher credit limit. This would raise the amount of available credit you have and lower your overallcredit utilization ratio.

-Spread out your balances: If you have multiple cards with balances, consider transferring some of the debt to a card with a higher limit. This will lower the percentage of debt you’re using on each card and could help improveyour overallcredit score.

How to improve your credit score

Credit scores are important because they show how likely you are to repay a loan. A higher credit score means you’re a lower-risk borrower, which could lead to a lower interest rate on a loan. There are two types of credit scores: FICO® Scores and VantageScore®. FICO® Scores are the most widely used credit scores, while VantageScore® is a newer scoring model.

Tips for improving your TransUnion score

There are a few things you can do to improve your TransUnion credit score:

1. Check your credit report regularly for accuracy. You can get a free copy of your report from TransUnion once every 12 months.

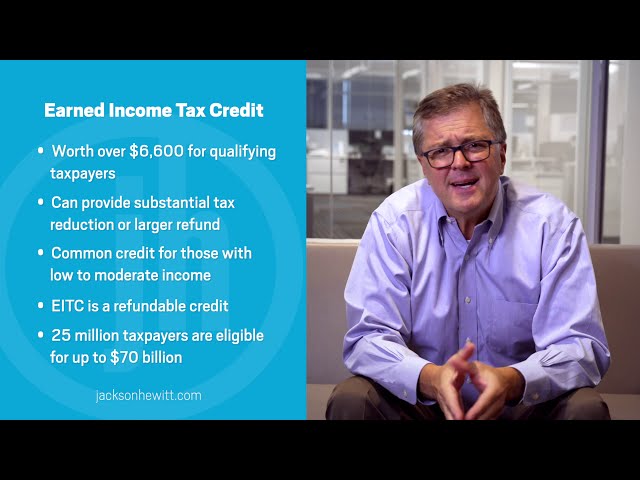

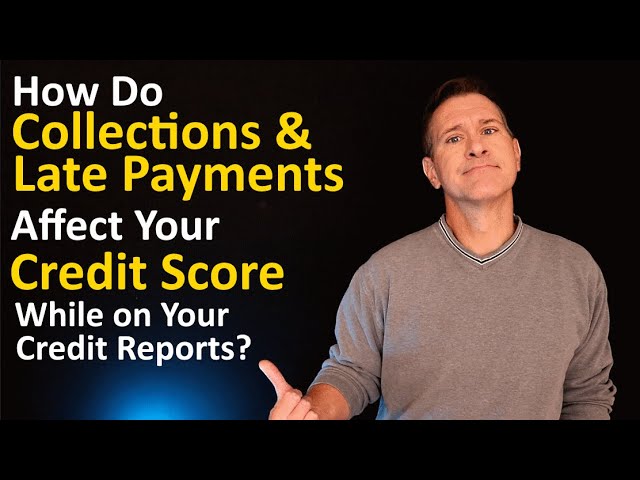

2. Pay your bills on time. Late payments can damage your credit score.

3. Keep your credit balances low. High balances can also hurt your credit score. Try to keep your balances below 30% of your credit limit.

4. Use a mix of different types of credit, such as revolving credit (credit cards) and installment loans (auto loans). This shows lenders that you can manage different types of debt responsibly.

5. Apply for new credit only when you need it. too many new applications can hurt your score.

Tips for improving your Equifax score

There are a few things you can do to improve your Equifax credit score:

-Check your credit report for errors and dispute any inaccuracies

-Pay all of your bills on time, including utility bills, credit cards, and loans

-Reduce your debt levels by paying down balances and avoiding new debt

-Limit the number of hard inquiries on your credit report by only applying for new credit when necessary

-Build a positive credit history by using credit responsibly over time

By following these tips, you can improve your Equifax score and get on the path to better financial health.

The bottom line

The importance of monitoring your credit score

It’s important to keep an eye on your credit score because it is a key factor in determining your financial health. A good credit score means you’re more likely to be approved for loans and credit cards, and you’ll likely get better interest rates. A bad credit score can make it difficult to get a loan, a credit card, or a mortgage.

There are two main types of credit scores: FICO scores and VantageScore. FICO scores are the most widely used type of credit score, and they’re based on your payment history, debt-to-credit ratio, length of credit history, and other factors. VantageScore is the other type of credit score; it’s newer and not as widely used as FICO scores, but it’s based on similar factors.

You have multiple TransUnion and Equifax scores because each company uses a different scoring model. That said, the scoring models are similar enough that your scores will be in the same general range (although there may be some variation). For example, if you have a FICO score of 750 from TransUnion, that’s considered excellent; if you have a VantageScore of 750 from Equifax, that’s also considered excellent.

It’s important to monitor all of your credit scores because different creditors use different scoring models. Some creditors only look at your TransUnion score, while others only look at your Equifax score. Still others consider both your TransUnion score and your Equifax score when making lending decisions. So if one of your scores drops, you could be at risk of being denied for a loan or getting a less favorable interest rate.

Bottom line: Monitoring all of your credit scores is the best way to ensure that you have the highest possiblescore when lenders are making lending decisions.