Which Credit Bureau Does Chase Use?

Contents

If you’re wondering which credit bureau Chase uses for their credit decisions, you’re not alone. Many people are curious about which credit report Chase pulls when they apply for a credit card or loan.

Unfortunately, Chase is tight-lipped about which bureau they use. However, we’ve done some research and we can share what we’ve learned about Chase and credit reports.

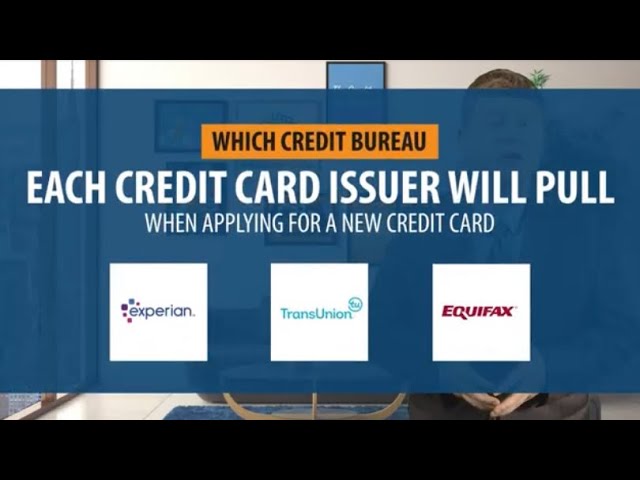

Checkout this video:

Chase and the Credit Bureaus

Chase is one of the largest credit card issuers in the United States. And because they are a large company, they have the ability to choose which credit bureau they use. So, which credit bureau does Chase use?

What is a credit bureau?

A credit bureau is a company that collects information about how you use and repay debt. This information is used to create your credit report. lender, businesses, and other organizations will then use your credit report to determine whether or not to give you a loan, extend you credit, or offer you a job. There are three major credit bureaus in the United States: Experian, Equifax, and TransUnion. Each credit bureau has its own data collection methods and criteria for determining your credit score.

The three major credit bureaus

The three major credit bureaus are Equifax, Experian, and TransUnion. They are sometimes referred to as the “big three” credit bureaus. These companies collect information about you and provide it to lenders when you apply for a loan or credit card.

Chase uses all three credit bureaus to make its lending decisions. This means that if you have a good credit score with one bureau, you’re likely to have a good credit score with Chase. Conversely, if you have a poor credit score with one bureau, your chances of getting approved for a Chase loan or credit card are slim.

Does Chase Use All Three Credit Bureaus?

Chase uses all three credit bureaus, which are Equifax, Experian, and TransUnion. Chase will use the credit bureau that gives them the most favorable report. This is why it’s important to keep all three of your credit bureaus in good standing.

Experian

Chase uses Experian for credit decisions. This means that if you have a good credit score with Experian, you’re more likely to be approved for a Chase credit card. However, it’s still possible to be approved with a bad Experian score, depending on your other qualifications.

Equifax

Chase generally uses Equifax for their credit decisions. However, they may also use Experian and/or TransUnion in certain circumstances. If you’re applying for a Chase credit card, you can check which bureau they’ll pull from by using our tool.

TransUnion

Chase generally uses TransUnion for credit decisions. However, they may also pull Equifax or Experian in some instances. If you’re trying to figure out which credit bureau Chase is using for your specific case, you can check your latest credit report to see which one they pulled.

What if I Have Bad Credit?

Chase uses all three credit bureaus, so if you have bad credit, you may still be able to get a Chase credit card. However, you may only be approved for a secured credit card, which requires a deposit. If you have bad credit, you may still be able to get a Chase credit card, but you may only be approved for a secured credit card.

Chase’s credit card options

If you’re wondering “Which credit bureau does Chase use?”, the answer is all of them. Chase looks at your credit history from all three major credit bureaus – Experian, Equifax, and TransUnion – when considering you for a credit card. So, if you have bad credit, you might still be able to get a Chase credit card.

Of course, having bad credit means you’ll likely have to pay a higher interest rate on your card. But if you use your card responsibly and make your payments on time, you can eventually improve your credit score and qualify for a better card with a lower interest rate.

If you’re not sure which Chase credit card is right for you, consider speaking with a representative who can help you choose the best option based on your individual circumstances.

Other ways to improve your credit score

Bad credit can make it difficult to get approved for a loan, but there are other ways to improve your credit score. You can dispute inaccuracies on your credit report, rehabilitate delinquent accounts, and practice using credit responsibly.

If you have bad credit, you might still be able to get a loan from a lender who specializes in helping people with bad credit. These lenders may be more forgiving of past mistakes and willing to work with you to build your credit score.

You can also use a secured credit card to help improve your credit score. A secured card is backed by a deposit you make, which acts as collateral in case you default on the card. Using a secured card responsibly can help improve your credit score over time.

If you have bad credit, there are still ways to improve your financial situation. Take steps to improve your credit score and make smart financial decisions to get back on track.