Which Accounts Have a Normal Credit Balance?

Contents

If you are wondering which types of accounts have a normal credit balance, you have come to the right place. This blog post will explain which types of accounts typically have a credit balance and why.

Checkout this video:

Accounts that Always Have a Debit Balance

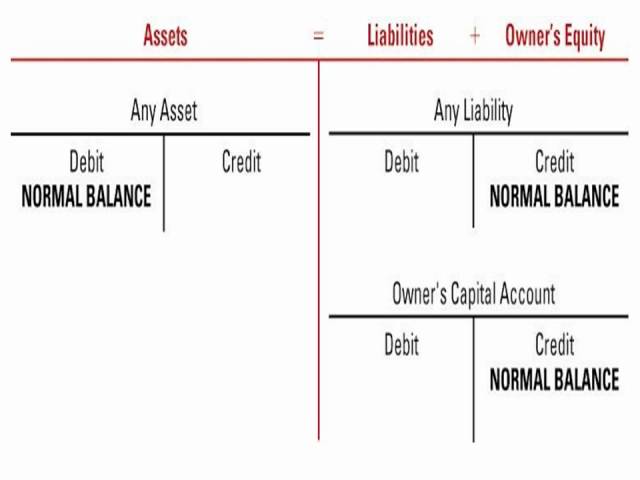

In accounting, there are a few terms that are important to understand. One of these terms is “normal balance.” So, what is a normal balance? A normal balance is the side of an account that contains the greater numbers. In other words, it is the side where increases go.

Service Revenue

Service revenue is revenue earned by providing a service. This type of revenue is found in service-based businesses, such as businesses that provide accounting, legal, or consulting services. When service revenue is earned, it is recorded as an increase in service revenue. This revenue type will have a normal debit balance.

Sales Revenue

Sales revenue is the income received by a company from its sales of goods or the provision of services. In accounting, the terms “sales” and “revenue” can be, and often are, used interchangeably, to mean the same thing.

Expenses

Normal Credit Balance vs. Debit Balance

The normal balance for an expense account is a debit balance. This means that when we make an entry to this account, we will debit the account. For example, suppose we purchase $100 of office supplies on credit. We would record this transaction by debiting Office Supplies Expense for $100 and crediting Accounts Receivable for $100.

An expense account with a debit balance represents an outflow of cash or other economic resources. Examples of common expense accounts that have normal debit balances include the following:

-Rent Expense

-Wages Expense

-Interest Expense

– Depreciation Expense

Debit balances in these accounts mean that cash is flowing out of the business as a result of these expenses.

Accounts that Always Have a Credit Balance

Assuming that all business transactions have been recorded, there are only a handful of accounts that will normally have a credit balance. These include the Accounts Receivable account, the Sales Tax Payable account, the Unearned Revenue account, and a few others. Let’s take a closer look at each of these.

Accounts Receivable

All businesses that sell products or services on credit will have an Accounts Receivable account. This account tracks all of the money that is owed to the business by its customers. Accounts Receivable is considered a current asset on the balance sheet, because the money is typically due within one year.

Other common accounts that usually have a credit balance include:

-Prepaid Expenses: This account tracks payments made for expenses that have not yet been incurred. An example would be prepaying rent or insurance premiums.

-Deferred Revenue: This account is used for advance payments made by customers for products or services that have not yet been delivered. An example would be paying for a one-year subscription to a magazine up front, with the understanding that you will receive the magazine once per month for the next 12 months.

-Allowance for Bad Debts: This account represents an estimation of how much of the Accounts Receivable balance will eventually not be collected. It is common for businesses to estimate this amount and set aside funds to cover it, so that they are not surprised by large losses in the future.

Unearned Revenue

Unearned revenue is a liability because it represents money that a company has received but has not yet earned. An example would be when a magazine company sells a one-year subscription to a customer. The company receives the cash up front but will not recognize the revenue until each issue is delivered.

Other examples of unearned revenue include gift certificates, advance payments for services, and interest payments that have not yet been earned.

Companies keep track of unearned revenue on their balance sheets as a liability because it represents money that the company owes to its subscribers or customers.

Prepaid Expenses

Prepaid expenses are those payments made in advance for goods or services that have not yet been received. Typically, these are payments made for insurance premiums, rent, utilities, and other periodic bills.

Prepaid expenses are reported on the balance sheet as assets. This is because they represent a future benefit to the company (in the form of reduced expenses), and therefore can be considered an asset. The expected benefit is typically realized within one year, so prepaid expenses are classified as short-term assets.

Although they are reported as assets, prepaid expenses are not included in the calculation of working capital because they are not considered to be liquid assets (assets that can be easily converted to cash).

Prepaid expenses will have a credit balance if the amount of the prepayment is greater than the expense for which it was made. For example, if a company pays $1,000 in insurance premiums for a six-month policy, but the policy only costs $800, the company will have a $200 credit balance in its Prepaid Expenses account.

Accounts that Can Have Either a Debit or Credit Balance

The credit and debit side of an account can be confusing. This is because some people use the terms “left” and “right” when they should be using “debit” and “credit.” As a result, the terms “left” and “right” can be used to describe both the side of the ledger where the account has a positive credit balance, as well as the side of the ledger where the account has a negative debit balance. So, which accounts could have a normal credit balance?

Common Stock

Common stock is a type of investment that represents ownership in a company. When you buy shares of common stock, you become a shareholder of the company and you have the potential to earn dividends and capital gains. Common stock is typically less risky than other types of investments, such as bonds, because the returns are not guaranteed. However, common stock does come with some risks, including the risk of losing money if the company goes bankrupt.

One of the key advantages of investing in common stock is that it gives you the opportunity to participate in the company’s growth. If the company does well, its stock price will go up and you will make money. On the other hand, if the company does poorly, its stock price will go down and you could lose money.

Another advantage of investing in common stock is that it gives you voting rights at shareholder meetings. This means that you have a say in how the company is run and you can elect directors who represent your interests.

Common stock also has some disadvantages. For example, because common stockholders are last in line when it comes to getting paid in the event of bankruptcy, they may not receive any payments if the company goes bankrupt. Additionally, common stockholders may not receive any dividend payments if the Board of Directors decides not to declare a dividend.

If you’re considering investing in common stock, it’s important to understand both the risks and rewards involved.

Retained Earnings

Retained earnings are the portion of a company’s profits that are plowed back into the business. They are found in the equity section of the balance sheet. A company’s management may decide to reinvest retained earnings back into the company to fund expansion, pay down debt, or for other purposes.

Depending on the accounting method used, retained earnings can have either a debit balance or a credit balance. With the accrual method, retained earnings typically have a credit balance—meaning that when they increase, they are recorded as a credit on the balance sheet. With the cash method, however, retained earnings typically have a debit balance—meaning that when they increase, they are recorded as a debit on the balance sheet. In both cases, if retained earnings decrease (or there is a net loss), then the account will have the opposite type of balance.

Regardless of which accounting method is used, all companies will show their accumulated retained earnings on their balance sheets—so you can always tell whether a company is recording its retained earnings with a debit or credit by looking at its financial statements.

Treasury Stock

Treasury stock is a contra account to stockholders’ equity. When a corporation repurchases its own common shares from investors, it reduces stockholders’ equity. The shares are removed from the market, and they cannot be voted or receive dividends. Treasury stock is not an investment and has no value on the balance sheet until it is resold.