Where Can I Get a Loan Without a Job?

Contents

There are a few options for getting a loan without a job, but they are not always the best option. Here are a few things to consider before taking out a loan without a job.

Checkout this video:

Where Can I Get a Loan Without a Job?

Personal Loans

Personal loans are a type of unsecured loan offered by banks, online lenders, and other financial institutions. Unlike a mortgage or auto loan, personal loans are not backed by collateral. This means that if you default on the loan, the lender cannot seize your property to recoup their losses.

Personal loans are a popular choice for borrowers who need to consolidate debt, finance a large purchase, or cover unexpected expenses. The interest rate on a personal loan is typically lower than the interest rate on a credit card, and the repayment term is usually longer. This makes personal loans an attractive option for borrowers who need time to pay off their debt.

There are many different types of personal loans available, and each has its own terms and conditions. You should compare offers from multiple lenders to find the loan that best meets your needs. Be sure to read the fine print before you sign any loan agreement, so you understand the full terms of the loan.

Payday Loans

A payday loan is a short-term, high-interest loan, generally for $500 or less, that is typically due on your next payday. Sometimes these loans can be extended to the following payday for an additional fee. All payday loans have fees and charges that must be disclosed before you sign for the loan.

Payday lenders are not interested in whether you can repay the loan. They are interested in whether you have a job (or other source of regular income) that will enable you to repay the loan on your next payday. That’s why these loans are sometimes called “cash advances” or “check loans.”

You can get a payday loan from a store or online. Storefront lenders typically require proof of income (a pay stub or bank statement showing direct deposit), an active checking account, and identification. Online lenders may require even less information. You will likely have to provide your social security number so the lender can check your credit history, but some lenders will approve loans without running a credit check.

Title Loans

If you need a loan but don’t have a job, your options are somewhat limited. There are a few things you can do, but it’s important to understand the risks involved.

Title loans are one option if you have a car or other vehicle that you can use as collateral. This type of loan is typically quite easy to get, but it comes with some risks. First, if you can’t repay the loan, you could lose your vehicle. Second, title loans often come with high interest rates and fees, which can make them very difficult to repay.

Another option is to borrow from friends or family. This can be a good option, but it’s important to make sure that you have a plan in place for repaying the loan. Otherwise, you could damage your relationships with these people.

You could also try taking out a personal loan from a lender like Avant or Prosper. These loans are typically easier to get than traditional bank loans, but they still come with some risks. For one thing, personal loans usually have high interest rates and fees. Additionally, if you can’t repay the loan, the lender could take legal action against you.

Finally, you could try getting a payday loan from a pawnshop or other short-term lender. This option is generally not recommended because payday loans come with high fees and interest rates, and they often require that the borrower provide collateral (such as a car or piece of jewelry). If you can’t repay the loan, the pawnshop could keep your collateral or even take legal action against you.

Pawn Shop Loans

Pawn shops offer loans for people who do not have a job. Pawn shops loan money based on the value of an item that is pledged as collateral. The amount of money loaned and the interest rate charged vary from pawn shop to pawn shop and are generally lower than rates charged by payday lenders.

Friends and Family Loans

If you’re in a pinch and need cash fast, one option is to borrow from friends or family. If you have good credit, you may be able to take out a personal loan from a bank or credit union. But if your credit is poor, you’ll likely have to look elsewhere.

If you decide to go this route, just be sure to draw up a contract and make payments on time. You don’t want to ruin your relationship with the people who are closest to you.

How to Get a Loan Without a Job

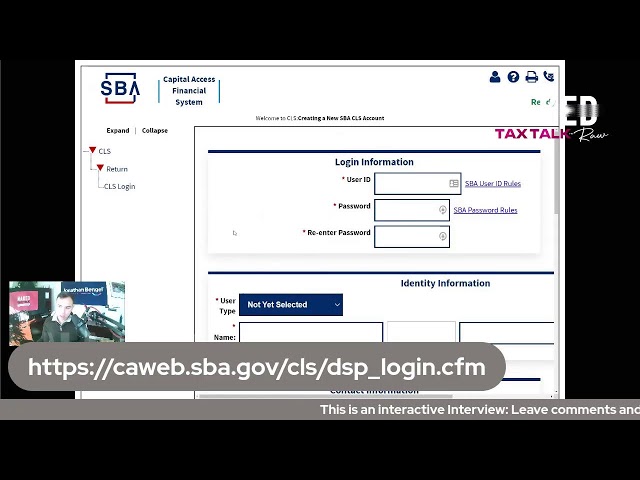

There are a few options available to people who need to get a loan without a job. The first option is to ask family and friends for help. The second option is to look into government assistance programs. The third option is to look into private lenders. Each of these options has its own set of pros and cons.

Have Good Credit

One option for getting a loan without a job is to have good credit. If you have good credit, you may be able to qualify for a personal loan. Many personal lenders require borrowers to have good or excellent credit, which is typically a FICO® Score of 670 or higher. And, if you want to increase your chances of approval and get a lower interest rate, you can apply with a co-signer who has strong credit.

Have Collateral

One option for getting a loan if you don’t have a job is to use collateral. You can use a car, boat, motorcycle, jewelry, or any other valuable property you own as collateral for the loan. The lender will hold onto the collateral until you repay the loan. If you don’t repay the loan, the lender will take possession of your collateral.

Find a Co-Signer

A co-signer is someone who agrees to be responsible for the loan if you can’t pay. This person will need to have good credit and a steady income. Having a family member or friend co-sign a loan with you can help you get approved even if you don’t have a job.

What are the Risks of Getting a Loan Without a Job?

Loans can be a great way to get the money you need without having to rely on a job. However, there are some risks associated with taking out a loan without a job. The first risk is that you may not be able to repay the loan. This can lead to the lender taking legal action against you. The second risk is that you may end up with a high interest rate. This can make the loan very expensive and difficult to repay.

You May Not Be Able to Repay the Loan

If you don’t have a job, you may not have the income needed to make loan payments. This could lead to defaulting on your loan, which could damage your credit score and make it harder to get future loans. In addition, you may have to pay late fees or penalties if you can’t make your payments on time.

You May Pay High Interest Rates

The higher the interest rate, the more you’ll pay in the long run. If you’re already struggling to make ends meet, adding a higher interest rate loan payment to your monthly budget can make things very tight. If you’re considering a loan without a job, be sure to compare interest rates from multiple lenders before deciding on one.

You May Lose Your Collateral

If you obtain a loan without a job, you may have to put up some form of collateral. This could be your home, your car, or some other valuable asset. If you default on the loan, the lender may seize your collateral in order to recoup their losses. This could leave you homeless or without transportation.