When Does Navy Federal Report to Credit Bureau?

Contents

Do you know when Navy Federal reports to the credit bureau? It’s important to know so you can keep track of your credit score. Here’s what you need to know.

Checkout this video:

Navy Federal Credit Union is the world’s largest credit union with over 8 million members, $91 billion in assets, and more than 18,000 employees. Navy Federal offers a full range of banking products and services to its members, including checking and savings accounts, auto and home loans, credit cards, and more.

Navy Federal is a not-for-profit organization that is owned by its members and operated for their benefit. Navy Federal is governed by a Board of Directors made up of Navy Federal Credit Union members.

Navy Federal Credit Union was founded in 1933 with just seven members and has since grown to become one of the largest financial institutions in the world.

Types of Accounts That Report to the Credit Bureaus

Navy Federal Credit Union reports most types of accounts to the three major credit bureaus (Experian, Equifax and TransUnion), with some notable exceptions. These include checking accounts, savings accounts, certificates of deposit, money market accounts, auto loans, home equity lines of credit, personal loans and student loans. Navy Federal does not report mortgage payments to the credit bureaus.

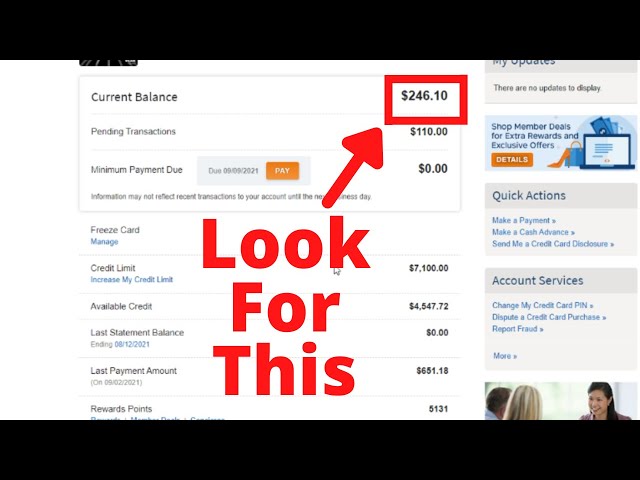

Navy Federal reports information to the credit bureaus on a monthly basis. However, it can take up to 45 days for new information to appear on your credit report. If you open a new account or make a major change to an existing account (such as increasing your credit limit), Navy Federal may report this information more frequently.

Navy Federal does not have a specific policy for how long it will continue to report information to the credit bureaus after an account is closed. However, in general, lenders will continue to report closed accounts for up to seven years from the date of closing. This means that even if you close an account with Navy Federal, it could still affect your credit score for several years.

Navy Federal Credit Union is a credit union that serves members of the United States Armed Forces, veterans, and their families. The credit union offers a variety of financial products and services, including checking and savings accounts, credit cards, mortgages, and personal loans. One thing that sets Navy Federal Credit Union apart from other financial institutions is that it reports information about your account to the credit bureaus on a regular basis.

If you have a Navy Federal Credit Union account, it’s important to monitor your account activity so you can make sure your information is being reported accurately. You can do this by accessing your account online or by calling customer service. By monitoring your account, you can make sure that Navy Federal is reporting accurate information to the credit bureaus. This can help you maintain a good credit score.

If you find that Navy Federal is not reporting accurate information about your account to the credit bureaus, you can file a dispute with the credit union. You can also contact the credit bureaus directly to have them investigate any incorrect information that is being reported.

What to Do If You Find an Error on Your Credit Report

If you’re concerned about inaccuracies on your credit report, the first step is to order a copy of your report from all three major credit reporting agencies: Equifax, Experian and TransUnion. You’re entitled to one free copy from each agency every 12 months.

Once you have your reports, review them carefully to look for any errors. If you find an error, contact the credit bureau directly to file a dispute. The credit bureau will then investigate and, if necessary, remove the incorrect information from your report.

If you have negative information on your credit report that is accurate, there is no way to remove it yourself. However, time heals all wounds, and eventually negative items will drop off your report automatically. For example, most bankruptcies stay on your report for seven years, while late payments generally fall off after seven years as well.

Navy Federal Credit Union is one of the largest credit unions in the United States, with more than $91 billion in assets and more than 7 million members. If you’re a Navy Federal member, you might be wondering when the credit union reports to credit bureaus.

Generally, Navy Federal reports to credit bureaus once a month. However, it’s important to note that Navy Federal only reports account information for members who have granted permission for their information to be shared with credit bureaus.

If you’re not sure whether you’ve given permission for your account information to be shared with credit bureaus, you can contact Navy Federal Credit Union directly. Customer service representatives will be able to tell you whether or not your account information is being shared with credit bureaus.

You can reach Navy Federal customer service by calling 1-888-842-6328. Representatives are available Monday through Friday from 8 a.m. to 8 p.m. ET, and Saturday from 9 a.m. to 5 p.m. ET