When Do Credit Cards Get Reported to Credit Bureaus?

Contents

If you’re trying to improve your credit score, you might be wondering when credit cards get reported to credit bureaus. Here’s what you need to know.

Checkout this video:

Introduction

Your credit card activity is reported to the credit bureaus every month. That means that every time you make a purchase, sign up for a new card, or use your card for a balance transfer or cash advance, the information will show up on your credit report.

The credit bureaus use this information to calculate your credit score, which is a number that lenders use to determine your creditworthiness. The higher your score, the better your chances of getting approved for a loan or line of credit.

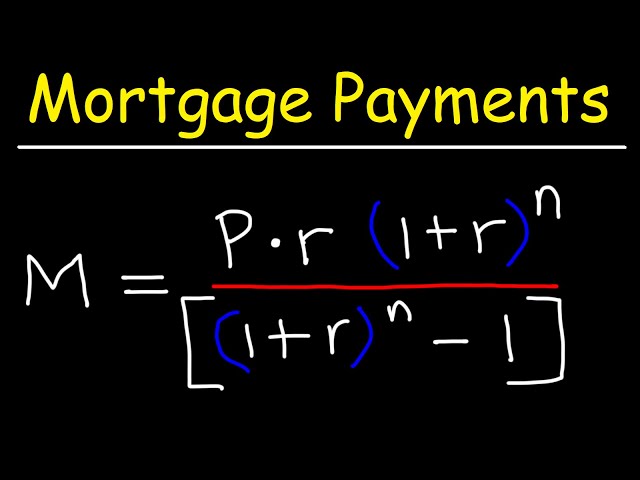

Most of the time, you don’t need to worry about when your credit card activity is reported to the credit bureaus. But in some cases, it can be helpful to know. For example, if you’re trying to improve your credit score before applying for a mortgage, you might want to make sure that all of your recent activity is reported before your loan application is reviewed.

Here’s a rundown of when different types of credit card activity are reported to the credit bureaus:

-Purchases: Purchases are reported at the end of each billing cycle. So if you make a purchase on March 1st, it will show up on your April 1st report.

-Balance transfers: Balance transfers are reported as soon as they are processed by the issuer. So if you make a balance transfer on March 1st, it will show up on your March 1st report.

-Cash advances: Cash advances are reported as soon as they are processed by the issuer. So if you take out a cash advance on March 1st, it will show up on your March 1st report.

What is a Credit Bureau?

A credit bureau is a financial institution that collects credit information on individuals and businesses. This information is then used to generate credit reports, which are accessed by lenders to help them make lending decisions.

There are three major credit bureaus in the United States: Experian, Equifax, and TransUnion. Each credit bureau has its own process for reporting information to the bureau, but generally speaking, most creditors will report information to all three bureaus on a monthly basis.

It’s important to note that not all creditors report to credit bureaus. For example, utilities and cell phone providers typically do not report payment history to the credit bureaus. Additionally, some creditors may only report information to one or two of the major bureaus. Therefore, it’s possible for your credit reports from each bureau to contain different information.

How often do Credit Bureaus update?

Most credit reporting agencies update information on a monthly basis, although some may update more frequently. You can check your own credit report as often as you like without impacting your credit score.

When you first open a new credit card, it may take a few months for the account to appear on your credit report. Once it does, your credit score will be based on the information in your report at that time.

If you make any changes to your account, such as closing it or opening a new one, those changes will be reflected in your next monthly update.

What are the types of Credit Bureaus?

There are four types of credit bureaus– Equifax, Experian, TransUnion, and Innovis.

Your credit activity is reported to the credit bureaus by your creditors. The creditors send reports to the credit bureaus every month. Your payment history, credit utilization, and other factors are all included in these reports.

The information contained in your credit report is used to generate your credit score. Your credit score is a number that lenders use to decide whether or not to give you a loan, and what interest rate they will charge you.

The three main types of information in your credit report are:

-Identifying information: This includes your name, address, Social Security number, and date of birth.

-Credit history: This is a record of your past and present debts, including loans, credit cards, and other types of debt. It also includes information about how well you have repaid your debts in the past.

-Inquiries: This is a record of who has looked at your credit report in the past two years

How do Credit Bureaus report?

Most credit cards report to the credit bureaus on a monthly basis, although some report more frequently. Reporting schedules can vary, so it’s important to check with your card issuer to find out when they report.

Some issuers may report your activity sooner if you’re close to your credit limit or if you’re carrying a balance from month to month. Depending on your payment history, this could either help or hurt your credit score.

If you’re trying to improve your credit score, you may want to consider using a credit card that reports your activity more frequently. This way, you can show a consistent pattern of good behavior and improve your chances of getting approved for new lines of credit.

How to dispute errors on your Credit Bureau report

If you find errors on your credit bureau report, you have the right to dispute them. By law, credit bureaus must investigate and correct any errors that you bring to their attention.

If you find mistakes on your credit report, the first step is to contact the credit bureau and file a dispute. You can do this online, by mail, or by phone.

The credit bureau will then investigate your claim and get back to you with their findings. If they find that the information on your report is inaccurate, they will notify the lender or collection agency and ask them to correct it.

If you are not satisfied with the outcome of your dispute, you can also file a complaint with the Consumer Financial Protection Bureau (CFPB).

Conclusion

In conclusion, credit cards are reported to credit bureaus on a regular basis. This information is used to calculate your credit score, which is a important factor in determining your creditworthiness. If you have any questions about your credit report or credit score, be sure to contact a qualified credit counseling agency.