What is the Security Code on a Credit Card?

Contents

The Security Code on a Credit Card is a 3 or 4 digit number located on the back of your card. This code is used as an added security measure when making online or phone purchases.

Credit Card?’ style=”display:none”>Checkout this video:

The Security Code

The security code is a three- or four-digit number printed on your credit card . It’s also called a card verification value (CVV) or card security code (CSC). The code is used to verify that you have a physical copy of the credit card and helps to protect you from fraud. When you’re shopping online, the code is required to complete a purchase.

What is the security code?

The security code is a three- or four-digit number printed on your credit card. It’s different from your credit card number, and you may need it to complete online or phone transactions that require extra verification.

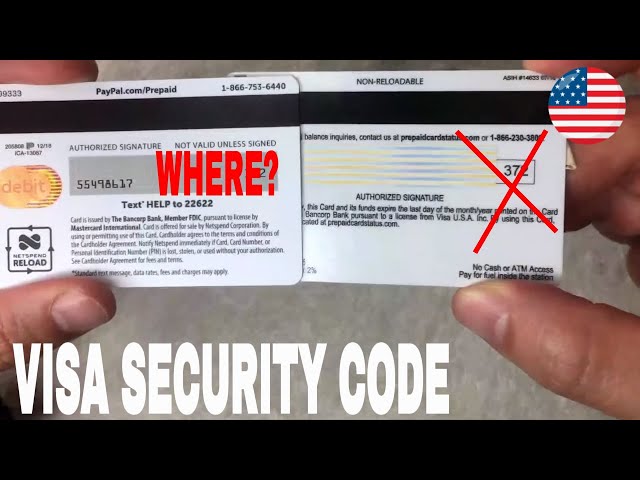

The security code for Visa®, Mastercard®, and Discover® is the three-digit number on the back of your card, to the right of your card’s main number.

For American Express®, the security code is the four-digit number on the front of your card, to the right of and above your main card number. If you have a Discover®, JCB®, Diners Club®, or Maestro® card, you’ll find your security code on the back of your card in the same place as Visa, Mastercard, and Discover.

Where is the security code located?

The security code is a unique 3 or 4-digit number printed on your credit card. It is not raised like the numbers in the cardholder’s signature strip, so it is sometimes called a flat number. You can find the security code on American Express, Discover, MasterCard and Visa cards in the following locations:

American Express: The security code for American Express is a 4-digit number printed on the front of the card above the card number.

Discover: The security code for Discover is a 3-digit number printed on the back of the card to the right of the signature strip.

MasterCard: The security code for MasterCard is a 3-digit number printed on the back of the card to the right of the signature strip.

Visa: The security code for Visa is a 3-digit number printed on the back of the card to the right of the signature strip.

How is the security code used?

The security code is a 3 or 4 digit number that is unique to your card. It is not raised like the numbers on the front of your card, so you can’t feel it. The security code is an important security feature. It helps to verify that you have a physical copy of your credit or debit card and helps protect you from fraud.

When you use your card online, in-store, or over the phone, the merchant will ask for your security code to verify that you are the rightful owner of the card. This service is important because it helps to prevent fraud and ensures that only authorized purchases are made with your card.

If you are making a purchase online or over the phone, you will need to provide your security code at the time of purchase. The merchant may also request your security code when you are making a purchase in-store, but this is not always required. If you are asked for your security code in-store, you can typically find it on the back of your credit or debit card.

The Security Code and Credit Card Fraud

The security code is a three or four-digit number located on the back of a credit card. This number is an important security feature because it helps to verify that the person who is using the card is the rightful owner. In the event that your card is lost or stolen, the security code can help to prevent someone from using it fraudulently.

How does the security code help prevent credit card fraud?

The security code is a three- or four-digit number that is intended to help verify that the person using the card is the rightful owner. The code is typically printed on the back of the card in the signature strip, but may also be printed on the front of the card above the number. When making a purchase online or over the phone, you will be asked to provide this number as proof that you are in possession of the card.

Studies have shown that requiring the security code can help to prevent credit card fraud, as it is more difficult for thieves to obtain this information. In addition, many banks and credit card issuers offer additional protections for online purchases, such as Verified by Visa or Mastercard SecureCode, which provide an extra layer of security by requiring a PIN or password be entered before a purchase can be completed.

What are some other ways to prevent credit card fraud?

In addition to using a credit card with a security code, there are other things you can do to prevent credit card fraud. Here are some tips:

-Only use trusted websites when making online purchases. Make sure the website is secure (look for https:// in the address bar) and that it has a good reputation.

-Never give your credit card information to someone you don’t know or trust.

-Keep your credit card in a secure place and keep track of your credit card statements so you can spot any suspicious activity.

-If you think you’ve been a victim of credit card fraud, contact your credit card company right away.

The Security Code and Online Shopping

The security code is an important part of credit card security. It is a three or four digit number located on the back of your card. This number helps to protect your card from fraud. When you make an online purchase, you will be asked to enter your security code. This code is used to verify that you are the owner of the card and that the purchase is legitimate.

How does the security code help prevent online fraud?

The security code is a 3- or 4-digit number printed on your credit card. It’s used as an additional security measure when you’re making online purchases. It helps verify that you are the authorized cardholder and that the order is not being placed fraudulently.

When you’re shopping online, you’ll typically be asked to enter your credit card number, expiration date, and the security code. The merchant will then run an authorization check to make sure the information is correct and that there are sufficient funds available to complete the transaction.

If you’re making a purchase in person, you may be asked to show your ID and enter your security code as well. This helps verify that you are the authorized cardholder and can help prevent fraud.

Some credit cards also have a chip that contains your account information. This is used for EMV (Europay, Mastercard, Visa) transactions and provides an extra layer of security by creating a unique transaction code that can’t be reused.

What are some other ways to prevent online fraud?

There are a few other ways you can help prevent online fraud:

-Make sure your computer has up-to-date security software. This will help protect your personal information if you accidentally go to a fake website.

-Be cautious about clicking on links in emails or instant messages. These can take you to fake websites that may try to steal your personal information.

-Don’t enter personal or financial information on a website unless you see the “https” at the beginning of the web address and a closed lock icon. This means the site is secure and less likely to steal your information.