What is the Minimum Credit Score for a FHA Loan?

Contents

If you’re looking to get a FHA loan, you’re probably wondering what the minimum credit score is. Here’s everything you need to know about the credit score requirements for FHA loans.

Checkout this video:

The FHA Loan

FHA loans are a popular choice for first-time home buyers and people with a limited budget. The minimum credit score for a FHA loan is 580. With a credit score of 580, you will only be required to pay a 3.5% down payment on your home.

What is an FHA loan?

FHA loans are government-backed mortgages that are insured by the Federal Housing Administration. This insurance protection protects the lender from financial loss if the borrower defaults on the loan. Because of this insurance, lenders are willing to work with borrowers who may have less-than-perfect credit and who might not otherwise qualify for a conventional mortgage.

How do FHA loans work?

The Federal Housing Administration (FHA) is a government agency that insures loans made by private lenders. The FHA does not actually lend the money; they just insure the loan, in case the borrower defaults on it. This insurance protects the lender from losses, and makes it possible for them to offer loans to people with less-than-perfect credit and low down payments.

What are the benefits of an FHA loan?

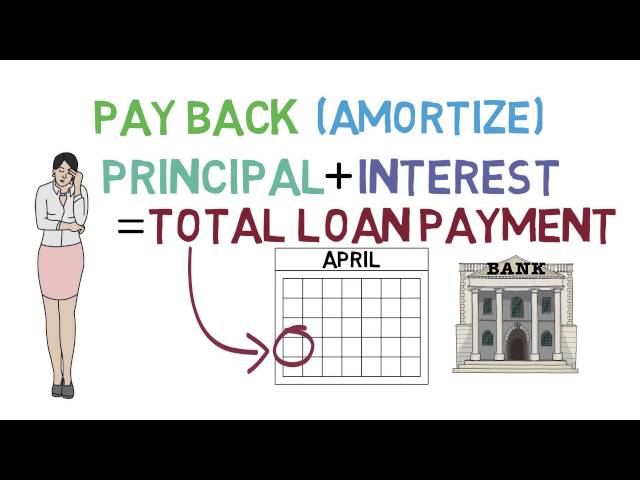

An FHA loan is a mortgage insured by the Federal Housing Administration, a federal agency within the U.S. Department of Housing and Urban Development (HUD). This type of loan is available to homebuyers with a credit score of 580 or higher, and allows for a down payment as low as 3.5%. Borrowers with credit scores between 500 and 579 are still eligible for an FHA loan, but they must come up with at least 10% down.

The Minimum Credit Score for a FHA Loan

The Federal Housing Administration (FHA) is a government agency that provides insurance on loans made by FHA-approved lenders. The FHA does not issue loans or set interest rates. The FHA insures loans made by approved lenders, keeping lenders from suffering losses if borrowers default on their loans. The FHA allows borrowers with minimum credit scores of 580 to buy a home with a 3.5% down payment. Borrowers with credit scores of 500-579 can buy a home with a 10% down payment.

What is the minimum credit score for a FHA loan?

The minimum credit score for a FHA loan is 580. This is the lowest score acceptable by the lender, and you will need a 3.5% down payment to qualify for the loan. If your credit score is lower than 580, you can still get an FHA loan, but you will need a 10% down payment.

How can I improve my credit score?

There are a number of ways to improve your credit score, but some methods are more effective than others. One of the best things you can do is to make sure you keep updated records of all your bills and payments. This will help show potential lenders that you’re a responsible borrower.

Another good way to improve your credit score is to use a credit monitoring service. These services will help you keep track of your credit report and score, and they can also provide you with tips on how to improve your credit rating.

If you have negative items on your credit report, such as late payments or collections, you can try to negotiate with the lender to have these items removed. Often times, lenders are willing to work with borrowers to remove negative items if it means the borrower will be able to repay their loan.

You should also avoid opening new lines of credit or taking out new loans unless absolutely necessary. Each time you do so, it causes a hard inquiry on your credit report, which can temporarily lower your score. If you need to borrow money, try to get a personal loan from a friend or family member instead of taking out a new loan from a lender.

What are the consequences of having a low credit score?

A low credit score could limit your borrowing options and mean you pay more for car insurance and loans. You may find it difficult to get a mortgage or rent an apartment. You may also have to pay a higher security deposit for utilities. If you have bad credit, you may not be able to get a credit card or qualify for a loan with favorable terms.