What Is The Lowest Credit Score Nissan Will Finance?

Contents

- What is the lowest credit score Nissan will finance?

- How can I improve my credit score to get a Nissan loan?

- What are the benefits of financing a Nissan with a low credit score?

- How can I get the best interest rate on a Nissan loan with a low credit score?

- What is the minimum down payment for a Nissan with a low credit score?

- How can I build my credit to get a Nissan loan?

- What are the best ways to improve my credit score?

- What are some tips for getting a Nissan loan with a low credit score?

- How can I get a Nissan loan with a bad credit score?

- What should I do if I can’t get a Nissan loan with a low credit score?

If you’re looking to finance a Nissan vehicle, you may be wondering what the lowest credit score is that Nissan will finance. Here’s what you need to know.

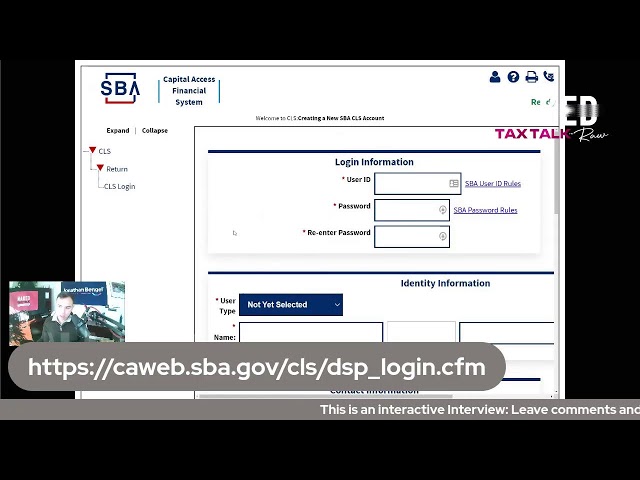

Checkout this video:

What is the lowest credit score Nissan will finance?

Nissan will finance practically any credit score, as they have many different lenders that they work with. However, the lowest credit score that Nissan will finance is probably around 580.

How can I improve my credit score to get a Nissan loan?

Your credit score is one of the important factors that lenders look at when considering a loan. The better your credit score, the more likely you are to get approved for a loan and the better interest rate you’ll get.

If you’re thinking about financing a Nissan, you might be wondering what the lowest credit score is that Nissan will finance. Unfortunately, there’s no definitive answer, as each lender has different standards. However, we can give you some general guidelines.

Generally speaking, you’ll need a credit score of at least 620 to qualify for most loans. If your score is lower than that, you may still be able to get approved, but you’ll likely have to pay a higher interest rate. And if your score is below 580, you’ll have a harder time getting approved for a loan at all.

If your credit score isn’t where you’d like it to be, there are things you can do to improve it. First, make sure you keep up with all your payments – this includes not only your mortgage or rent but also things like utility bills and credit card payments. Doing this will help show lenders that you’re responsible with your finances and capable of making regular payments on time.

You should also try to keep your balances low on your credit cards; using less than 30% of your available credit is ideal. If possible, pay off your balances in full every month to avoid paying interest charges. And finally, don’t open any new lines of credit or make any large purchases before applying for a loan, as this can temporarily lower your score.

By following these tips, you can improve your chances of getting approved for a Nissan loan – even if your credit score isn’t perfect.

What are the benefits of financing a Nissan with a low credit score?

There are many benefits to financing a Nissan with a low credit score. One of the biggest benefits is that you will be able to get a lower interest rate on your loan. This can save you money over the life of your loan, and it can make your monthly payments more affordable. Additionally, financing a Nissan with a low credit score can help you improve your credit score over time. By making timely payments on your loan, you can gradually improve your credit score and eventually qualify for better loan terms and rates in the future.

How can I get the best interest rate on a Nissan loan with a low credit score?

Nissan has a wide range of financing options available, even for those with less than perfect credit. However, the interest rate you’ll be offered will depend on your credit score. The higher your score, the lower the interest rate you’ll be offered.

If you’re looking to get the best interest rate possible on a Nissan loan, here are a few things you can do:

– Check your credit score and work to improve it before applying for financing.

– Shop around for the best interest rate from different lenders.

– Get pre-approved for financing before shopping for your vehicle.

What is the minimum down payment for a Nissan with a low credit score?

Nissan is one of the many carmakers that offer financing for customers with low credit scores. In order to qualify for financing, you’ll need to have a minimum down payment of $1,000. With a down payment of this size, you can expect to have a reasonable interest rate and monthly payments.

How can I build my credit to get a Nissan loan?

Nissan is a popular car manufacturer that offers financing options for those with good or bad credit. So, what is the lowest credit score Nissan will finance?

If you have bad credit, Nissan may still finance your loan if you have a cosigner with good credit. However, the interest rate on your loan will be higher if you have bad credit. The best way to get a lower interest rate is to improve your credit score before you apply for financing.

There are a few things you can do to improve your credit score, such as paying your bills on time, maintaining a good credit history, and using acredit monitoring service. If you have limited credit history, you can also try to get a secured credit card or a loans from family and friends to help build your credit.

Improving your credit score will take time and effort, but it will be worth it in the long run when you get approved for a Nissan loan with a lower interest rate.

What are the best ways to improve my credit score?

There are a number of things you can do to improve your credit score, including paying your bills on time, maintaining a good credit history, and using a credit monitoring service. You can also get help from a credit counseling service.

What are some tips for getting a Nissan loan with a low credit score?

If you’re looking to finance a Nissan with a low credit score, there are a few things you can do to improve your chances of being approved.

First, make sure you have all your financial paperwork in order. This includes things like your tax returns, pay stubs, and bank statements. Nissan will want to see that you’re financially stable and capable of making regular payments on your loan.

Second, try to get a co-signer for your loan. This is someone with good credit who agrees to sign the loan with you and be responsible for making payments if you can’t. Having a co-signer can greatly improve your chances of getting approved for financing.

Third, consider making a larger down payment on your loan. This shows Nissan that you’re serious about paying off your debt and are willing to put more money down upfront. A larger down payment can also help reduce the amount of interest you’ll pay over the life of the loan.

If you follow these tips, you’ll be in a great position to get approved for financing on a Nissan car even if you have a low credit score.

How can I get a Nissan loan with a bad credit score?

Nissan is one of the leading automakers in the United States, and they offer a wide variety of financing options for their customers. However, if you have a low credit score, you may be wondering if it’s possible to get a loan from Nissan.

The good news is that Nissan does offer financing for customers with bad credit. However, there are a few things you need to know before you apply.

First, it’s important to understand that you will likely have a higher interest rate if you’re approved for a loan with bad credit. This means that your monthly payments will be higher, and you’ll end up paying more interest over the life of the loan.

Second, Nissan may require a larger down payment if you have bad credit. This is because they view you as a greater risk, and they want to make sure they’re covered in case you default on the loan.

Third, your interest rate may not be the only factor that determines your monthly payment. Nissan may also require that you have a cosigner on the loan if your credit score is particularly low. This means that someone else will be responsible for making sure the loan is paid back if you can’t do it yourself.

If you’re interested in financing a Nissan with bad credit, it’s important to do your research and understand all of your options before you apply. By taking the time to learn about your financing options, you can make sure that you get the best possible deal on your loan.

What should I do if I can’t get a Nissan loan with a low credit score?

If you have a low credit score, you may still be able to get a Nissan loan by working with a lender that specializes in bad credit financing. There are a few things you can do to improve your chances of getting approved, such as making a larger down payment, choosing a less expensive car, or agreeing to a longer loan term. You should also make sure to shop around for the best interest rate and terms before applying for a loan.