How to Get a Loan for Rental Property

Contents

How to Get a Loan for Rental Property – It’s easier than you think! Just follow these simple steps and you’ll be on your way to becoming a landlord in no time.

Checkout this video:

Introduction

Anyone who’s invested in rental property knows that it can be a great way to earn money, but it also comes with its fair share of risks and obstacles. One of the biggest challenges faced by landlords is coming up with the initial investment to purchase a property, as well as the ongoing capital required to maintain and improve it.

One option for raising funds is to take out a loan, but this can be difficult to do if you don’t have a good credit history or collateral to offer. In this article, we’ll explore some of the different ways you can get a loan for rental property, including traditional loans, private lenders, andhard money loans.

How to Get a Loan for Rental Property

If you’re looking to get a loan for rental property, there are a few things you’ll need to know. The first is that you’ll need to have good credit. Lenders will want to see that you have a history of making on-time payments. You’ll also need to have a down payment of at least 20%.

How to Get a Loan for Rental Property

If you’re looking to get a loan for your rental property, there are a few things you’ll need to do in order to make sure you get the best deal possible. Here are a few tips:

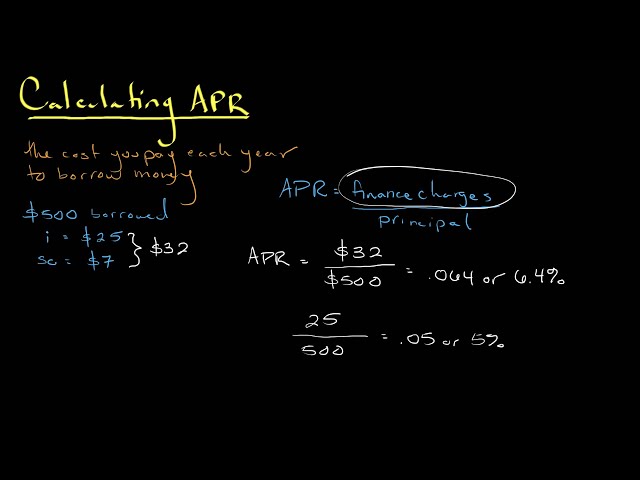

-Scout out the best interest rates. You’ll want to shop around and compare interest rates from different lenders in order to get the best deal possible.

-Make sure you have good credit. Your credit score will play a big factor in determining what interest rate you’re offered, so make sure you have a good score before applying for a loan.

-Get pre-approved for the loan. This will give you a better idea of how much money you can borrow and will make the whole process go more smoothly.

-Be prepared to put down a large down payment. Rental properties are considered riskier loans, so lenders will often require a larger down payment than they would for a primary residence.

How to Get a Loan for Rental Property

If you’re considering renting out a property, you may be wondering how to get a loan for rental property. While traditional mortgages can be used to purchase rentals, there are also loans specifically designed for investment properties. Here’s what you need to know about how to get a loan for rental property.

There are a few things to keep in mind when you’re looking for a loan for rental property. First, you’ll need to decide if you want a traditional mortgage or an investment property loan. Investment property loans typically have higher interest rates and down payment requirements than traditional mortgages, so it’s important to do your research before you apply.

Once you’ve decided what type of loan you need, it’s time to start shopping around. It’s a good idea to compare rates and terms from a few different lenders before you make a decision. Be sure to ask about any fees or closing costs associated with the loan, and make sure you understand all the terms and conditions before you sign anything.

Getting a loan for rental property can be a challenge, but it’s definitely possible with some planning and research. Be sure to shop around for the best rates and terms, and make sure you understand all the terms and conditions before you sign anything. With some effort, you should be able to find the perfect loan for your investment property.

How to Get a Loan for Rental Property

It’s no secret that financing for rental property can be tricky to come by. Lenders are often reluctant to provide loans for investment property, and when they do, the terms can be unfavorable.

However, there are a few options available for those looking to finance rental property. In this article, we’ll explore some of the best ways to get a loan for rental property.

One option for financing rental property is to take out a home equity loan. This can be a good option if you have equity in your primary residence and are looking for a low-interest way to finance your investment property.

Another option is to take out a personal loan. Personal loans can be a good option if you have good credit and can secure a favorable interest rate.

You could also consider using a credit card to finance your rental property. This can be a risky proposition, as you could end up paying high interest rates if you don’t pay off your balance in full each month. However, if you are able to secure a low interest rate and pay off your balance quickly, this could be an option worth considering.

Finally, you could also look into government-backed loans such as FHA loans or VA loans. These loans are typically available at favorable interest rates and with more flexible terms than conventional loans.

No matter which route you decide to go, it’s important to do your research and compare different options before making a decision. With careful planning and execution, you can find the right loan for your rental property needs.

Conclusion

In conclusion, it is possible to get a loan for rental property, but there are a few things to keep in mind. Make sure you have a good credit score and a solid business plan. You will also need to make sure the property is in good condition and has the potential to be profitable. Talk to a mortgage lender to see what loan options are available to you.