What Is the Average Interest Rate on a Personal Loan?

Contents

If you’re considering taking out a personal loan, you’re probably wondering what the average interest rate is. Here’s what you need to know.

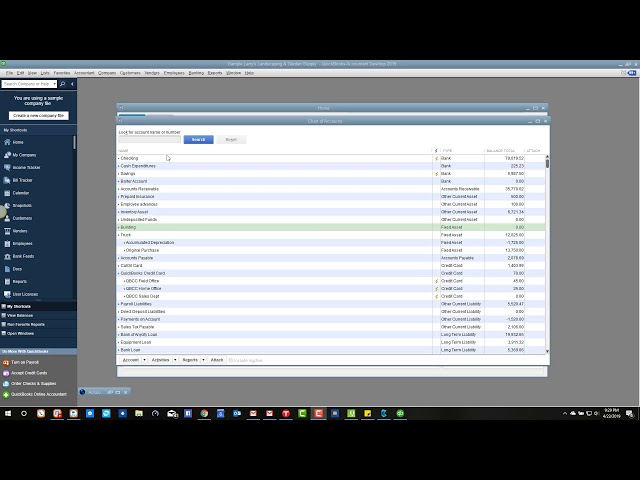

Checkout this video:

Introduction

Personal loans usually have lower interest rates than other types of borrowing, such as credit cards. The average rate on a personal loan was 10.09% in 2019, according to Federal Reserve data. But the average rate will vary depending on factors like your credit score, income and debts.

How Personal Loan Interest Rates Work

Personal loan interest rates are determined by many factors, including your credit score, income, and debt-to-income ratio. Lenders also consider the type of loan you’re requesting – whether it’s a secured loan (backed by collateral like a car or house), or an unsecured loan.

Interest rates on personal loans can range from around 6% to 36%. The actual rate you get will be determined based on these factors, as well as the lender you choose.

To get the best possible interest rate on a personal loan, it’s important to shop around and compare offers from multiple lenders. It’s also a good idea to check your credit report and credit score before applying, so you can be sure you’re getting the best rate possible.

Factors That Affect Your Personal Loan Interest Rate

The average interest rate for a personal loan varies depending on the type of lender, your creditworthiness as a borrower, the loan amount, and the repayment term. Here we cover some of the main factors that affect personal loan interest rates:

Lender Type: The type of lender you borrow from will affect the interest rate you pay on your loan. Banks and credit unions tend to offer lower rates than online lenders and retail stores.

Creditworthiness: Your creditworthiness is one of the main factors that lenders consider when setting an interest rate. Those with excellent credit (740+ FICO® Score) can expect to pay much lower rates than borrowers with poor credit (620 or below).

Loan Amount: The amount you borrow also plays a role in what you’ll pay in interest. In general, the larger your loan amount, the higher your interest rate will be.

Repayment Term: The length of time you have to repay your loan will also affect the interest rate you pay. Loans with shorter repayment terms typically have lower interest rates than loans with longer terms.

The Average Interest Rate for a Personal Loan

The average interest rate for a personal loan depends on the type of loan, the lender, your creditworthiness, and the prime rate. The prime rate is the lowest interest rate that commercial banks charge their most creditworthy customers. For example, if the prime rate is 3% and you qualify for a 6% personal loan from a bank, then your interest rate would be 6%. Your actual interest rate may be higher or lower than this example depending on your financial history.

How to Get the Best Interest Rate on a Personal Loan

When you’re looking for a personal loan, one of the first things you’ll want to compare is the annual percentage rate (APR). This is the amount of interest you’ll pay annually on the outstanding principal balance of your loan, and it can vary widely from lender to lender.

The average interest rate on a personal loan in the United States is 10.88%, according to our latest data from July 2020. But depending on the lender and your creditworthiness, you could qualify for an APR as low as 5.99% or as high as 28.99%.

Here’s a look at some of the factors that can influence your personal loan interest rate:

-Your credit score: This is one of the biggest factors that lenders will consider when determining your eligibility for a loan and what interest rate to offer you. In general, the higher your credit score, the lower your interest rate will be.

-Your debt-to-income ratio: This is a measure of how much debt you have relative to your income. Lenders use this metric to gauge your ability to repay a loan. The lower your debt-to-income ratio, the better chance you have of qualifying for a low interest rate.

-The type of loan you’re applying for: Some loans tend to have higher interest rates than others. For example, secured loans (like car loans) typically have lower rates than unsecured loans (like personal loans).

-The length of the loan: The longer the term of your loan, the more interest you’ll pay over time. That’s why it’s generally best to choose a shorter loan term if you can afford it.

Personal Loan Interest Rates by State

The average interest rate on a personal loan in the United States is 10.88%, according to our most recent data from February 2021. But depending on which state you live in, the average rate you’re offered can be much higher or lower.

For example, the average rate in Vermont is just 5.99%, while the average rate in Wyoming is a whopping 28.45%.

To see where your state ranks, check out our table below.

Conclusion

To get the best deal on a personal loan, it’s important to compare offers from multiple lenders. The average interest rate on a personal loan is 10.24%, but depending on your credit history, income, and other factors, you may be able to get a lower rate.