What is the Aim of the Consumer Credit Act?

Contents

The Consumer Credit Act is a UK law that provides protection for consumers when they enter into credit agreements. The Act sets out certain rights and responsibilities for both lenders and borrowers, and establishes a number of different protections for consumers.

Checkout this video:

Introduction

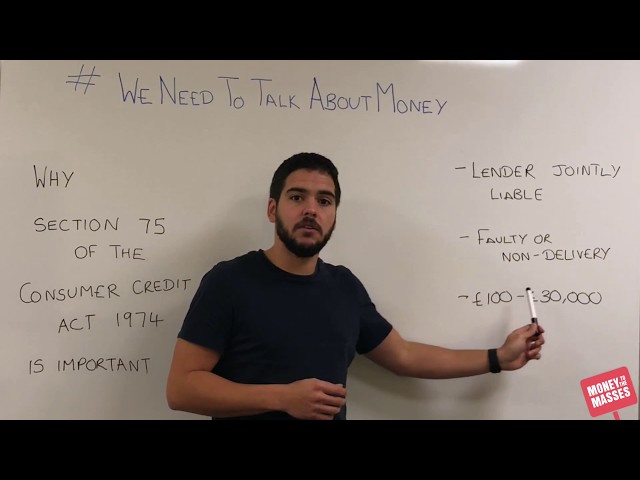

The Consumer Credit Act is a UK law that was introduced in 1974. The act is designed to protect consumers who enter into credit agreements with lenders. The act regulates the terms of credit agreements and gives consumers certain rights, such as the right to cancel agreements within 14 days.

What is the Consumer Credit Act?

The Consumer Credit Act is a law that covers credit agreements between businesses and consumers. It protects consumers by setting out rules that businesses must follow when they offer, sell or provide credit.

The Act covers a wide range of credit products including loans, overdrafts, store cards, credit cards and hire purchase agreements. It gives consumers important rights and protections, such as the right to cancel a credit agreement within 14 days, and the right to early repayment without penalty.

The Act also establishes a statutory duty on businesses to treat consumers fairly. This means that businesses must not only comply with the rules set out in the Act, but must also deal with consumers in a fair and reasonable way.

The Consumer Credit Act is enforced by the Financial Conduct Authority (FCA).

What are the aims of the Consumer Credit Act?

The Consumer Credit Act is a law that protects consumers who borrow money from lenders. The Act gives consumers the right to cancel certain credit contracts, and it puts limits on how much interest and fees can be charged. It also gives consumers the right to complain if they feel they have been treated unfairly by a lender.

Conclusion

It is evident that the overall aim of the Consumer Credit Act is to provide protection for consumers when they enter into credit agreements. This is done by ensuring that credit providers give customers clear information about the terms and conditions of the agreement, as well as their rights and obligations. In addition, the Act provides for a number of regulated activities which must be carried out by credit providers in order to ensure that customers are treated fairly.