What is Student Loan Default and How to Avoid It

Contents

If you’re thinking about taking out a student loan, you’re probably wondering what could happen if you can’t make your payments. One potential outcome is default, which can have serious consequences. In this blog post, we’ll explain what student loan default is and how you can avoid it.

Checkout this video:

Introduction

Defaulting on your student loans has serious consequences that can negatively affect your credit score and your ability to get future loans. It can also lead to wage garnishment, meaning the government can take money out of your paycheck to repay your debt.

To avoid default, it’s important to understand what it is and how to prevent it.

What is Student Loan Default?

Default occurs when you fail to make payments on your student loan for 270 days. At that point, your loan servicer will report the default to the credit bureaus, which will damage your credit score. The entire balance of the loan will then become due and payable immediately.

How to Avoid Default

There are a number of things you can do to avoid defaulting on your student loans:

-Make sure you know who your loan servicer is and how to contact them.

-Keep up with your payments. You can set up automatic payments so you don’t have to worry about forgetting.

-If you can’t make a payment, contact your loan servicer as soon as possible. They may be able to work with you to set up a new payment plan or deferment/forbearance options.

What is Student Loan Default?

Defaulting on your student loans has serious consequences that can last for years. Default is when you fail to make your loan payments as scheduled, and it can happen if you miss just one payment.

When you default, your entire unpaid balance and any interest you owe become immediately due and payable. You may also lose your eligibility for deferment, forbearance, and repayment plans. In addition, the entire unpaid balance of your loan and any accrued interest may be accelerated, meaning that you will have to pay it all back immediately.

Your loan holder may also assign your debt to a collection agency. If this happens, you will have to pay additional collection costs. You may also damage your credit rating, making it difficult to get a mortgage, car loan, or even a job.

The best way to avoid default is to make sure you stay on top of your payments. If you’re having trouble making payments, contact your loan holder right away to discuss your options.

The Consequences of Default

What is student loan default? Student loan default occurs when you fail to make payments on your student loans according to the terms of your promissory note. When you default, your entire unpaid balance and any accrued interest become immediately due and payable. In addition, you lose eligibility for deferment, forbearance, and repayment plans. You also will no longer receive additional federal student aid if you decide to return to school. The entire unpaid balance of your loan and any interest you owe could be subject to collection through garnishment of your wages and interception of your federal and state tax refunds. You also could be sued for the entire amount of the loan. Default will damage your credit rating for seven years, making it hard for you to get a car loan, buy a house, or get a credit card.

What are the consequences of default?

The consequences of default are serious. To avoid default, stay in touch with your loan servicer if you can’t make your payments, and explore all of your options for keeping your loans in good standing.

Steps to Take If You Can’t Afford Your Student Loans

If you’re struggling to make your student loan payments, don’t wait until you’ve fallen behind to seek help. There are several measures you can take to avoid default, including:

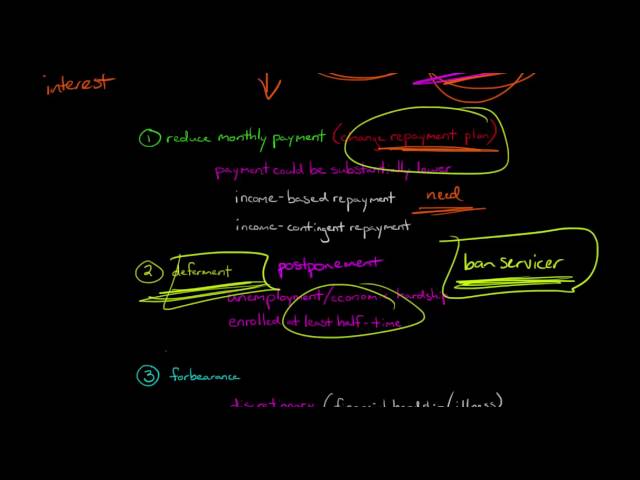

-Contact your loan servicer: Your loan servicer is the company that manages your student loan on behalf of the lender. They can help you understand your repayment options and direct you to resources that can help, such as income-driven repayment plans or deferment or forbearance.

-Consider an income-driven repayment plan: Income-driven repayment plans base your monthly student loan payment on a percentage of your disposable income. If you have a low income or are experiencing financial hardship, an income-driven repayment plan could make your payments more affordable.

-Deferment or forbearance: If you’re facing a temporary financial hardship, you may be eligible for a deferment or forbearance, which allows you to temporarily stop making payments or make reduced payments. Interest will continue to accrue during a deferment or forbearance, so this option should only be used as a last resort.

-Consolidate your loans: Loan consolidation allows you to combine multiple federal student loans into a single loan with one monthly payment. You may be able to lower your monthly payment by extending the term of your consolidation loan, but keep in mind that this will result in paying more in interest over the life of the loan.

-Refinance your loans: If you have good credit and steady income, you may be able to qualify for a lower interest rate by refinancing your student loans. Keep in mind that if you refinance federal student loans, they will no longer be eligible for certain benefits, such as income-driven repayment plans and Public Service Loan Forgiveness.

Avoiding Default

There are serious consequences to defaulting on your student loans. Not only will your credit score be adversely affected, but you may also be subject to wage garnishment, loan rehabilitation, and loan consolidation. In order to avoid default, it is important to stay on top of your payments and make sure you are paying on time every month. You can also sign up for automatic payments so that you never have to worry about making a late payment. If you are having trouble making your monthly payments, contact your loan servicer immediately to discuss your options.

Conclusion

Defaulting on your student loans has serious consequences that can follow you for years. Not only will it damage your credit score, but you may also have to deal with wage garnishment, seizure of tax refunds, and even legal action. If you’re struggling to make your student loan payments, there are options available to help you stay on track. You should contact your loan servicer to discuss your options and avoid default.