What Is Spread In Finance?

Contents

- What is spread in equity?

- What is spread called in banking?

- How do you calculate spread in finance?

- What is the purpose of a spread?

- What does a +7 spread mean?

- Why is there a spread in stock prices?

- What does a large spread mean in stocks?

- What are the types of spreads?

- What is spread example?

- How does spread work in trading?

- How do you make a spread?

- What is repo rate and spread?

- What is spread in mortgage?

- Can a bank change spread?

- What does a negative spread mean?

- Should I buy at bid or ask price?

- What is a table spread?

- What does spread mean in math?

- What is sandwich filling?

- What does +3 spread mean?

- What does +1.5 spread mean?

- How do you read a spread?

- Are wide spreads good?

- How do brokers make money on spread?

- What does a tight spread indicate?

- Conclusion

A spread is the difference between two prices, rates, or yields in finance. The bid-ask spread, which refers to the difference between the bid (from buyers) and ask (from sellers) prices of a security or asset, is one of the most prevalent varieties.

Similarly, What is spread in investing?

A spread is a key phrase in finance, the foreign currency market, the investment market, and commodity buying and selling. The difference in the prices offered for the sale and purchase of a commodity, stock, currency, or bond is referred to as a spread.

Also, it is asked, What is a spread in accounting?

The difference in price between two items. A spread, for example, is a profit made by selling an item at a higher price than when it was purchased. It may also refer to the gap between a security’s highest bid and lowest offer.

Secondly, What is the term spread means?

spread (Entry 1 of 2) is a transitive verb with a definition. 1a: stretch out the map by opening it up or expanding it across a bigger region. b: to expand its wings in preparation for takeoff. 2a: to spread fertilizer over a large region.

Also, What are spread products in finance?

Spread product is the awful moniker for non-Treasury taxable (as opposed to municipal) bonds. Various forms of spread products include agency securities, asset-backed securities, corporate bonds, high-yield bonds, and mortgage-backed securities.

People also ask, What are the 3 types of spreads?

Options spread strategies are divided into three categories: vertical, horizontal, and diagonal.

Related Questions and Answers

What is spread in equity?

What is Equity Spread, and how does it work? The value provided by a company’s stock base is measured by equity spread. It’s the difference between a period’s return on equity and the cost of equity, multiplied by the equity balance at the start.

What is spread called in banking?

The difference between the interest rate a bank charges a borrower and the interest rate a bank pays a depositor is known as the bank spread. The bank spread, also known as the net interest spread, is a percentage that indicates how much money the bank receives vs how much it pays away.

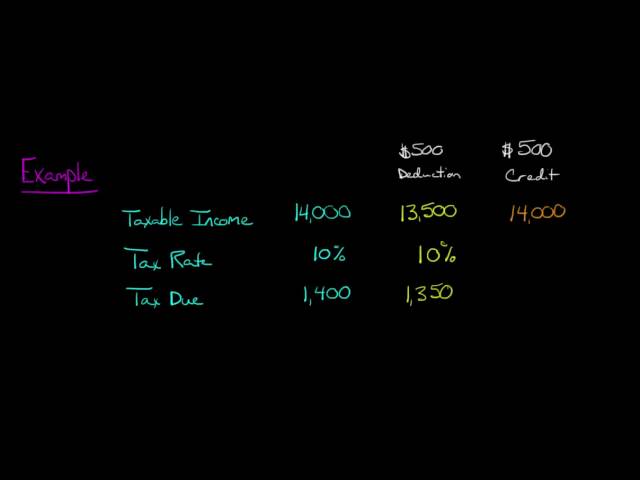

How do you calculate spread in finance?

Take the bid-ask spread and divide it by the selling price to get the bid-ask spread percentage. For example, a $100 stock with a penny spread has a spread percentage of $0.01 / $100 = 0.01 percent, but a $10 stock with a dime spread has a spread percentage of $0.10 / $10 = 1%.

What is the purpose of a spread?

The spread serves three purposes: it keeps the bread from soaking up the filling, adds taste, and keeps it wet. The most widely used spreads are butter and mayonnaise. The major taste of the sandwich comes from the filling, and the options are practically endless.

What does a +7 spread mean?

What does it mean to have a +7 spread? If a game’s spread is seven points, the underdog will get seven points, shown as +7 on the odds. The favored is a team with a -7 point spread and is laying seven points.

Why is there a spread in stock prices?

The broker or expert managing the transaction makes a profit on the difference. The supply and demand of a certain asset, such as stocks, is represented by this spread. The demand is reflected in bids, while the supply is reflected in the ask price. When one outweighs the other, the margin might widen dramatically.

What does a large spread mean in stocks?

Important Points to Remember When a market is not frequently traded and has low volume, or when the number of contracts transacted is lower than typical, a significant spread occurs.

What are the types of spreads?

Dairy spreads (such as cheeses, creams, and butters), margarines, honey, plant-based spreads (such as jams, jellies, and hummus), yeast spreads (such as vegemite and marmite), and meat-based spreads (such as pâté) are all common.

What is spread example?

Unfolding and putting out a picnic blanket is an example of to spread. The term spread out, which depicts someone lying on their back with their arms completely extended, is an example of to spread. Spreading peanut butter on a slice of bread using a knife is an example of to spread.

How does spread work in trading?

The difference between the purchase (offer) and sell (bid) prices offered for an item is known as a spread in trading. The spread is an important aspect of CFD trading since it determines the price of both derivatives. A spread is used by many brokers, market makers, and other providers to quote their pricing.

How do you make a spread?

2:3619:31 We essentially collapse on the ground. You also shatter the bag of to. Look. That’s right up there with popcorn. More We essentially collapse on the ground. You also shatter the bag of to. Look. That’s right up there with popcorn. the color nonsense Mexican pop is all over there, and you need to put it in every soup and on every tooth.

What is repo rate and spread?

A bank charges the borrower a specific amount in interest and pays the depositor a certain amount in interest. The bank spread or margin is the difference between these two interest rates. When taking out a house loan, the homeowner must pay this spread to the bank on top of the repo rate.

What is spread in mortgage?

The difference in interest rates between a 10-year US Treasury bill and the average rate on a 30-year mortgage is known as the mortgage spread. Mortgage rates are typically 1.5 percentage points higher than 10-year Treasury rates.

Can a bank change spread?

One of the various strategies used to manipulate interest rates is the spread. To preserve profitability, banks raise and reduce their spread in response to changes in policy rates.

What does a negative spread mean?

the most popular

Should I buy at bid or ask price?

The lowest price a vendor will take is the ask price. The spread is the difference between the bid and ask prices. The lesser the liquidity, the larger the spread. Only when someone is prepared to sell the security at the bid price or purchase it at the ask price will a transaction take place.

What is a table spread?

A substantial dinner, particularly one served at a table.

What does spread mean in math?

The spread in data is the distance between the mean and the median of the values in a data collection. The data spread may show us how much variance there is in the data set’s values.

What is sandwich filling?

The name of the sandwich comes from the contents. Meat, poultry, fish, eggs, cheese, and vegetables might be used as fillings. Popular fillings include salami, cooked roast chicken, ox tongue, sliced cucumber, and tomato. A single item or a mix of items might be used as the filler.

What does +3 spread mean?

The odds on both sides of a spread bet are normally set at -110, depending on the sportsbook and state. That implies that whether you win a wager on the Colts -3 or the Texans +3, you’ll earn the same amount of money.

What does +1.5 spread mean?

The puck line is a term used to describe the point spread in hockey betting. The puck line in the NHL is nearly typically placed at 1.5, implying that the favorite must win by two or more goals.

How do you read a spread?

Spread vs. Straight Up For example, if the spread is (-7.5), your side must win by at least eight points. If you bet on an underdog, they must lose by a smaller margin than the spread or win outright in order for you to win. If the spread is (+5.5), for example, your side may lose by 5 points or win outright.

Are wide spreads good?

On illiquid shares, market makers often employ greater bid-ask spreads to mitigate the risk of owning low volume stocks. They have a responsibility to guarantee that markets run smoothly by providing liquidity. For market makers, a larger spread means more premiums.

How do brokers make money on spread?

The spread is the difference between real instrument prices and the prices traders pay on their transactions in plain words. Brokers will offer purchase prices that are higher than the real price and sell prices that are lower. Brokers profit on trading instruments by adding a markup and pocketing the difference.

What does a tight spread indicate?

A market that has small bid-ask spreads is considered tight. A tight market for a security or commodity is defined by a high trading volume and an abundance of market liquidity. Tight spreads, the characteristic of a tight market, are the result of intense price rivalry on both the buyers’ and sellers’ sides.

Conclusion

The “what is spread in banking” is a term that refers to the difference between what an investor pays for a security and what it is worth. The more “spread” there is, the more risk involved with the investment.

This Video Should Help:

The “spread finance formula” is a mathematical formula that is used in the world of sports betting. It can be used to calculate the probability of an event happening.

Related Tags

- what is spread in trading

- what is spread in forex

- spread trading example

- bid-ask spread

- spread synonym