What Is High APR on Credit Cards?

Contents

If you’re wondering what high APR on credit cards is, you’re not alone. Many people don’t know what it means or how it affects their credit card balance. Keep reading to learn more about high APR and how to avoid it.

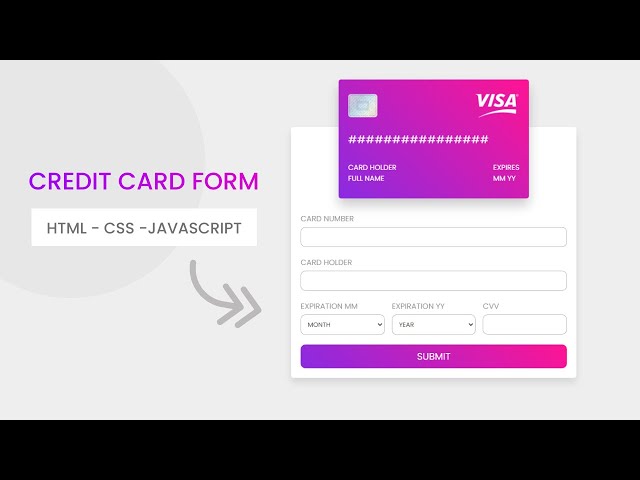

Checkout this video:

What is APR?

APR, or annual percentage rate, is the amount of interest you’ll pay on your credit card balance each year. The higher your APR, the more interest you’ll pay. Most credit cards have an APR between 14% and 24%.

How is APR calculated?

Annual percentage rates (APRs) are calculated in a few different ways, depending on the type of loan. For revolving debt, such as credit cards, APRs are calculated by taking the debt’s daily periodic rate and multiplying it by 365 (days in a year). This calculation does not include compounding, so the APR you see listed on your credit card statement is actually lower than the true cost of borrowing if you carry a balance from month to month.

For installment loans, such as auto loans or mortgages, APRs are calculated using a method called “simple interest.” This means that interest is charged only on the principal loan amount and not on any accrued interest. The APR you see listed on your loan documents includes both the interest rate and any origination or discount points charged by the lender.

What is a high APR?

A high APR is when the Annual Percentage Rate on your credit card is higher than average. This can be a problem if you have a lot of debt because it will take you longer to pay it off. A high APR can also make it difficult to get approved for new credit.

What are the consequences of high APR?

High APR can have significant consequences for your financial health. Not only will you end up paying more in interest, but it will also take you longer to pay off your debt. This can have a major impact on your credit score, as well as your ability to qualify for future loans and lines of credit. In some cases, high APR can also lead to late fees and other penalties. If you’re struggling to keep up with your payments, it’s important to reach out to your lender or credit card company as soon as possible to discuss your options.

How can you avoid high APR?

APR is the annual percentage rate that is charged on a credit card balance. If you have a high APR, it means that you will be paying more interest on your outstanding balance. This can make it difficult to pay off your credit card debt. There are a few ways to avoid high APR. You can transfer your balance to a card with a lower APR, you can negotiate with your credit card company for a lower APR, or you can make sure that you always pay your balance in full each month. Let’s discuss each of these options in more detail.

How can you negotiate APR?

If you have a high APR on your credit card, there are a few ways you can try to negotiation a lower rate. The first step is to call your credit card issuer and ask for a lower APR. You might be able to get a lower APR if you have a good history with the credit card issuer and if you threaten to transfer your balance to another card with a lower APR.

If your credit card issuer is not willing to negotiate a lower APR, you can try to find another credit card with a lower APR. There are many balance transfer credit cards that offer 0% APR for an introductory period, which can help you save money on interest. You can also look for new no-annual-fee credit cards that offer 0% APR on purchases and balance transfers for an introductory period.

If you are unable to find a new credit card with a lower APR, you can try to pay off your debt as quickly as possible so that you pay less interest overall. You can do this by making more than the minimum payment each month or by making extra payments when you can afford it. If you have a large balance, it might take longer to pay off your debt, but it will be worth it in the end because you will save money on interest.