How to Get a Credit Card from Wells Fargo

Contents

If you’re looking to get a credit card from Wells Fargo, there are a few things you’ll need to do. First, make sure you meet the minimum requirements. Then, fill out an application and wait for a decision. If you’re approved, you’ll receive your new credit card in the mail.

Checkout this video:

Research the Wells Fargo credit card options

Be sure to research the Wells Fargo credit card options before you apply. You will want to make sure that you choose the card that best suits your needs. Wells Fargo offers a variety of credit cards, so be sure to compare the features and benefits of each before you decide which one is right for you.

Some things you may want to consider when researching credit cards include:

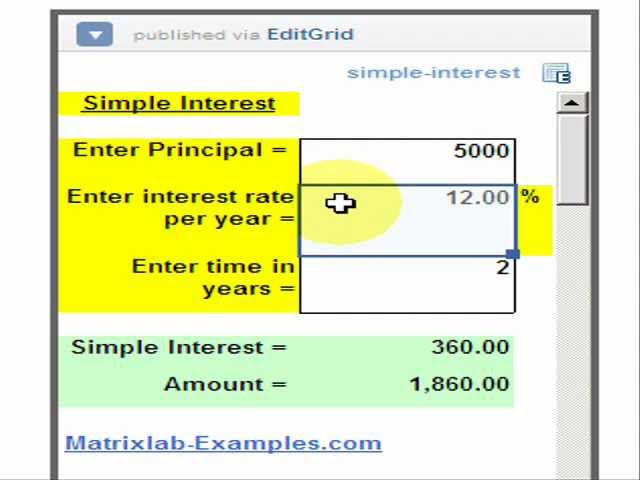

-The interest rate and fees associated with the card

-The credit limit

-The rewards program

-The perks and benefits offered by the card

Once you have narrowed down your choices, you can begin the application process.

Find the credit card that best suits your needs

There are many different credit cards offered by Wells Fargo, so it is important to find the card that best suits your needs. If you are a student, you may want to consider a student credit card. If you are looking for a card with low interest rates, you may want to consider a balance transfer credit card. If you are looking for a rewards card, you may want to consider a cash back credit card.

Once you have chosen the type of credit card that you would like, you can apply for the card online or in person at a Wells Fargo branch. To apply for the card online, you will need to provide your personal information, such as your name, address, and Social Security number. You will also need to provide financial information, such as your income and debts.

Once you have been approved for the credit card, you will receive your new credit card in the mail within 7-10 business days.

Apply for the credit card online or in person

To apply for the credit card online or in person, you will need to:

-Complete an application form

-Provide proof of identity, income and residency

-Be at least 18 years old and a U.S. citizen or resident alien

Activate your credit card

It’s easy to activate your new Wells Fargo credit card. To get started, go to Wells Fargo online and log in to your account. From there, you’ll be asked to provide your credit card number, expiration date, and security code. Once you’ve entered that information, click “Submit” and your credit card will be activated. If you have any questions, please call the customer service number on the back of your credit card.

Start using your credit card

Now that you have been approved for a credit card from Wells Fargo, you will need to start using it in order to begin building your credit history. Here are a few tips on how to use your new credit card:

– Use your credit card for small purchases that you would normally use cash or a debit card for, such as gas or groceries.

– Make sure you pay your credit card bill on time and in full every month. This will help you avoid late fees and interest charges, and also demonstrate to creditors that you are a responsible borrower.

– Keep your credit utilization low by only charging what you can afford to pay off in full each month. Your credit utilization is the amount of debt you have relative to your credit limit, and it is one of the key factors that creditors consider when determining your creditworthiness.