What is Derogatory Credit?

Contents

derogatory credit is any mark on your credit report that indicates you have made a late payment, had an account sent to collections, or declared bankruptcy.

Checkout this video:

What is Derogatory Credit?

Derogatory credit is negative information on your credit report that is often the result of missing payments, defaulting on a loan, or declaring bankruptcy. This can make it difficult to get approved for new credit. Having derogatory credit can also make it difficult to get a job, rent an apartment, or qualify for a mortgage.

What is a derogatory credit item?

A derogatory credit item is any indication on your credit report that you have defaulted on a loan, made late payments, or have otherwise mismanaged your credit. Derogatory items can stay on your credit report for up to seven years, and can have a major negative impact on your credit score.

How long do derogatory items stay on your credit report?

Derogatory items are negative marks on a credit report that can indicate financial problems or management. They can stay on a report for up to seven years, with some items remaining for 10 years. Derogatory items can make it difficult to get approved for new credit and may also result in higher interest rates.

The Impact of Derogatory Credit

Derogatory credit is any kind of negative information on your credit report. This can include late payments, collections, foreclosures, and bankruptcies. Having derogatory credit can impact your ability to get a loan, obtain employment, and even rent an apartment. Let’s take a look at how derogatory credit can impact your life.

How does derogatory credit affect your credit score?

Derogatory credit information is any mark on your credit report that indicates you have made a late payment, had an account sent to collections, declare bankruptcy, or have any other type of negative information. This information remains on your credit report for varying lengths of time, depending on the type of derogatory information.

While derogatory credit information will lower your credit score, it is important to remember that your credit score is just one factor in determining whether or not you will be approved for a loan. Lenders will also take into account your income, employment history, and other factors when making a decision.

If you have derogatory information on your credit report, there are several things you can do to improve your chances of being approved for a loan:

-Pay off any outstanding debts: This will show lenders that you are committed to paying off your debts.

-Correct any errors on your credit report: If there are any inaccuracies on your report, be sure to dispute them with the credit bureau.

-Build up a history of positive payments: If you have recently started making all of your payments on time, this will show lenders that you have changed your payment habits.

-Find a cosigner: If you can find someone with good credit to cosign for a loan with you, this will improve your chances of being approved.

How can derogatory credit affect your ability to get a loan?

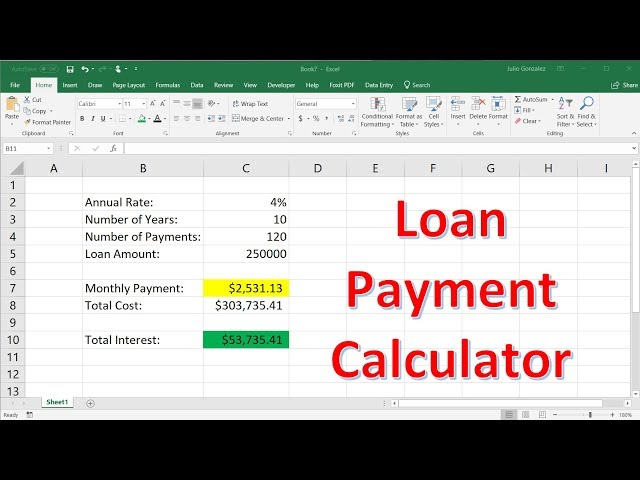

Derogatory credit can make it difficult to get a loan because it indicates to lenders that you may be a high-risk borrower. Lenders may be hesitant to give you a loan if they see that you have derogatory items on your credit report, such as late payments, collections, or bankruptcies.

Derogatory credit can also affect your ability to get a loan by causing your interest rates to be higher than average. Lenders may charge you a higher interest rate if they see that you have derogatory items on your credit report, because they view you as being more likely to default on the loan.

If you have derogatory items on your credit report, it is important to work on repairing your credit so that you can improve your chances of getting approved for a loan in the future. You can do this by making all of your payments on time, paying off any outstanding collections accounts, and disputing any inaccurate information on your credit report.

How to Remove Derogatory Credit From Your Credit Report

Derogatory credit is any type of negative mark on your credit report. This can include late payments, collections, charge-offs, etc. Derogatory credit can stay on your credit report for up to 7 years and can have a major impact on your credit score. If you have derogatory credit, you may have difficulty getting approved for new credit cards or loans. Luckily, there are a few things you can do to remove derogatory credit from your credit report.

How to dispute derogatory credit items

If you have derogatory items on your credit report, you can dispute them with the credit bureau in an effort to have them removed. The process is relatively simple and straightforward, but it does require that you have all of your documentation in order. Here’s a step-by-step guide to disputing derogatory items on your credit report:

1. Gather your documentation. You will need any and all documentation that supports your claim that the derogatory item is inaccurate or outdated. This could include things like canceled checks, letters from creditors, or statement from third-party witnesses.

2. Write a dispute letter to the credit bureau. In this letter, you will need to state clearly and concisely why you are disputing the item in question. Be sure to include copies (not originals) of all supporting documentation.

3. Send your dispute letter and supporting documentation by certified mail with a return receipt requested so that you have proof of delivery.

4. The credit bureau has 30 days to investigate your claim and respond back to you in writing with their findings. If they find that the disputed item is indeed accurate, it will remain on your credit report. However, if they find that the item is inaccurate or outdated, they will remove it from your report and notify all three major credit reporting agencies accordingly.

How to negotiate with creditors to remove derogatory items

If you find derogatory items on your credit report, you can try to negotiate with the creditor to have the item removed. This is especially effective if the derogatory item is due to a error on the part of the creditor.

If you are unable to negotiate with the creditor, you can also try to get the item removed by disputing it with the credit bureau. To do this, you will need to send a certified letter to the credit bureau that includes documentation supporting your claim that the item is inaccurate.

Derogatory Credit and Your Rights

Derogatory credit is any mark on your credit report that indicates you have made a late payment, had an account sent to collections, or declared bankruptcy. If you have derogatory credit, you may have difficulty getting approved for a loan, credit card, or mortgage. The good news is, you have rights under the Fair Credit Reporting Act.

The Fair Credit Reporting Act

The Fair Credit Reporting Act is a federal law that regulates the collection and dissemination of consumer credit information. Under the FCRA, consumer reporting agencies (CRAs) must maintain accurate and complete information, and they must correct any errors in a timely manner.

The FCRA also gives consumers the right to access their credit reports, and to dispute any inaccurate or incomplete information. If you have been denied credit, or if you have been subjected to unfavorable terms due to derogatory information in your credit report, you may have a claim under the FCRA.

If you believe your rights have been violated, you should contact an experienced attorney who can help you protect your rights and recover damages.

The Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from unfair or abusive debt collection practices. The FDCPA applies to any company that regularly collects debts on behalf of other companies, including debt collectors, attorneys who collect debts on behalf of their clients, and businesses that collect their own debts.

The FDCPA prohibits debt collectors from using unfair, deceptive, or abusive practices when collecting a debt. Debt collectors are also prohibited from harassing, oppressing, or abusing any person in connection with the collection of a debt.

If you believe that a debt collector has violated the FDCPA, you can sue the debt collector in federal court. You may be able to recover damages, including your costs and attorney’s fees.