What Is Credit? Definitions and Explanations

Contents

What is credit? It’s a simple question with a not-so-simple answer. Check out our blog post to get a comprehensive explanation of all things credit-related. From credit scores to credit reports, we’ve got you covered.

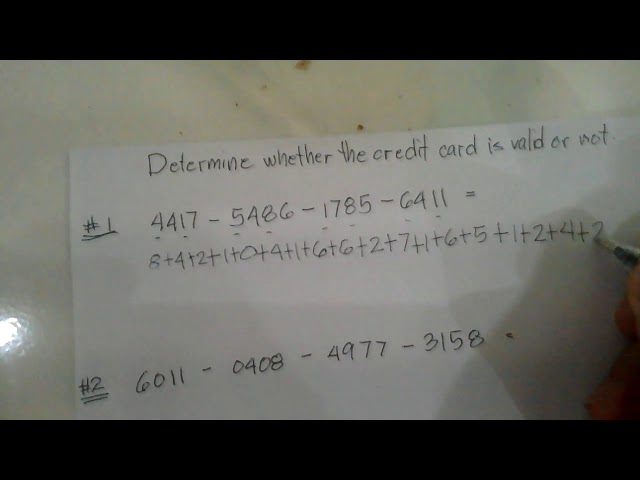

Checkout this video:

What is credit?

Credit is an arrangement between a borrower and a lender in which the borrower receives something of value now and agrees to repay the lender at a later date. The lender may be a bank, credit card company, or other financial institution.

The three major credit reporting agencies

The three major credit reporting agencies are Equifax, Experian, and TransUnion. They are sometimes referred to as the “big three.” These companies collect and maintain information about your credit history. They then sell this information to creditors, employers, insurers, and others who use it to evaluate your applications for credit, insurance, employment, or renting a home.

The difference between good and bad credit

Your credit score is a number that represents your creditworthiness. A higher number means you’re less of a risk to lenders, and you’ll likely be approved for loans and lines of credit with lower interest rates. A lower number means you’re more of a risk, and you may be denied for loans or stuck with higher interest rates.

There are two main types of credit: good credit and bad credit. Good credit means you have a history of making payments on time and maintaining a low balance on your borrowing accounts. Bad credit means you have a history of late or missed payments, or you have a high balance on your borrowing accounts.

Good credit can help you get approved for loans, lines of credit, and other forms of borrowing at better terms (like lower interest rates). Bad credit can make it harder to get approved for borrowing, or it can result in higher interest rates and other unfavorable terms.

If you’re not sure what your credit score is, you can check it for free on websites like Credit Karma or Credit Sesame.

How is credit used?

Credit is often thought of as a loan, but it can also refer to the act of using someone else’s money. When you borrow money, you are using credit. When you use a credit card, you are also using credit. Credit can be a useful tool if used responsibly.

Loans

Credit is money that is loaned to you with the agreement that you will repay it with interest. The interest rate is the amount of money that you pay for the privilege of borrowing the money. In order to borrow money, you will usually have to provide some collateral, which is an asset that can be sold to repay the loan if you default on the payments.

There are many different types of loans, but some of the most common are auto loans, home loans, and student loans. Loans can also be used to finance large purchases such as a boat or a new business.

Auto loans are used to finance the purchase of a new or used car. The interest rate on an auto loan is usually higher than the rate on a home loan because cars are considered to be a higher risk for lenders. Home loans are used to finance the purchase of a house or other property. The interest rate on a home loan is usually lower than the rate on an auto loan because homes are considered to be a more stable investment for lenders. Student loans are used to finance the cost of attending college or university. The interest rate on a student loan is usually lower than the rates on other types of loans because education is considered to be an investment in your future earning potential.

Credit cards

Credit cards are one of the most common ways that people use credit. When you use a credit card, you are borrowing money from the credit card issuer. You will then have to pay back the money you borrowed, plus interest and fees.

Most credit cards have a minimum monthly payment that you will need to make. If you only make the minimum payment, it will take you longer to pay off your debt and you will end up paying more in interest and fees. It is important to try to pay more than the minimum payments whenever possible.

Some credit cards also offer rewards programs. These programs can give you points for every purchase that you make. You can then redeem these points for cash back, gift cards, or other prizes.

Mortgage

A mortgage is a loan from a bank or a financial institution that is used to purchase a home. The down payment for the home can be as low as 3% for first-time buyers, but it is recommended that you have at least 20% saved for the down payment to avoid having to pay private mortgage insurance (PMI). The terms of the mortgage can be anywhere from 15-30 years, and the interest rate will be determined by your credit score.

How can I improve my credit score?

Credit is an arrangement in which a borrower receives something of value now and agrees to repay the lender at some date in the future, usually with interest. There are a few things you can do to help improve your credit score. In this article, we’ll go over a few of them.

Payment history

One of the biggest factors in your credit score is your payment history. This includes whether you make your payments on time and how often you miss payments. Payment history makes up about 35% of your credit score, so it’s important to keep track of your payment patterns.

If you have a history of missed payments or late payments, this will damage your credit score. If you have a history of making all your payments on time, this will improve your credit score. To improve your payment history, make sure you pay all your bills on time going forward. You may also want to consider setting up automatic payments so you never have to worry about missing a payment.

Credit utilization

Credit utilization is one of the most important factors in your credit score—it accounts for 30% of your FICO® Score 8 calculation. You can impact your credit utilization by either paying down your revolving debt or by increasing your credit limits. Doing both will have an even more positive impact.

To get started, check your credit report and calculate your credit utilization rate. Your rate is the ratio of your outstanding revolving balances divided by your total available credit limits. To keep your score strong, aim to keep your credit utilization under 30%. The lower it is, the better. If you have a high balance on one card, consider transferring part of the balance to a card with a lower limit to help reduce your overall utilization.

Length of credit history

One important factor in your credit score is the length of your credit history. The longer your credit history, the better. This is because lenders like to see a track record of on-time payments and responsible borrowing. If you don’t have a long credit history, there are still things you can do to improve your score.

In general, try to avoid opening new lines of credit too frequently. Every time you open a new account, it can lower the average age of your accounts, which can have a negative impact on your score. Also, make sure you keep your oldest accounts active by using them occasionally and paying them off on time.

What are the consequences of bad credit?

Credit is financial assistance extended to a person or business with the understanding that it will be repaid with interest over a specified period of time. Lenders, such as banks and credit card companies, use credit scores to evaluate an individual’s creditworthiness. A low credit score may result in higher interest rates and could lead to difficulty in getting approved for loans or credit cards.

Higher interest rates

If you have bad credit, you’re going to have a hard time getting a loan with favorable terms. That’s because lenders see you as a higher risk and are more likely to charge higher interest rates in order to offset that risk.

Interest is the amount of money that you pay for the privilege of borrowing money, and it’s expressed as a percentage of the total loan amount. The higher your interest rate, the more you’ll end up paying for your loan over time.

Say, for example, that you’re looking at two different loans: one with an interest rate of 10% and another with an interest rate of 20%. If both loans had the same terms (the same length of time to repay, the same monthly payment), the loan with the higher interest rate would end up costing you more money in the long run. That’s why it’s so important to get the best interest rate that you can.

Bad credit can also cause problems when it comes to renting an apartment or getting insurance. That’s because many landlords and insurers use credit scores to help them decide whether or not to approve someone for a lease or policy. If your credit score is low, they may be less likely to approve you, or they may charge you higher rates than someone with good credit.

Difficulty getting approved for loans

It’s harder to get approved for a loan if you have bad credit. Lenders are more likely to view you as a high-risk borrower, which means they’ll be less likely to give you a loan or extend you favorable terms and rates. Even if you are approved for a loan, it will likely come with a higher interest rate, which means you’ll end up paying more money in the long run.

Limited credit options

Because of the way lenders use credit scores to assess risk, having bad credit can make it very difficult to get a loan. Lenders may be unwilling to give you a loan at all, or they may only offer loans with very high interest rates. This can make it difficult or impossible to finance major purchases, such as a car or a house. In addition, bad credit can make it more difficult to get approved for rent or utilities. Landlords and utility companies may require higher deposits or refuse service altogether.