What Is Credco on My Credit Report?

Contents

Here’s what you need to know about Credco, a company that provides consumer credit reporting services.

Checkout this video:

What is Credco?

Credco is a provider of credit information and reports. They are a member of the three nationwide credit reporting companies. Credco also provides data to companies that use credit information to make lending decisions.

Credco is a credit reporting agency

Credco is a credit reporting agency that collects data from creditors and compiles it into credit reports. These reports are then used by landlords, employers, and others to help assess an individual’s creditworthiness.

Credco is one of the three major credit reporting agencies in the United States, along with Experian and TransUnion.

Credco is a subsidiary of Experian

Credco is a subsidiary of Experian, one of the three major credit reporting agencies in the United States. Credco provides two types of services:

1. A consumer credit reporting service that allows individuals to view their own credit reports.

2. A business-to-business service that helps businesses verify the identity and creditworthiness of their customers.

You may see Credco listed on your credit report if you have used their consumer service to pull your own report, or if a business has accessed your report through their business-to-business service. Either way, there is no need to be concerned – Credco is a legitimate company with a good reputation.

How Does Credco Get Its Information?

If you see “Credco” on your credit report, it means that you have been pulled for a soft credit inquiry. Credco is a consumer reporting agency that provides information about you to businesses that request it. Credco does not make decisions about your creditworthiness.

Credco gets its information from lenders and creditors

Credco gets its information from lenders and creditors who report to the credit reporting agency on a regular basis. Lenders and creditors are not required to report to Credco, but many do because it is a valuable tool for them to use when making lending decisions.

Credco also gets information from public records

Credco also gets information from public records. This could include things like bankruptcies, foreclosures, or tax liens. These items will stay on your credit report for seven years (or 10 years for a bankruptcy). Fortunately, Credco only reports information that is 100% accurate and complete. So you don’t have to worry about any errors showing up on your report.

How Does Credco Affect My Credit Score?

Credco is a company that provides information to creditors about your credit history. This information includes your credit score, credit report, and other data. Credco is one of the three major credit reporting agencies in the United States. So, how does Credco affect your credit score? Let’s take a look.

Credco can help you improve your credit score

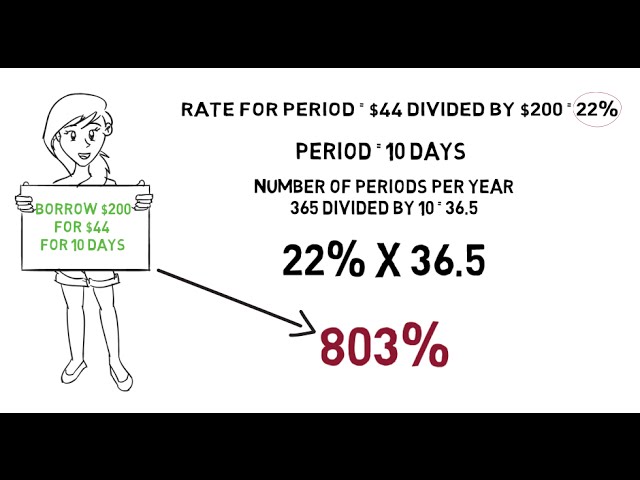

Your credit score is important. It is used by lenders to determine if you are a good candidate for a loan and what interest rate you will be offered. A high credit score means you are a low-risk borrower, which could lead to a lower interest rate on your loan. Conversely, a low credit score could lead to a higher interest rate and could mean you will not be approved for the loan at all.

Credco is a company that provides credit reporting services. They gather information from various sources and compile it into a report that is then sold to lenders and other businesses that use it to make decisions about lending money or extending credit.

One of the things Credco does is compile data about your payment history. This information is then used by the lender to help them determine your creditworthiness. If you have been late on payments or have defaulted on loans in the past, this will be reflected in your Credco report and could lead to a lower credit score.

You can get your Credco report by requesting it from the company or by contacting one of the three major credit reporting agencies (Equifax, Experian, or TransUnion). You are entitled to one free copy of your Credco report every 12 months.

If you find errors on your Credco report, you can dispute them with the company. You should also notify the credit reporting agency so they can update their records.

Credco can also help you monitor your credit report

Credco can help you keep an eye on your credit report and score. If you’re not familiar with Credco, it’s a company that provides credit information and other services to businesses and consumers.

One way that Credco can help you monitor your credit is by providing you with a free copy of your credit report. This report can help you keep track of your credit history and make sure that there are no errors on your report.

In addition to providing you with a free copy of your credit report, Credco can also help you monitor your credit score. Your credit score is a number that lenders use to determine whether or not you’re a good candidate for a loan. A high score means that you’re a low-risk borrower, which means that you’re more likely to get approved for a loan. A low score means that you’re a high-risk borrower, which means that you might not get approved for a loan.

If you have a low credit score, Credco can help you improve your score by providing you with tips and resources. For example, Credco can help you understand what factors influence your credit score and how to improve your payment history.

Credco is a valuable resource for both businesses and consumers. If you’re interested in monitoring your credit, Credco is a great option.

How Do I Get My Credco Report?

Credco is one of the leading providers of consumer credit reporting products and services. You can get your Credco report by requesting it from the company. You will need to provide some personal information, such as your name, address, and Social Security number.

You can get your Credco report by requesting it from Experian

You can get your Credco report by requesting it from Experian. Experian is a credit reporting agency that keeps a record of your credit history. Credco is a company that provides credit reports to lenders, landlords and employers.

To get your Credco report, you will need to provide Experian with your full name, date of birth, Social Security number and current address. You will also need to provide a copy of your government-issued ID. Once you have provided all of the required information, Experian will send you your Credco report.

You can also get your Credco report by subscribing to a credit monitoring service

If you want to get your Credco report, you can either order it directly from the company or subscribe to a credit monitoring service that will include your Credco report as part of its package. Credit monitoring services typically cost around $15-20 per month, but they offer a lot of other benefits in addition to your Credco report. These benefits can include:

· Access to your credit score and credit history

· Alerts when there is activity on your account

· Help with identity theft protection

If you decide to subscribe to a credit monitoring service, make sure to choose one that is reputable and has good reviews. You should also make sure that the service offers a free trial period so that you can cancel if you’re not satisfied.