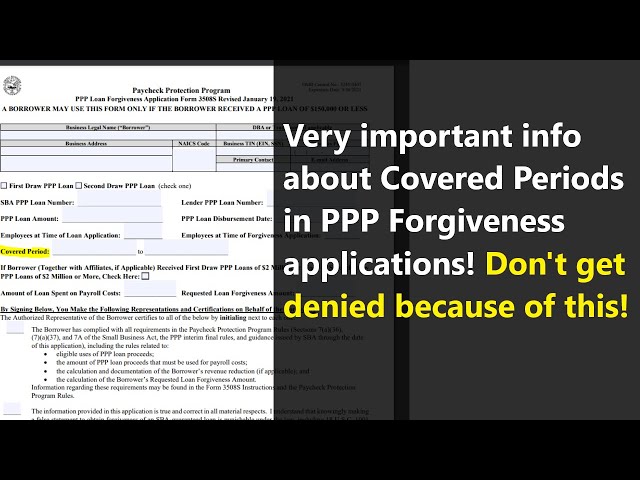

What is the Covered Period for a PPP Loan?

Contents

The Covered Period for a PPP Loan is the time frame during which you can use your loan funds. Get more details on what this means and how it works.

Checkout this video:

Introduction

The covered period for a PPP loan is the period of time during which the borrower may use the loan proceeds. The covered period begins on the date that the loan is disbursed and ends on the earlier of:

-the date that is 24 weeks after the date of disbursement; or

-the date that is December 31, 2020.

What is the covered period for a PPP loan?

The covered period is the time during which you may use your PPP loan. It begins on the date that you receive your loan proceeds, and ends either:

– 24 weeks after that date, or

– December 31, 2020, whichever comes first.

What are some of the changes made to the PPP loan program?

The Payment Protection Program has been modified several times since it was first implemented in March of 2020. The most recent changes were made in late 2020 in response to the continuing COVID-19 pandemic.

One of the most significant changes is the extension of the covered period for PPP loans. Previously, the covered period was eight weeks. This has been extended to 24 weeks or to the date that is either (a) 120 days after receipt of the loan, or (b) December 31, 2020, whichever comes first.

This change gives borrowers more time to use their PPP loan funds and also provides more flexibility in how those funds can be used. For example, borrowers can now use PPP loan funds for payroll costs, rent, mortgage interest, utilities, and operational expenses such as supplier costs and employee protective equipment.

Another change that has been made to the PPP loan program is the addition of a “second draw” option for certain eligible borrowers. Second draw loans are available to businesses with 300 or fewer employees that have previously received a PPP loan and have used up all of those funds. These businesses must also demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

Second draw loans have a maximum amount of $2 million and can be used for the same purposes as first draw loans (payroll costs, rent, mortgage interest, utilities, operational expenses, etc.). Borrowers will also have a choice of either a 24-week covered period or a covered period that ends on December 31, 2020.

What are some of the challenges faced by small businesses during the pandemic?

The CARES Act created the Paycheck Protection Program, or PPP, to provide small businesses with grants to cover payroll and other certain expenses during the pandemic. The PPP is administered by the Small Business Administration (SBA) through participating lenders.

To be eligible for a PPP loan, businesses must have been in operation on February 15, 2020 and have paid salaries and payroll taxes. Businesses can apply for a loan through any SBA-approved lender. Loans will be forgiven if businesses use the funds for approved expenses and maintain their workforce during the covered period, which runs from February 15, 2020 through December 31, 2020.

Some of the challenges faced by small businesses during the pandemic include reduced customer demand, supply chain disruptions, and disrupted operations due to government-mandated shutdowns. Many small businesses have also been struggling to access capital during the pandemic. The PPP loan program is designed to help small businesses weather these challenges and continue paying their employees.

How can small businesses get help during the pandemic?

The CARES Act, passed by Congress and signed into law by President Trump on March 27, 2020, provides small businesses with two loan programs: the Paycheck Protection Program (PPP) and the Economic Injury Disaster Loan (EIDL) program.

The PPP is a loan designed to help small businesses keep their workers on the payroll during the COVID-19 pandemic. The loan can be used to cover payroll and certain other expenses. Loans are available through participating lenders, and the Small Business Administration (SBA) guarantees a portion of the loan.

The covered period for a PPP loan is the 8-week period beginning on the date that the loan is funded. The covered period can be extended by up to 6 weeks if approved by the SBA.

If you have questions about how to apply for a PPP loan or how to use your loan proceeds, please contact your local SBA District Office or visit www.sba.gov/coronavirus.

Conclusion

The covered period for a PPP loan is the time during which you can use the loan proceeds. You can use the loan proceeds for any eligible expenses incurred during the covered period. The covered period begins on the date that you receive the loan proceeds and ends either 24 weeks after that date or December 31, 2020, whichever comes first.