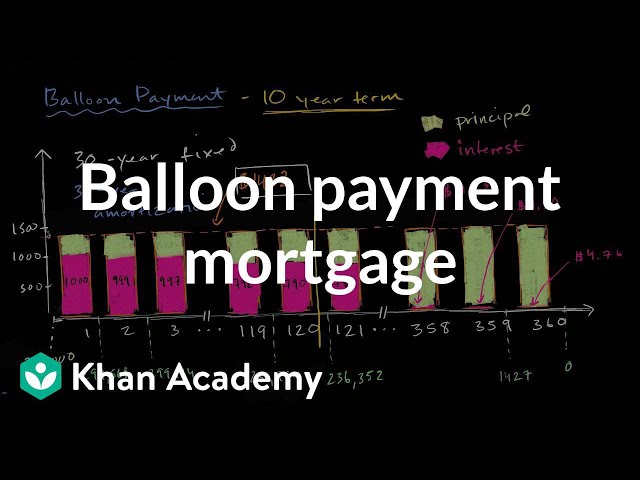

What is a Balloon Loan?

Contents

A balloon loan is a type of loan that does not fully amortize over its term. This means that at the end of the loan’s term, the borrower still owes a balance to the lender.

Checkout this video:

What is a Balloon Loan?

A balloon loan is a type of loan that offers lower monthly payments in the beginning, but requires one large payment for the remainder of the loan at the end. This type of loan can be attractive to borrowers because it offers lower monthly payments in the beginning of the loan term. However, it’s important to understand that you will be responsible for a large payment at the end of the loan term.

Balloon loans are typically used for short-term financing, such as for a new car or home purchase. They are not typically used for long-term financing, such as for a mortgage. If you are considering a balloon loan, be sure to understand all the terms and conditions before signing any paperwork.

How Does a Balloon Loan Work?

A balloon loan is a specific type of mortgage where you make regular payments for a set period of time and then pay off the rest of the loan in one lump sum. This lump sum is usually due at the end of the loan term, hence the name “balloon.”

Pros and Cons of a Balloon Loan

A balloon loan is a type of loan that is typically used for short-term financing. Balloon loans can be either secured or unsecured, and they usually have lower interest rates than other types of loans.

There are some advantages to taking out a balloon loan, including the following:

-Lower interest rates: Because balloon loans are typically for a shorter time period, the interest rates are often lower than those for other types of loans.

-Easier to qualify for: Balloon loans can be easier to qualify for than other types of loans because the amount you borrow is often smaller.

-Flexible repayment terms: Balloon loans often have flexible repayment terms, so you can choose how long you want to take to repay the loan.

However, there are also some disadvantages to taking out a balloon loan, including the following:

-You could end up owing more money than you borrowed: If you don’t repay the loan in full at the end of the term, you will be required to pay off the remaining balance in one lump sum. This could leave you owing more money than you originally borrowed.

-Your payments could increase: If you have a balloon loan with an adjustable interest rate, your payments could increase over time if interest rates go up.

-You may not be able to refinance: If you have a balloon loan and want to refinance it before the end of the term, you may not be able to do so. This is because lenders typically only offer refinancing options for traditional mortgages.

How to Get a Balloon Loan

A balloon loan is a loan that is typically paid off in five years or less, though it can be as long as seven. The payments are usually small and interest-only during the loan term, with a large “balloon” payment at the end. This type of loan allows people to buy a home or make improvements on their home even if they cannot afford the entire loan right away.

If you’re thinking about getting a balloon loan, there are a few things you should know. First, balloon loans are not for everyone. They are best for people who are confident that they will be able to pay off the entire loan within the five-year (or less) term. Second, you will need to have good credit to qualify for a balloon loan. Lenders view balloon loans as higher risks because of the large payment at the end, so they will be looking for borrowers with strong credit histories.

If you think you can handle a balloon loan and you meet the lenders’ qualifications, then it’s time to start shopping around. You can get balloon loans from banks, credit unions, and online lenders. Compare rates and terms from several lenders before choosing one, and make sure you understand all the terms of the loan before signing any paperwork.

Alternatives to a Balloon Loan

If you’re considering a balloon loan, there are a few alternatives that you may want to consider as well.

One option is an adjustable-rate mortgage (ARM). An ARM can give you a lower interest rate for a set period of time, after which your interest rate will adjust up or down, depending on market conditions.

Another option is a conventional fixed-rate mortgage. With a fixed-rate mortgage, your interest rate will stay the same for the life of the loan, so you’ll know exactly how much your monthly payments will be.

A third option is a government-backed loan, such as an FHA loan or a VA loan. These loans may have different terms and conditions than other types of loans, so be sure to do your research before you decide on one.

No matter what type of loan you choose, make sure you understand all the terms and conditions before you sign anything. And, as always, consult with a financial advisor to see which option is best for your individual needs.