What Is an Interest Charge on a Credit Card?

Contents

Interest charges on credit cards can be confusing. Here’s a breakdown of what they are and how they work.

Checkout this video:

What is an interest charge?

An interest charge is a fee that’s charged on a credit card’s outstanding balance. This fee is expressed as a percentage of the balance and is typically charged every month. For example, if your credit card has an annual percentage rate (APR) of 15%, you’ll be charged interest at a rate of 1.25% per month on any outstanding balances.

How is the interest charge calculated?

Interest is charged on credit card balances from the date the transaction is posted until the balance is paid in full. The interest rate charged is generally a variable rate, which means it can change over time.

Interest is calculated by multiplying the daily balance by the daily periodic rate and the number of days in the billing period. The daily periodic rate is equal to the annual percentage rate divided by 365.

For example, if your credit card has an annual percentage rate of 18% and you have a balance of $1,000 at the beginning of a 30-day billing period, your daily periodic rate would be 0.049% (18% ÷ 365 = 0.049%). If you make no additional charges during that billing period, your interest charge for that period would be $1.47 ((1000 x 0.00049) x 30).

What is the average interest rate for a credit card?

Interest is basically the price you pay for borrowing money, whether it’s from a bank, a friend or a credit card company. The interest rate is the percentage of the loan that you pay in addition to the principal, or the amount of money you borrowed.

For example, let’s say you borrow $100 from a friend at an annual interest rate of 10%. This means that you’ll owe your friend $110 at the end of the year — the original $100 plus 10% interest.

When it comes to credit cards, interest is typically charged on any outstanding balances. So if you have a balance of $1,000 and an annual percentage rate (APR) of 15%, your credit card company will charge you $150 in interest over the course of a year.

How can you avoid interest charges?

An interest charge is a fee that is charged on a credit card when you carry a balance from one month to the next. The interest rate is the percentage of the outstanding balance that you will be charged each month. If you have a credit card with a $1000 balance and an interest rate of 18%, you will be charged $180 in interest each month.

What is a grace period?

Your grace period is the time you have to pay your credit card bill in full before interest is applied to your balance. For example, if your grace period is 25 days and you paid your previous month’s balance in full, you won’t be charged interest on purchases made in the current billing cycle until 25 days after your statement closing date.

To avoid being charged interest, always pay your full balance by the due date listed on your monthly statement. You can find your statement’s closing date and due date in the summary box on the first page. If you don’t see a summary box, look for “Important Dates” near the top of your statement.

What is a deferred interest promotion?

With a deferred interest promotion, you can enjoy financing on large purchases without having to pay any interest if you pay off the entire purchase price within the promotional period. Promotional periods usually range from 6 to 18 months, but can be as long as 24 months. If you don’t pay off your entire purchase by the end of the promotional period, you will be charged retroactive interest from the date of purchase—so it’s important to understand how these offers work before taking advantage of them.

To avoid paying deferred interest, do not miss any monthly payments and pay off your entire purchase price before the end of the promotional period. You can find all the details about your deferred interest promotion—including the start date, end date, and minimum monthly payment required—in the “Deferred Interest Promotion” section of your credit card agreement.

How can you take advantage of a grace period?

If you have a grace period on your credit card, that means you have a set amount of time after your billing period ends during which you can pay your balance in full without being charged interest. Grace periods typically last 20 to 25 days, but they can be as short as 14 days or as long as 55 days.

To take advantage of a grace period, you’ll need to make sure you pay your balance in full by the due date each month. If you don’t, you’ll be charged interest on your balance from the date of purchase (or from the previous billing cycle’s ending balance if you carried a balance over).

It’s important to note that not all credit cards offer grace periods. If yours doesn’t, you’ll be charged interest on your purchases from the date of purchase, so it’s always best to pay off your balance in full each month to avoid interest charges.

What are some other ways to avoid interest charges?

Here are a few other methods you can use to avoid interest charges on your credit card:

1. Pay your balance in full each month.

This is the best way to avoid interest charges, as you will only be charged interest if you carry a balance on your card from one month to the next. Try to make it a goal to pay off your balance in full each month, and you’ll never have to worry about being charged interest.

2. Use a 0% APR credit card.

There are some credit cards that offer 0% APR periods, which means you won’t be charged any interest on your balance for a set period of time. This can be helpful if you need to finance a large purchase or consolidate debt, as you can save a lot of money in interest charges by using one of these cards. Just be sure to pay off your balance before the 0% APR period expires, or you’ll start being charged interest again.

3. Get a personal loan.

If you have good credit, you may be able to qualify for a personal loan with a lower interest rate than your credit card APR. You can use the loan to pay off your credit card balance, and then just make payments on the loan instead of your credit card. This can help you save money on interest charges and potentially get out of debt faster.

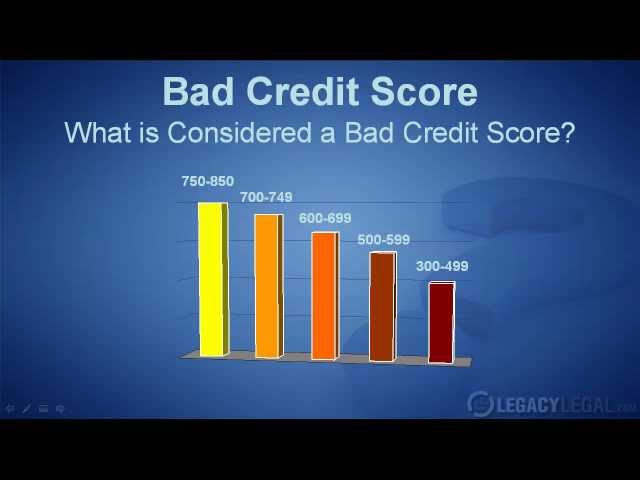

What are the consequences of not paying your interest charges?

If you don’t pay your interest charges, you will be charged a late fee. This late fee will be added to your outstanding balance. If you continue to not pay your interest charges, your credit card company may report this to the credit agencies. This will negatively impact your credit score.

What is a late fee?

If you don’t pay your credit card bill in full each month, you will be charged interest on the unpaid balance. Interest is calculated daily and is added to your account monthly.

If you don’t pay at least the minimum due by the due date on your monthly statement, you’ll be charged a late fee. Most credit card companies charge a fee of up to $35 for a late payment, although some card companies charge less. You may also be charged a higher interest rate on future purchases and cash advances if you make a late payment.

What is a penalty APR?

If you have a penalty APR, it’ll be much higher than your card’s standard APR. That could mean an APR of 30% or even higher. And if you have a balance on your card when the penalty APR goes into effect, interest will be calculated using that higher rate.

The penalty APR is applied to your entire balance, not just new transactions. And once it goes into effect, the penalty APR can last for as long as 6 months or longer. After that, the APR will generally revert to the card’s standard rate.

Penalty APRs are just one more reason to pay your credit card bill on time every month!

What are some other consequences of not paying your interest charges?

Defaulting on your credit card debt has serious consequences.

Your credit score will suffer, you may be hit with late fees, and your issuer could even raise your interest rate. But those aren’t the only impacts of not paying your credit card bill.

Here are some of the other consequences of failing to pay your credit card debt:

1. You could lose your rewards.

If you have a rewards credit card, you may forfeit your points or miles if you default on your debt. That’s because issuers typically reserve the right to take away rewards if you stop making payments.

2. You could be denied for future credit.

Your payment history is one of the most important factors in your credit score, so if you default on your debt, it will damage your score. That, in turn, could make it harder for you to get approved for new lines of credit in the future.

3. Your interest rates could go up.

If you default on your debt, your issuer could raise your interest rates, making it even harder to get out of debt. And if you’re already struggling to make ends meet, that could push you further into financial distress.