What is an ACH Credit?

Contents

ACH credits are a type of electronic funds transfer. They are commonly used to facilitate regular payments, such as payroll or utility bills.

Checkout this video:

What is an ACH Credit?

An ACH Credit is a type of electronic payment. ACH stands for Automated Clearing House. With an ACH Credit, funds are transferred from one bank account to another. This type of payment is often used for recurring payments, such as utility bills or gym memberships.

What is an ACH?

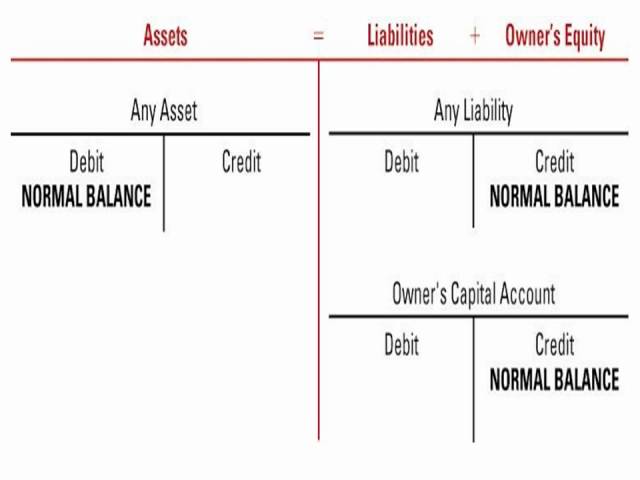

An Automated Clearing House (ACH) is an electronic network for financial transactions in the United States. ACH processes large volumes of credit and debit transactions in batches. ACH credit transfers include direct deposit payroll and vendor payments. ACHRDCredit transfers also include consumer payments for mortgages, loans, insurance premiums, utility bills, and charitable donations.

What is an ACH Credit?

An ACH credit is an electronic funds transfer from one financial institution to another that uses the Automated Clearing House Network. ACH credits are commonly used for payroll direct deposit, vendor payments, and tax refunds.

ACH credits are processed differently than ACH debits. When you initiate an ACH debit transaction, the funds are transferred from the payee’s account to your account on the same day. With an ACH credit, the funds are transferred from your account to the payee’s account on the next business day.

While ACH credits are generally considered safe and secure, there is always a risk of fraud when sending or receiving payments electronically. To help protect your account from unauthorized transactions, be sure to carefully verify the payee information before initiating any ACH credit transaction.

How does an ACH Credit work?

An ACH Credit is a bank-to-bank transfer of funds that is initiated by the payer. The payer’s bank originates an ACH Credit transaction, which is then transmitted through the ACH network to the payee’s account.

The ACH network is a nationwide system that facilitates the clearing and settlement of electronic transactions between financial institutions. When an ACH Credit is processed, the funds are transferred from the payer’s account to the payee’s account on the next business day.

The Benefits of an ACH Credit

An ACH credit is a type of electronic funds transfer that allows you to send money from one account to another. ACH credits are typically used to pay bills or to send money to friends and family. They are safe and secure, and they can be done from the comfort of your own home. Let’s take a closer look at the benefits of an ACH credit.

Faster Payments

ACH credits are payments that are electronically deposited into your account. These credits can come from a variety of sources, including your employer, the government, or other organizations.

The main benefit of an ACH credit is that it is a faster way to receive payments than traditional methods, like paper checks. In most cases, you can expect to see the funds in your account within one to two business days. This speed can be beneficial if you are waiting on a critical payment, like rent or a mortgage.

Another advantage of ACH credits is that they can help you avoid fees associated with paper checks, such as check-cashing fees or late payment penalties. In addition, ACH credits are typically less expensive for businesses to process than paper checks.

If you are receiving repetitive payments by ACH credit, you may also have the option to set up automatic payments. This feature can save you time and energy by eliminating the need to manually initiate each payment yourself.

Increased Efficiency

There are many benefits of an ACH credit, but one of the most important is increased efficiency. ACH credits are processed electronically, which means that they can be cleared and settled much faster than traditional paper checks. This can save your business time and money by reducing the need for manual processing and accounting.

Reduced Costs

An ACH credit provides a number of benefits for businesses, including reduced costs.

An ACH credit is an electronic payment method used to make payments to businesses and individuals. ACH credits are processed through the federal ACH network, which is a network of banks and financial institutions that have agreed to process ACH transactions.

ACH credits are typically cheaper for businesses than other methods of payment, such as credit cards or wire transfers. This is because businesses can avoid paying merchant fees, which are typically around 2-3% of the total transaction amount. In addition, businesses can avoid paying any other fees associated with other methods of payment, such as transaction fees for credit card payments.

How to set up an ACH Credit

An ACH Credit is a funds transfer from one bank account to another. The ACH Credit Transfer system is used for a wide variety of payments, including direct deposit of payroll, Social Security and pension payments. ACH Credit Transfers are also used to pay bills, such as utilities, credit cards and mortgage payments. To set up an ACH Credit Transfer, you will need the routing number and account number for the receiving bank account.

Set up with your bank or credit union

setting up an automatic payment from your bank account, you’ll need to provide your bank or credit union with the following information:

-The name of the company you want to pay

-The company’s address

-The company’s 9-digit routing number

-Your account number with the company

You may also need to provide a voided check or deposit slip so the company can verify your account number and routing number.

Set up with a third-party provider

There are a few different ways to set up an ACH Credit, but the most common is to use a third-party provider. There are many providers out there that can help you set up an ACH Credit, so it’s important to shop around and find one that best suits your needs. Once you’ve found a provider, you’ll need to provide them with some basic information about your business, including your bank account number and routing number. You may also be asked to provide a voided check or bank statement.Once you’ve provided the necessary information, the provider will set up the ACH Credit and deposit the funds into your account.

FAQs

ACH stands for Automated Clearing House. ACH Credit is an electronic funds transfer from one bank account to another. This type of transaction is initiated by the payer and authorized by the payee. ACH Credit transactions are commonly used to make single or recurring payments, such as mortgage or utility payments.

What are the fees associated with an ACH Credit?

ACH Credits are generally free or have a nominal fee associated with them. The fees associated with an ACH Credit will depend on the financial institution through which you are sending the ACH Credit. To find out what fees may apply, please contact your financial institution directly.

How long does it take for an ACH Credit to process?

Once an ACH Credit is processed, the funds are typically available in 1-2 business days.

What are the risks associated with an ACH Credit?

There are a few risks associated with ACH Credits that consumers should be aware of before using this service. One risk is that if a consumer owes money to a company or organization that initiated the ACH Credit, the funds may be taken back from the consumer’s account without their consent or knowledge. Additionally, if an ACH Credit is returned for any reason, the consumer may be responsible for any fees associated with the return. Finally, there is always a risk of fraud when giving out personal and financial information online; however, this risk can be minimized by only providing information to trusted sources.