What is a Uniform Residential Loan Application?

Contents

If you’re in the process of buying a home, you may have come across the Uniform Residential Loan Application (or “URLA”). This document is required by most lenders in order to assess your eligibility for a home loan. In this article, we’ll explain what a URLA is and what information you’ll need to provide in order to fill one out.

Checkout this video:

Introduction

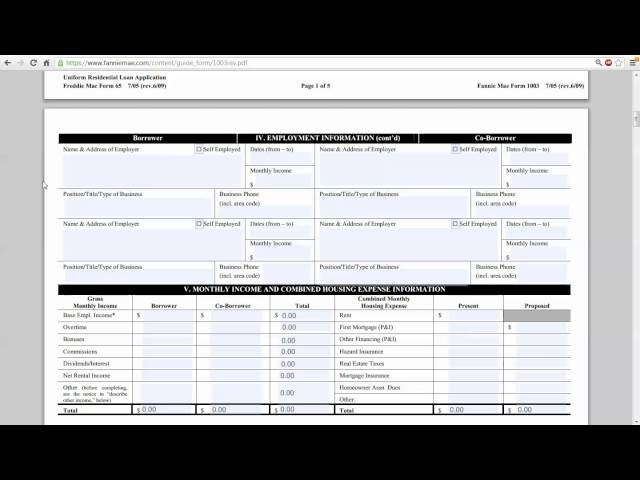

A Uniform Residential Loan Application, also known as a 1003 loan application or a standard loan application, is a standardized mortgage loan application form that provides lenders with information about a borrower’s requested loan. The form must be completed by the borrower and co-borrower (if applicable) and submitted to the lender for approval.

The form includes basic information about the borrower and co-borrower (if applicable), including name, address, date of birth, social security number, and employment information. It also asks for information about the property being purchased, such as the address, purchase price, and estimated value of the property. The form must be signed by both the borrower and co-borrower (if applicable) in order to be valid.

The Uniform Residential Loan Application is just one part of the mortgage process. Other steps in the process include obtaining a credit report, choosing a loan type, and selecting a lender. Once you have completed the Uniform Residential Loan Application and submitted it to your chosen lender, they will review your information and make a decision on whether or not to approve your loan.

What is a Uniform Residential Loan Application?

A Uniform Residential Loan Application is a standardized mortgage loan application form that provides lenders with the necessary information to process a loan. The form is used for both purchase and refinance transactions.

The Basics of a Uniform Residential Loan Application

A Uniform Residential Loan Application is a document that is used by lenders to collect information about a borrower who is applying for a mortgage loan. The application collects information about the borrower’s employment, income, debts, and other financial information.

The Uniform Residential Loan Application is also known as Form 1003 or Form 65. It is a standard form that is used by most lenders in the United States.

The purpose of the Uniform Residential Loan Application is to help lenders evaluate a borrower’s creditworthiness and to determine whether or not they are qualified for a loan. The application also helps lenders determine the terms of the loan, such as the interest rate and monthly payment amount.

The Uniform Residential Loan Application is just one part of the mortgage process. Borrowers will also need to provide documentation to support the information that they have provided on the application. This documentation can include pay stubs, tax returns, and bank statements.

The Benefits of a Uniform Residential Loan Application

There are many benefits to using a Uniform Residential Loan Application (or URLA). A URLA allows potential borrowers to provide lenders with standard information about their financial situation and helps to streamline the mortgage application process.

Some of the benefits of using a URLA include:

– standardized documentation which can help to reduce processing time and errors;

– the ability to compare loans across different lenders more easily; and

– greater transparency for borrowers in terms of the information that they are required to provide.

Overall, using a URLA can help to make the mortgage application process smoother and more efficient for both borrowers and lenders.

How to Use a Uniform Residential Loan Application

A Uniform Residential Loan Application is a standard loan application that is used by most lenders to obtain information about a borrower. The application is used to collect information about the borrower’s employment, income, assets, and debts. The application can also be used to collect information about the property that is being purchased.

Applying for a Mortgage

A Uniform Residential Loan Application is the standard form used by borrowers to apply for a mortgage. The form is uniform across lenders, so borrowers only need to fill it out once when applying for multiple loans. The form includes basic information about the borrower, their employment history, income, debts, and other financial details.

Lenders will use the information on the form to determine whether the borrower is eligible for a loan and, if so, how much they can afford to borrow. Borrowers should take care to accurately and truthfully fill out the form, as any misrepresentations could lead to problems later on.

The Uniform Residential Loan Application can be found online or through a lender. Borrowers can also get help from a housing counselor or real estate agent when completing the form.

Applying for a Refinance

A refinance occurs when you replace the current loan on your home with a new loan, and you can use a Uniform Residential Loan Application (URLA) when applying for a refinance with any lender.The URLA is also known as Form 1003 or Form 65, and you can find it on the website of the Federal Housing Finance Agency, which is the government-sponsored entity that developed this form for lenders. You’ll need to provide some personal information on the form, as well as information about your current mortgage loan and your financial history.

Applying for a Home Equity Loan

Most home equity lenders require a borrowers to submit a uniform residential loan application. Lenders use this application to get detailed information about the borrower’s finances and housing situation. This information helps the lender determine whether the borrower is a good candidate for a home equity loan.

To complete a uniform residential loan application, borrowers must provide detailed information about their employment history, income, debts, and housing situation. Borrowers must also disclose whether they have filed for bankruptcy in the past seven years. Lenders use this information to determine whether the borrower is likely to default on the loan.

Some home equity lenders may require additional information from borrowers who are self-employed or who have nontraditional sources of income. Lenders may also require borrowers to submit copies of their tax returns or other financial documents.

Conclusion

In conclusion, the Uniform Residential Loan Application is a document that is used by potential homebuyers to provide information about themselves and their finances to lenders. This information is used by lenders to determine whether or not the borrower is a good candidate for a loan. The application is also used to determine the terms of the loan, such as the interest rate and the length of the loan.