What is a Non Conforming Loan?

Contents

A non-conforming loan is a loan that doesn’t meet the guidelines that are set by government-sponsored enterprises (GSEs) such as Fannie Mae and Freddie Mac.

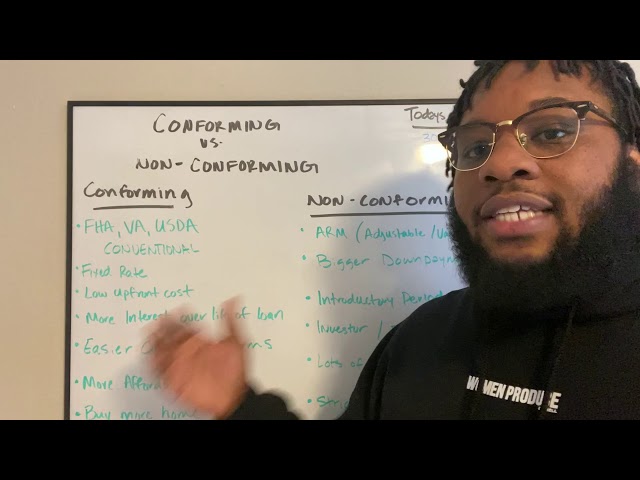

Checkout this video:

What is a Non Conforming Loan?

A non-conforming loan is a loan that does not meet the guidelines of a conventional loan. These types of loans are also sometimes referred to as jumbo loans or portfolio loans. Conventional loans are issued by lenders who are backed by government-sponsored enterprises such as Fannie Mae and Freddie Mac. These types of loans follow stricter guidelines, including criteria related to borrower credit history, employment history, and maximum loan amount. Non-conforming loans do not meet these guidelines and are not backed by government-sponsored enterprises. As a result, these types of loans usually carry higher interest rates and may be more difficult to qualify for.

Who is a Non Conforming Loan For?

A non conforming loan is a mortgage loan that does not meet the guidelines set by the Federal National Mortgage Association (Fannie Mae) or the Federal Home Loan Mortgage Corporation (Freddie Mac).

Lenders who make these loans must follow different guidelines set by Fannie Mae and Freddie Mac, as well as the federal government, than they would for a conforming loan. Non conforming loans are also sometimes called jumbo loans or portfolio loans.

The most well-known non conforming loan is the jumbo loan. Jumbo loans are mortgages that are higher than the conforming limit set by Fannie Mae and Freddie Mac. A jumbo loan may be necessary if you’ve got your eye on something in a higher price range.

If you’re buying a home in a high-cost market, like San Francisco or New York City, a jumbo mortgage may be right for you. Jumbo mortgages usually require a higher credit score and a larger down payment than conforming loans, but if you can qualify for one, you can generally expect to pay lower interest rates than with a non-conforming loan of the same size.

What are the Benefits of a Non Conforming Loan?

A non conforming loan is a mortgage loan that does not conform to the guidelines set by the Federal National Mortgage Association (Fannie Mae) or the Federal Home Loan Mortgage Corporation (Freddie Mac). Loans that don’t conform to these guidelines are sometimes called “jumbo” loans.

The main benefit of a non conforming loan is that you can borrow an amount that exceeds the limit set by Fannie Mae and Freddie Mac. This means you can finance a larger home, a luxury home, or an investment property. Non conforming loans also generally have lower interest rates than conforming loans, so they can be cheaper to borrow.

What are the Disadvantages of a Non Conforming Loan?

The disadvantages of a non conforming loan are that they typically come with a higher interest rate, may require a larger down payment, and the underlying reasons for the loan not conforming to standard guidelines may not meet with underwriting approval. In some cases, borrowers who are self-employed or have other “unconventional” incomes may not qualify for a non conforming loan.