What is a Loan?

Contents

A loan is a form of debt that individuals and businesses can use to finance various expenses. Loans are typically provided by banks, credit unions, and other financial institutions, and they can be either secured or unsecured. Borrowers typically have to pay interest on the loan, as well as any fees that may be charged by the lender.

Checkout this video:

Introduction

A loan is a type of debt that is meant to be repaid over a fixed period of time, usually with interest. There are many different types of loans, but they all work in basically the same way: You borrow money from a lender and agree to pay it back, plus interest, over a certain period of time.

What is a Loan?

A loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations etc. The recipient incurs a debt and is usually liable to pay interest on the sum of money borrowed, as well as to repay the principal amount borrowed.

The Different Types of Loans

There are many different types of loans available to consumers, each with its own set of terms, conditions, and repayment options. It’s important to understand the differences between the various types of loans before you borrow money.

The most common types of loans are:

-Mortgage Loans: A mortgage loan is a loan used to purchase a home. The home serves as collateral for the loan, which means that if you default on the loan, the lender can foreclose on your home. Mortgage loans are typically repaid over a period of 15 to 30 years.

-Auto Loans: An auto loan is a loan used to purchase a vehicle. The vehicle serves as collateral for the loan, which means that if you default on the loan, the lender can repossess your vehicle. Auto loans are typically repaid over a period of 2 to 5 years.

-Personal Loans: A personal loan is an unsecured loan that can be used for any purpose. Personal loans are typically repaid in monthly installments over a period of 2 to 5 years.

How do Loans Work?

A loan is a sum of money that is lent to you by a financial institution with the agreement that you will repay the debt over a set period of time. The loan may be for a specific, one-time amount or for ongoing, periodic payments. The terms of the loan will be stated in a contract called a promissory note.

How do Loans Work?

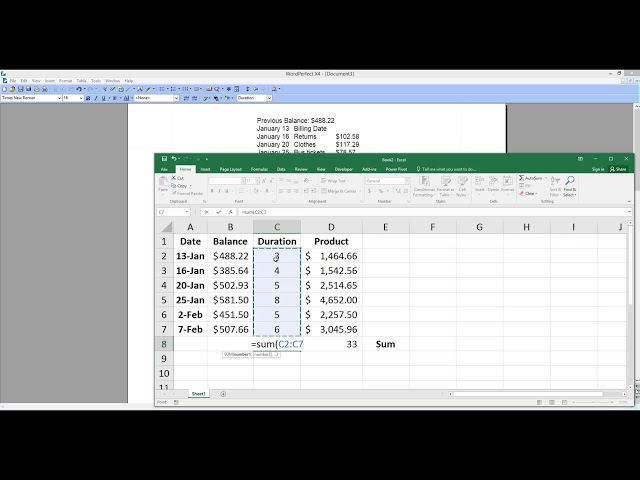

The institution lending the money is called the creditor and you are the debtor. The creditor will typically require some form of collateral, which may be an asset such as your home or car that can be seized if you default on the loan. The interest rate charged by the creditor will be stated in the promissory note and may be fixed or variable.

The monthly payments on most loans are calculated using what is called an amortization schedule. This schedule determines how much of each payment goes toward paying off the interest on the loan and how much goes toward paying off the principal, or borrowed amount.

Applying for a Loan

Before you begin the process of applying for a loan, it’s important that you understand what a loan is and what it entails. A loan is a sum of money that is borrowed from a financial institution and is to be repaid over a set period of time, usually with interest. There are many different types of loans available, so it’s important that you choose the one that best suits your needs. The process of applying for a loan can vary depending on the type of loan you’re applying for, but there are some general steps that you can follow.

The Loan Application Process

The loan application process can be a complex and time-consuming one, so it’s important to be prepared. Here’s a general overview of what you can expect:

1. Gather your financial documents. Before you begin the application process, you’ll need to have all your financial documentation in order. This includes tax returns, pay stubs, bank statements, and more.

2. Choose a lender. Once you have your documents together, you’ll need to choose a lender. There are many different types of lenders out there, so do your research to find the best one for your needs.

3. Fill out the application. The next step is to fill out the loan application. This will include personal information such as your name, address, and Social Security number. You’ll also need to provide financial information such as your income and assets.

4. Submit the application. Once you’ve completed the application, you’ll need to submit it to the lender for approval.

5. Wait for approval. The lender will then review your application and make a decision on whether or not to approve the loan. If approved, you’ll receive the funds in a lump sum or in installments, depending on the terms of the loan agreement.

What do Lenders Look for When Approving a Loan?

When you apply for a loan, the lender will look at a variety of factors to determine if you are a good candidate for a loan and how much they are willing to lend you. Some of the key factors that lenders look at include your:

-Income

-Employment history

-Credit history

-Assets

-Debts

-Collateral

Conclusion

In conclusion, a loan is a debt that one party owes to another. It is typically repaid over time, with interest. Loans can be used for a variety of purposes, including personal expenses, business start-ups, or to purchase large assets such as a home or a car. There are many different types of loans available, and the terms of each loan will vary depending on the lender and the borrower. It is important to carefully consider all of the terms of a loan before agreeing to it.