What is a Loan Payoff?

Contents

A loan payoff is the full amount of money required to pay off an outstanding loan . The loan payoff amount includes the principal balance and any outstanding interest and fees.

Checkout this video:

Introduction

A loan payoff is when you “pay off” your loan by making a final payment that covers the entire remaining balance of the loan. This final payment is typically higher than your regular monthly payments, and it is usually made in one lump sum.

Paying off your loan may seem like a daunting task, but it can be a very rewarding experience. Not only will you save money on interest charges, but you will also become debt-free! There are a few things to keep in mind when preparing for your loan payoff, such as making sure you have enough money saved up and knowing exactly when your final payment is due.

If you are ready to pay off your loan, follow these simple steps:

1) Make sure you have enough money saved up: You will need to have enough money saved up in order to make your final payment. Depending on the size of your loan, this could be a few thousand dollars or more. It is important to make sure you have this money saved up so that you do not have to take out another loan to cover the cost of the payoff.

2) Know when your final payment is due: Your lender will provide you with information on when your final payment is due. This date is typically about two weeks after your last regular monthly payment. Make sure you mark this date down in your calendar so that you do not forget!

3) Make your final payment: On the date that your final payment is due, simply write a check or arrange for an electronic transfer for the full amount of the remaining balance on your loan. Be sure to include any required fees or other charges that may be associated with the payoff. Once this payment has been made, your loan will be officially paid off!

What is a Loan Payoff?

A loan payoff is the full amount of money required to pay off a loan. This can be calculated in a number of ways, but most often it is simply the remaining balance on the loan multiplied by the number of payments left to be made. In some cases, a lenders may require a higher payoff amount if the borrower has missed any payments or if the property securing the loan has decreased in value.

How to Pay Off a Loan

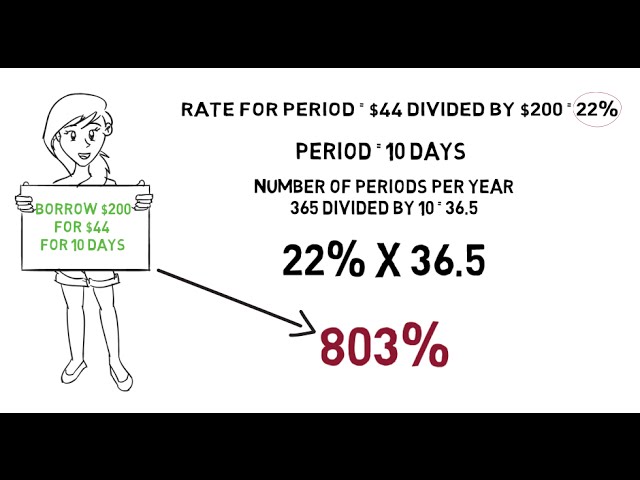

Paying off a loan can be a daunting task, but there are some simple strategies you can use to make it more manageable. First, it’s important to understand how loans work. A loan is a sum of money that is borrowed and needs to be repaid over time, usually with interest.

There are two main types of loans: secured and unsecured. A secured loan is one that is backed by an asset, such as a home or car. An unsecured loan is not backed by an asset and is therefore more risky for the lender.

The first step in paying off a loan is to understand the terms of the loan agreement. This includes the interest rate, repayment schedule, and any fees or charges that may be associated with the loan. It’s important to know these terms so you can budget accordingly and make payments on time.

Once you know the terms of the loan, you can develop a repayment strategy. If you have a fixed interest rate, you may want to make extra payments each month to pay off the loan sooner. You can also make bi-weekly payments instead of monthly payments, which can save you money on interest charges.

If you have a variable interest rate, you may want to consider making only the minimum payment each month. This will help keep your monthly payment lower if interest rates go up. However, if interest rates go down, you may want to make extra payments so you can pay off the loan faster.

Another important factor to consider when repaying a loan is your personal cash flow situation. If you have extra money each month, you can apply it towards your loan balance to help speed up repayment. However, if money is tight, it’s important to stick with your regular repayment schedule so you don’t get behind on payments and incur late fees or other penalties.

Paying off a loan takes time and effort, but it’s doable with some careful planning and budgeting. By understanding the terms of your loan and developing a repayment strategy that fits your budget, you can successfully pay off your debt and get on with your life!

The Benefits of Paying Off a Loan

Paying off a loan can provide many benefits for borrowers. Perhaps the most obvious benefit is that it can save you money on interest payments. Once you pay off your loan, you will no longer be required to make interest payments, which can free up extra money in your budget each month.

In addition, paying off a loan can help improve your credit score. Borrowers who consistently make on-time payments and eventually pay off their loan in full show potential lenders that they are responsible and can be trusted to repay their debts. As a result, these borrowers may qualify for better interest rates and terms on future loans.

Finally, paying off a loan may also give you a sense of financial freedom and peace of mind. Once you are no longer required to make monthly loan payments, you may have more disposable income each month to save or spend as you please. Additionally, knowing that you are no longer tethered to a monthly debt payment can provide a great sense of relief.

The Disadvantages of Paying Off a Loan

The disadvantages of paying off a loan are mostly financial. When you pay off a loan, you no longer have that money to invest. You also may no longer be able to deduct the interest you were paying on your taxes.

Should You Pay Off Your Loan Early?

If you have extra money and want to save on interest, you may be considering paying off your loan early. But is it the right decision for you?

There are a few things to consider before you make a decision. First, check if there are any penalties for paying off your loan early. Some lenders charge a fee for this, so it’s important to know what you’re getting into.

Next, think about how much extra money you have each month. If you can easily afford the additional payment, then paying off your loan early may be a good idea. But if it would strain your budget, you may want to wait and put the extra money into savings or investments.

Finally, consider the interest rate on your loan. If it’s a low rate, you may not save much by paying off the loan early. In this case, it may be better to keep the money in savings or invest it so you can earn more interest.

If you have considered all of these factors and decide that paying off your loan early is right for you, there are a few different ways to do it. You can make additional payments each month, or make a lump-sum payment if you have the funds available. Be sure to let your lender know that the extra payment is for principal only so they apply it correctly.

How to Pay Off Your Loan Early

Most loans, including mortgage and auto loans, are amortizing loans. That means each monthly payment you make includes both interest and principal. The amount of interest you pay goes down as you pay off more of the principal, and the amount of principal you pay goes up. By making additional payments toward the principal, you can pay off your loan early.

There are several ways to do this:

You can make an additional payment each month.

You can make a lump-sum payment at any time.

You can refinance your loan and choose a shorter loan term.

Making additional payments each month is the most systematic way to pay off your loan early, but it’s not always possible for everyone. If you get a bonus at work or come into some extra money, making a lump-sum payment can really speed up the process. And if interest rates have dropped since you originally took out your loan, refinancing could be a good option to consider as well.

The Bottom Line

A loan payoff is when you pay the entire balance of your loan, including any interest and fees that may be due. Paying off your loan in full will close out your account and you will no longer owe any money to your lender.

Paying off your loan may seem like a daunting task, but it can be very rewarding to be debt-free. There are a few different ways to go about paying off your loan, and the best method for you will depend on your financial situation. You can use extra money from your paycheck, tax refund, or bonus to make a lump-sum payment towards your loan balance. You can also increase your monthly payment amount or make additional payments throughout the year.

Whatever method you choose, be sure to stay on top of your payments and make them on time. Once you’ve paid off your loan, you’ll feel a sense of relief and accomplishment!