What is a Loan Out?

Contents

A loan out is a type of business arrangement in which an individual lends their name and likeness to a company in exchange for compensation.

Checkout this video:

What is a Loan Out?

A loan out is a company set up by an individual to pay personal expenses with pre-tax dollars. This type of arrangement is commonly used by sole proprietors and LLCs. The money saved on taxes can be significant, but there are some drawbacks to consider before setting up a loan out.

One downside is that the IRS may challenge the legality of a loan out if it feels that the company is not being used for legitimate business purposes. Another potential issue is that the company may be liable for payroll taxes if it has employees. Finally, there can be administrative costs associated with setting up and maintaining a loan out.

Before making the decision to set up a loan out, be sure to speak with an accountant or tax attorney to determine if this strategy is right for you.

The Pros and Cons of Loan Outs

A loan out is a financial arrangement in which one party loans money to another party and the borrower agrees to repay the loan in full with interest. The loan may be for a specific purpose, such as purchasing a car or home, or it may be for general purposes. A loan out can be an attractive option for borrowers who need money but do not have the resources to obtain a traditional bank loan. There are some risks associated with loan outs, however, and borrowers should carefully consider the pros and cons of this type of financing before entering into a loan agreement.

One of the major advantages of a loan out is that it can provide borrowers with access to cash when they need it. Loan outs are often used by individuals who have poor credit histories and would not be able to qualify for a bank loan. Additionally, because lenders are typically willing to work with borrowers on repayment terms, a loan out can provide flexible repayment options that work with the borrower’s budget.

There are some significant disadvantages to consider when taking out a loan, however. One of the biggest dangers associated with loan outs is that they can become very expensive if the borrower is unable to repay the debt in full and on time. Additionally, because lenders do not typically require collateral for these types of loans, there is a greater risk of default. This means that if the borrower does not repay the debt, the lender has little recourse except to take legal action against the borrower. For these reasons, it is important that borrowers carefully consider their ability to repay a loan before entering into an agreement.

How to Set Up a Loan Out

A loan out is a type of business arrangement in which an individual contracts with a company to provide services on a loaned-out basis. Typically, the individual is an employee of the company that they are contracted to, but they may also be an independent contractor. The individual provides their services to the company on a loaned-out basis, and the company reimburses the individual for their time and expenses.

The primary benefit of this arrangement is that it allows the individual to avoid paying self-employment taxes on their income. Additionally, it may allow the individual to deduct their business expenses from their income taxes.

If you are thinking about setting up a loan out, there are several things that you will need to do in order to ensure that your arrangement is legal and compliant with all applicable laws. First, you will need to draft a contract between yourself and the company that you will be providing services to. This contract should clearly outline the terms of your agreement, including your compensation and any benefits that you will receive.

Next, you will need to set up a business entity for your loan out. This can be done by forming a limited liability company (LLC) or another type of business entity. This will protect you from liability if something goes wrong while you are providing services on a loaned-out basis.

Finally, you will need to obtain all of the necessary licenses and permits for your business. Depending on the type of services that you will be providing, you may need to obtain a license from your state or local government. Additionally, if you plan on operating your business from home, you may need to obtain a permit from your municipality.

Once you have completed all of these steps, you will be ready to start providing services on a loaned-out basis. Be sure to keep meticulous records of all income and expenses related to your loan out so that you can comply with tax laws come tax time.

How to Manage a Loan Out

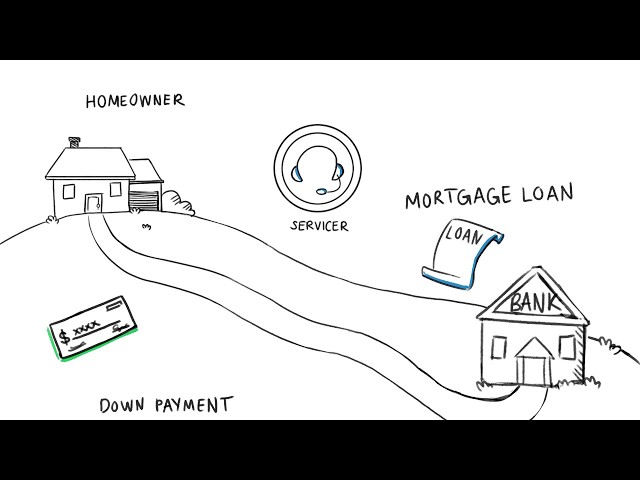

A loan out is when you take out a loan with the intention of using the money to buy a property. The most common type of loan out is a mortgage.

When you have a mortgage, the lender will give you the money to buy the property and you will make monthly payments to them until the loan is paid off. A mortgage is a good option if you have good credit and can afford the monthly payments.

Another type of loan out is a home equity loan. With this type of loan, you borrow against the value of your home. Home equity loans can be used for any purpose, such as remodeling your home or consolidating debt.

Loan outs can be a great way to finance a property purchase, but it’s important to make sure that you can afford the monthly payments before taking one out.