What Is a Hardship Loan?

Contents

If you’re struggling to make ends meet, you may be wondering if a hardship loan is right for you. Keep reading to learn what a hardship loan is and how it can help you get back on your feet.

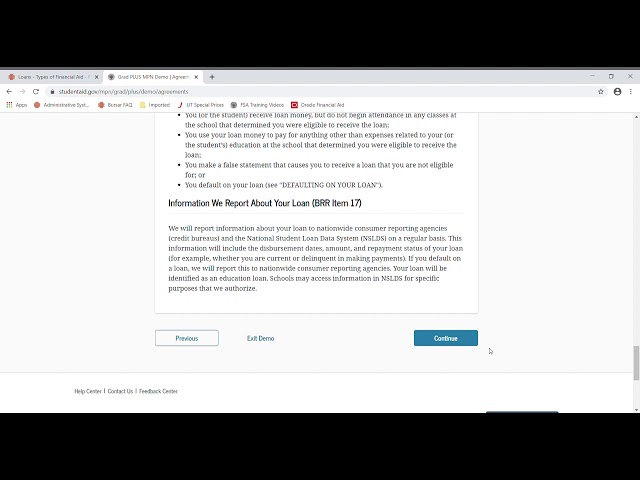

Checkout this video:

What is a hardship loan?

A hardship loan is a type of loan that is designed to help people who are experiencing financial difficulty. Hardship loans can be used for a variety of purposes, including paying for medical expenses, buying food or paying rent.

Hardship loans are usually available from banks and other financial institutions. However, there are also some nonprofit organizations that offer hardship loans to people in need.

Hardship loans typically have high interest rates and fees. They also often have strict repayment terms. For these reasons, it is important to only take out a hardship loan if you absolutely need one and if you are confident that you will be able to repay the loan on time.

How can a hardship loan help you?

If you’re experiencing a financial hardship, you may be considering a hardship loan. But what is a hardship loan?

A hardship loan is a type of loan that is designed to help borrowers who are facing financial difficulties. Hardship loans can be used for a variety of purposes, including but not limited to, medical expenses, funeral costs, and moving expenses.

Hardship loans are typically unsecured loans, which means they are not backed by collateral. As such, they typically come with higher interest rates than secured loans. Hardship loans also tend to have stricter eligibility requirements than other types of loans.

If you’re considering a hardship loan, it’s important to understand the terms and conditions of the loan before you apply. Be sure to shop around and compare offers from various lenders to ensure you get the best deal possible.

What are the benefits of a hardship loan?

A hardship loan can offer several benefits to borrowers who are struggling to make ends meet. These loans can provide a much-needed financial lifeline to help people get back on their feet. Some of the benefits of a hardship loan include:

-The ability to catch up on past-due bills and expenses: A hardship loan can give you the funds you need to catch up on past-due bills and expenses. This can help you avoid late fees, collection calls, and damage to your credit score.

-The chance to consolidate debt: If you have multiple debts, a hardship loan can help you consolidate those debts into one monthly payment. This can make it easier to manage your finances and pay off your debt in a timely manner.

-Lower interest rates: Hardship loans often have lower interest rates than other types of loans, such as credit cards or personal loans. This can save you money over the life of the loan and help you get out of debt more quickly.

-Flexible repayment terms: Hardship loans typically have more flexible repayment terms than other types of loans. This can give you some breathing room as you work to get back on your feet financially.

How to get a hardship loan?

If you are suffering from financial hardship and need a loan, there are a few things you can do to improve your chances of getting approved. The most important thing you can do is to show the lender that you have a plan for how you will repay the loan. You may also need to provide evidence of your financial hardship, such as proof of income or bills.

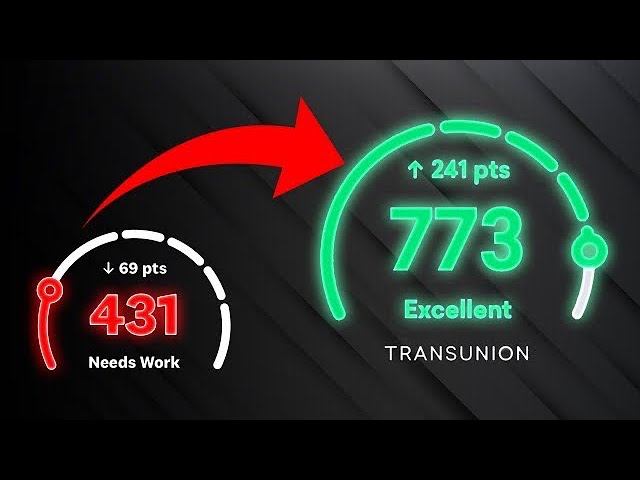

Another important factor in getting approved for a hardship loan is your credit score. Lenders will often take this into account when considering your application. If you have a good credit score, it will improve your chances of getting approved. Finally, remember that lenders are more likely to approve loans for people who have collateral, such as a house or car. If you can offer collateral, it will increase your chances of getting approved for a hardship loan.