What Is a Good Length of Credit?

Contents

If you’re wondering how long your credit history should be in order to qualify for a loan or credit card, the answer is that it depends. Find out more here.

Checkout this video:

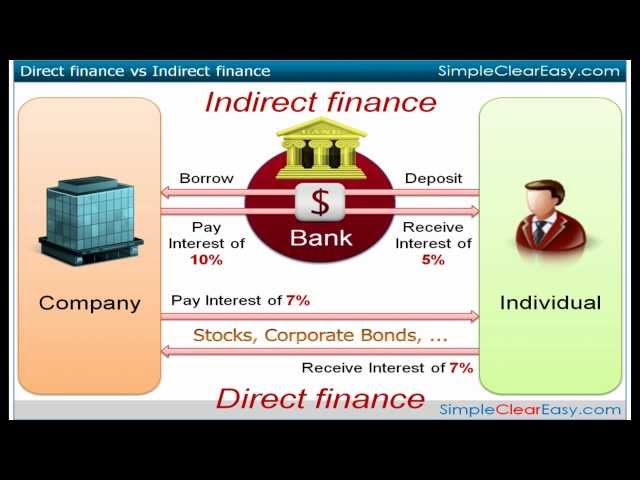

The Various Types of Credit

Credit is a financial tool that can be used in a number of ways. There are different types of credit, each with its own benefits and drawbacks. The length of credit is one factor that determines the type of credit you can use. In this article, we’ll explore the different types of credit and the lengths that are associated with each.

Installment Loans

An installment loan is a type of loan that is repaid in periodic payments, typically monthly payments, over a period of time. The term of the loan can vary from a few months to several years. Installment loans are often used to finance the purchase of big-ticket items such as cars or home improvements.

There are two main types of installment loans—secured and unsecured. A secured installment loan is one that is backed by collateral, such as a car or home. An unsecured installment loan does not require collateral.

Installment loans can be helpful when you need to borrow money to make a major purchase, but they may not be the best option if you are struggling to make ends meet each month. If you are behind on your bills and need help getting caught up, you may want to consider a different type of loan, such as a personal loan or a debt consolidation loan.

Revolving Loans

A revolving loan is a type of loan that allows you to borrow money up to a certain limit. you can then use that money and can continue to borrow against the limit as long as you make payments on the loan. The most common revolving loans are credit cards, although lines of credit and some other types of loans may also be considered revolving loans.

The Different Credit Lengths

Credit length is the amount of time you have to repay a loan. The credit bureaus consider credit length when they’re calculating your credit score. A longer credit history with no late payments will help boost your score. So, what is a good length of credit?

Short-Term Loans

Short-term loans are a type of credit that is typically repaid within a year or less. These loans can be used for various purposes, such as financing a large purchase or covering unexpected expenses. Some short-term loans, such as payday loans, can have high interest rates and fees, so it’s important to compare your options before borrowing.

Medium-Term Loans

Medium-term loans are a type of credit that is typically repaid over a period of 2 to 5 years. These loans are typically used for larger purchases, such as a car or home improvement project. Medium-term loans usually have lower interest rates than short-term loans, but the repayment period is longer, so you’ll need to make sure you can afford the monthly payments.

Long-Term Loans

Long-term loans are a type of credit that is typically repaid over a period of 5 years or more. These loans are usually used for major purchases, such as buying a home or financing a small business. Long-term loans often have lower interest rates than both short- and medium-term loans, but the repayment period is much longer, so you’ll need to make sure you can afford the monthly payments.

Medium-Term Loans

A medium-term loan is a type of loan that is typically repaid over a period of time that is longer than a short-term loan, but shorter than a long-term loan. Medium-term loans are usually repaid in installments, like most long-term loans, but the repayment periods are shorter, usually lasting anywhere from one to five years.

Medium-term loans can be used for a variety of purposes, including business expansion, inventory financing, and equipment purchases. They can be obtained from banks, credit unions, and online lenders. The terms of the loan will vary depending on the lender and the borrower’s creditworthiness.

As with any loan, there are pros and cons to taking out a medium-term loan. Some of the benefits include:

• The ability to borrow a larger amount of money than you could with a short-term loan

• More flexible repayment terms than a short-term loan

• Lower interest rates than a short-term loan

Some of the drawbacks include:

• The need to make installment payments over an extended period of time

• The possibility of paying more in interest than you would with a shorter-term loan

Long-Term Loans

Long-term loans are generally used for large purchases such as a home or a car. The repayment period for a long-term loan is usually between two and five years, although it can be longer. The advantage of a long-term loan is that it allows you to spread the cost of the purchase over a longer period of time, making it more affordable. The downside is that you will pay more interest over the life of the loan.

The Pros and Cons of Each Credit Length

Deciding on a credit length can be difficult. There are many things to consider, such as annual fees, interest rates, and how it will affect your credit score. Let’s take a look at the pros and cons of each credit length so you can make an informed decision.

Short-Term Loans

Short-term loans are generally repayable within a year. They can have fixed or variable interest rates, and some come with origination fees. They are typically used for small purchases, such as a car down payment, or for emergency expenses. Short-term loans can be a good option if you need cash quickly and you have good credit. However, they can be expensive, so it’s important to compare offers and make sure you can afford the repayment terms.

Medium-Term Loans

Medium-term loans are a type of financing that allows you to borrow money for a period of time longer than a short-term loan, but shorter than a long-term loan. The terms of these loans can vary depending on the lender, but they typically range from one to five years.

There are several benefits to taking out a medium-term loan. One of the biggest advantages is that you will have more time to repay the loan than you would with a short-term loan. This means that you can take on a larger loan amount and still have manageable monthly payments. Additionally, medium-term loans often come with lower interest rates than short-term loans, so you can save money on interest charges over the life of the loan.

However, there are also some drawbacks to consider before taking out a medium-term loan. One potential downside is that you may end up paying more in interest over the life of the loan than you would with a long-term loan. Additionally, if you encounter financial difficulties during the life of the loan and are unable to make your monthly payments, you may be faced with late fees or penalties.

Long-Term Loans

Long-term loans are those that have a repayment period of more than five years. Mortgages, for example, typically have repayment terms of 15 or 30 years. The longer the repayment term, the lower the monthly payment but the higher the total interest you will pay over the life of the loan.

There are several advantages to taking out a long-term loan. First, as mentioned above, the monthly payments are lower which can free up cash flow for other purposes. Additionally, long-term loans can be a good way to consolidate multiple debts into one monthly payment which can make budgeting and managing your finances easier. Finally, long-term loans often have lower interest rates than shorter-term loans which can save you money over time.

There are also some disadvantages to long-term loans that should be considered before taking one out. First, because you will be making payments for a longer period of time, you will ultimately pay more in interest even if the interest rate is lower. Additionally, if you should encounter financial difficulties at any point during the repayment period and are unable to make your payments, you could face serious consequences such as damaging your credit score or even losing your home if you have taken out a mortgage.

For these reasons, it is important to carefully consider all of the pros and cons of taking out a long-term loan before making a decision. If you decide that a long-term loan is right for you, be sure to shop around and compare interest rates and terms from different lenders to get the best deal possible.

Which Credit Length Is Right for You?

Most people have heard that credit length can influence your credit score, but not everyone knows how or why. The length of credit history is just one factor that goes into your credit score, but it can be an important one. So, which credit length is right for you? The answer may depend on your credit goals.

Installment Loans

An installment loan is a loan in which there are a set number of scheduled payments over time. The term of the loan can range from a few months to several years. A mortgage, for example, is a type of installment loan. The borrower makes regular payments over a period of 30 years, and when the loan is paid off, he or she owns the property.

Other types of installment loans include auto loans and student loans. An auto loan is a loan used to purchase a vehicle, and the borrower makes regular payments over the life of the loan. A student loan is a type of installment loan that is used to finance the cost of education. The borrower makes regular payments over the life of the loan, which can be 10 years or more.

Revolving Loans

Credit cards and other revolving loans are typically renewed annually. If you have a good history with your lender, you may be able to negotiate a longer term for your loan. This can provide you with the stability of a longer repayment period and may save you money on interest payments over the life of the loan.