What is a Flagged PPP Loan?

Contents

If you’re a small business owner, you may have heard of the Paycheck Protection Program (PPP). But what is a flagged PPP loan?

Here’s what you need to know.

The PPP is a federal loan program that provides small businesses with funding to help them keep their employees on the payroll during the COVID-19 pandemic.

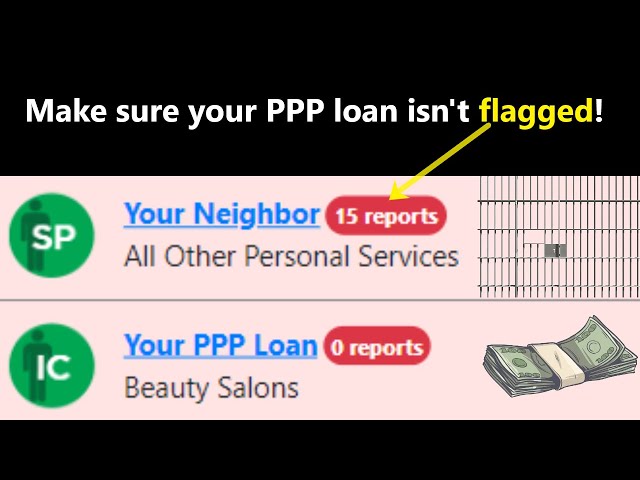

However, some PPP loans have been flagged by the Small Business Administration (SBA) for potential fraud

Checkout this video:

Flagged PPP Loans

The Paycheck Protection Program (PPP) is a loan designed to help businesses keep their employees on the payroll during the COVID-19 pandemic. The PPP loan is 100% forgiven if the loan proceeds are used for payroll costs, interest on mortgages, rent, and utilities. The Small Business Administration (SBA) is responsible for administering the PPP.

What is a flagged PPP loan?

A flagged PPP loan is a loan that has been designated by the Small Business Administration (SBA) for further review. This review is typically done in cases where the SBA suspects fraud or abuse of the program.

Loans may be flagged for several reasons, including if the borrower:

-Has a history of fraud

-Has filed for bankruptcy in the past

-Has defaulted on a previous loan

-Has been involved in a lawsuit or criminal investigation

If your loan has been flagged, it does not necessarily mean that there is something wrong with it. However, it does mean that the SBA will be taking a closer look at your loan application and supporting documentation. You may be asked to provide additional information or documentation to substantiate your claims.

If you have any questions about your flagged loan, you should contact your lender or the SBA directly.

How can a PPP loan be flagged?

A PPP loan can be flagged for a number of reasons, including:

-The borrower has applied for and received multiple PPP loans

-The borrower has failed to provide required documentation

-The borrower has made false or misleading statements on their application

-The borrower is under investigation by state or federal authorities

If a PPP loan is flagged, the lender may choose to suspend or cancel the loan. In some cases, the lender may refer the loan to the SBA for further review.

The Consequences of a Flagged PPP Loan

A flagged PPP loan is a loan that has been identified by the Small Business Administration (SBA) as being potentially ineligible for forgiveness. If your loan is flagged, it does not mean that your loan is ineligible for forgiveness, but it does mean that the SBA will require additional documentation from you in order to determine whether or not your loan is eligible for forgiveness.

What are the consequences of a flagged PPP loan?

If your PPP loan is flagged, it means that the SBA considers your loan to be higher risk. This means that you may be subject to additional requirements, such as providing additional documentation to prove your eligibility for the loan. You may also be required to repay your loan in full immediately.

How can I avoid having my PPP loan flagged?

To avoid having your PPP loan flagged, you should make sure that you:

-Borrow only what you need

-Use the loan for eligible expenses

-Keep detailed records of how you use the loan

-Submit accurate information on your loan application

-Repay the loan if you are not eligible for forgiveness