Who Gets Earned Income Credit?

Contents

If you have low or moderate income and you have a qualifying child, you may be able to get the Earned Income Credit (EIC).

Checkout this video:

The Basics of Earned Income Credit

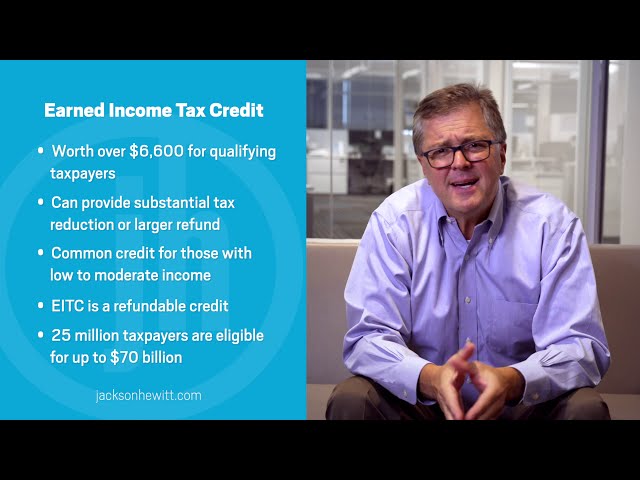

The Earned Income Credit, also called the EIC, is a refundable tax credit for working families with low to moderate incomes. The credit is designed to supplement the wages earned by these families and help them make ends meet. To qualify for the EIC, you must have earned income from a job or from running your own business. You also must meet certain other requirements.

What is earned income credit?

Earned income credit is a tax credit for certain working people with low to moderate incomes. To qualify, you must have earned income from working for someone or from running or owning a business or farm. You also must meet certain rules for filing status, age, and investment income. If you have a qualifying child, you may be able to get a larger credit.

Who is eligible for earned income credit?

To be eligible for the Earned Income Tax Credit (EITC) you must have earned income from working for someone or from running or owning your own business or farm. You must also meet basic rules and you must file a tax return to claim the credit.

If you have children, they must meet certain requirements to qualify you for the EITC with children. For the 2020 tax year, these included:

-The child must have lived with you for more than half the year.

-The child cannot be married and filing a joint return for the year.

-The child must be younger than you or your spouse if filing a joint return. A qualifying child can be any age if he or she is permanently and totally disabled, doesn’t have to meet the relationship test, and meets all other rules.

-You, as the parent or Guardian, must provide more than half of the child’s support for the year.

How to Claim Earned Income Credit

The Earned Income Credit (EIC) is a refundable tax credit for low- and moderate-income workers. To claim the credit, you must file a tax return, even if you do not owe any tax. The credit is calculated based on your earned income and the number of children you have. If you have no children, you can still claim the credit if your earned income is below a certain amount.

How to claim earned income credit on your taxes

The earned income tax credit, also called the EITC or the EIC, is a federal tax credit for low- and moderate-income working families. The credit is based on your earnings and the number of children you have.

To claim the credit, you must file a tax return even if you do not owe any taxes. And, you must have earned income from working for someone or from running your own business or farm. If you are married, you must file a joint return to claim the credit.

You may be able to take the credit even if you do not have any children. The amount of the credit ranges from a few hundred to several thousand dollars, depending on your circumstances.

Here’s more information on who can take the credit and how to claim it.

What documentation do you need to claim earned income credit?

To claim the Earned Income Credit (EIC), you need to provide certain documentation to the Internal Revenue Service (IRS). The type of documentation you need will depend on your personal situation, but may include things like your W-2 form, 1099 form, or other earnings statements. In addition, you will need to provide proof of identification, such as a driver’s license or passport, and proof of your relationship to any qualifying children claimed on your tax return.

What if You Don’t Qualify for Earned Income Credit?

If you don’t qualify for earned income credit, don’t worry- there are other tax credits and deductions you may be eligible for. The earned income credit is a refundable tax credit for low- and moderate-income working taxpayers. To qualify, you must have earned income from working for someone or from running or owning a business or farm.

What are some other tax credits you may be eligible for?

There are a few other tax credits that you may be eligible for if you do not qualify for the Earned Income Credit. These credits include the Child Tax Credit, the American Opportunity Tax Credit, and the Lifetime Learning Credit.

The Child Tax Credit is a credit for taxpayers who have children under the age of 17. The credit is worth up to $1,000 per child. To qualify, your child must be a dependent, must be a U.S. citizen or resident alien, and must have lived with you for more than half of the tax year. Additionally, your income must be below certain thresholds to qualify.

The American Opportunity Tax Credit is a credit for taxpayers who are paying for their own or their dependent’s higher education. The credit is worth up to $2,500 per student and can be used for tuition and other related expenses such as books and supplies. To qualify, your income must be below certain thresholds and you or your dependent must be enrolled in an eligible educational institution.

The Lifetime Learning Credit is a credit for taxpayers who are paying for their own or their dependent’s higher education. The credit is worth up to $2,000 per student and can be used for tuition and other related expenses such as books and supplies. To qualify, your income must be below certain thresholds and you or your dependent must be enrolled in an eligible educational institution.

What are some other ways to reduce your tax liability?

If you don’t qualify for the Earned Income Credit, there are a few other ways you can reduce your tax liability:

– The Child Tax Credit is available to taxpayers who have children under the age of 17.

– The American Opportunity Tax Credit is available to taxpayers who are pursuing an undergraduate or graduate degree.

– The Lifetime Learning Credit is available to taxpayers who are pursuing continuing education courses.